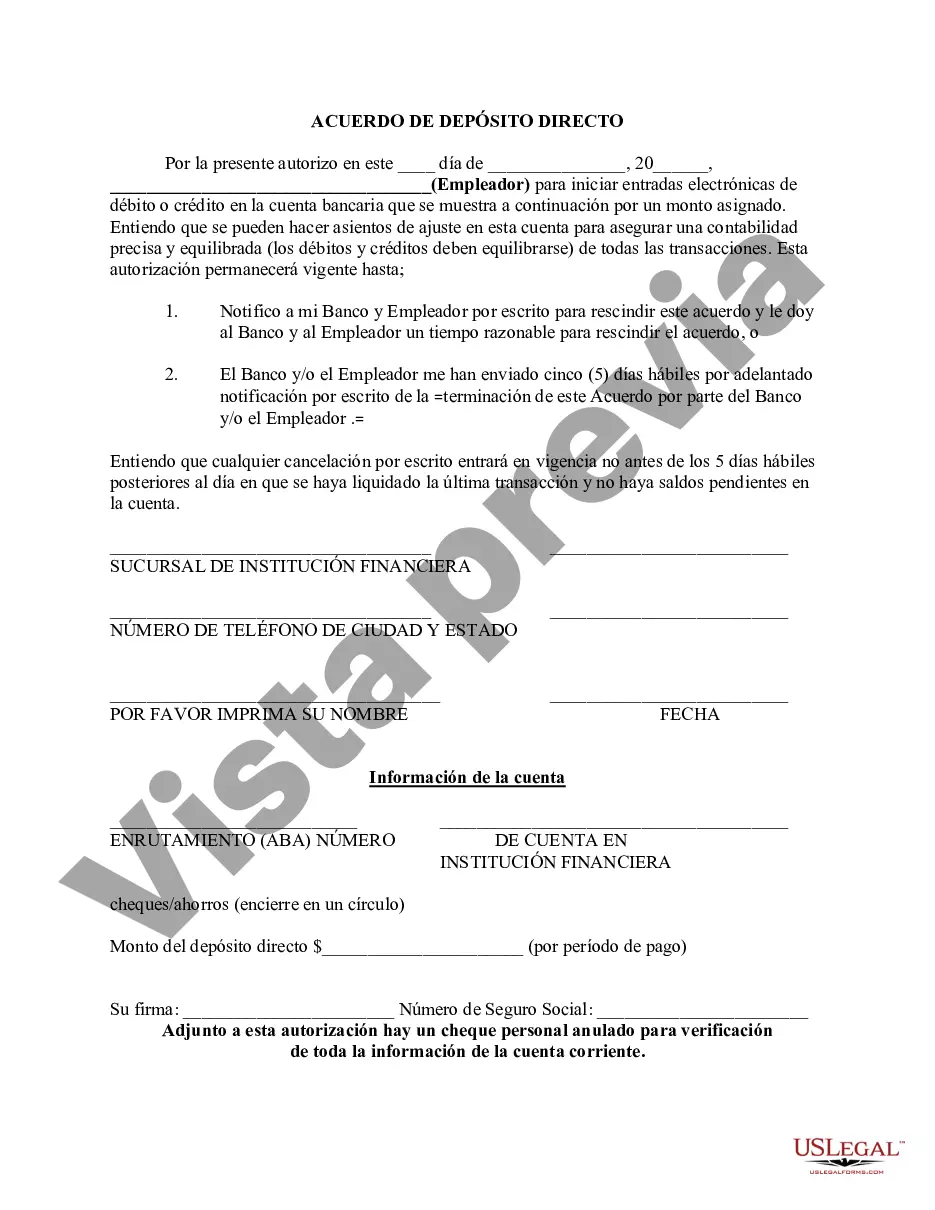

Franklin Ohio Direct Deposit Form for IRS is a document that enables individuals and businesses to authorize the Internal Revenue Service (IRS) to deposit their tax refunds directly into their bank accounts instead of receiving a physical check in the mail. This process provides a fast, secure, and convenient way to receive tax refunds without the hassle of waiting for the mail or standing in line at the bank. The Franklin Ohio Direct Deposit Form for IRS is completed by taxpayers who wish to set up or change their direct deposit information for federal tax refunds. This form requires individuals to provide their personal information, such as their name, social security number, address, and contact details. Additionally, taxpayers must include their bank account information, including the routing number and account number, to ensure the accurate and timely deposit of their refunds. By using the Franklin Ohio Direct Deposit Form for IRS, taxpayers can expect to receive their tax refunds faster compared to traditional methods of payment. Direct deposit eliminates the risk of lost or stolen checks and allows recipients to have immediate access to their funds once the refund is processed by the IRS. It is essential to note that there aren't different types of Franklin Ohio Direct Deposit Form for IRS. However, various versions of the direct deposit form are used by taxpayers throughout the United States, each featuring similar fields for personal and bank account information. The official form used nationwide is the IRS Form 8888, Allocation of Refund (including Savings Bond Purchases), which incorporates direct deposit information for tax refunds. In conclusion, the Franklin Ohio Direct Deposit Form for IRS is a critical document that streamlines the tax refund process by allowing individuals and businesses to authorize the IRS to deposit their refunds directly into their bank accounts. By utilizing this form, taxpayers can experience the convenience, security, and swiftness of receiving their refunds, while minimizing the risk of lost or stolen checks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Formulario de depósito directo para el IRS - Direct Deposit Form for IRS

Description

How to fill out Franklin Ohio Formulario De Depósito Directo Para El IRS?

If you need to find a reliable legal document supplier to find the Franklin Direct Deposit Form for IRS, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it simple to get and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Franklin Direct Deposit Form for IRS, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Franklin Direct Deposit Form for IRS template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less expensive and more affordable. Create your first business, arrange your advance care planning, create a real estate agreement, or execute the Franklin Direct Deposit Form for IRS - all from the convenience of your home.

Join US Legal Forms now!