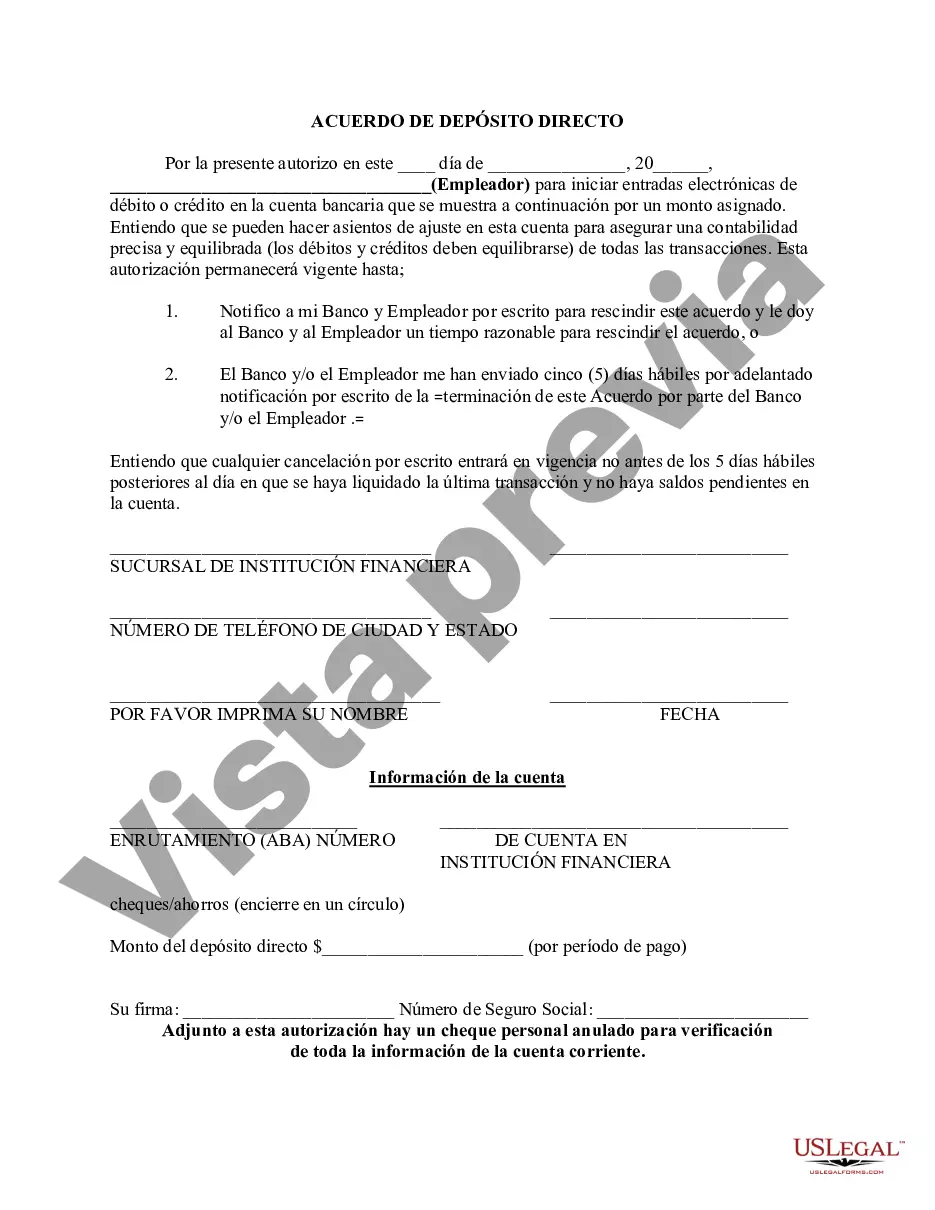

Maricopa Arizona Direct Deposit Form for IRS is a vital document used by taxpayers residing in Maricopa, Arizona, to authorize the Internal Revenue Service (IRS) to directly deposit their tax refunds or other IRS-related payments into their bank accounts. This convenient method eliminates the need for paper checks and significantly expedites the refund process. The Maricopa Arizona Direct Deposit Form for IRS is designed to capture essential information, including the taxpayer's name, social security number, contact details, and bank account details. These details are necessary to ensure accurate and secure electronic transfers. It is crucial to double-check the provided information to avoid any errors that may delay the direct deposit process. Different types or variations of the Maricopa Arizona Direct Deposit Form for IRS may exist based on specific purposes or taxpayer situations. These include: 1. Form 8888: Some taxpayers may use this form to split their tax refunds into multiple accounts, such as depositing a portion into a checking account and the rest into a savings account. 2. Form 4868: This form is specifically for taxpayers who are requesting an extension to file their tax return. It allows them to authorize direct deposit for any potential refund or pay their owed taxes. 3. Form 1040: This standard individual income tax return form includes a section where taxpayers can provide their bank account details for direct deposit. By utilizing the Maricopa Arizona Direct Deposit Form for IRS, taxpayers can enjoy several benefits. First, it ensures a safe and secure transfer of funds, eliminating the risk of lost or stolen checks. Second, it expedites the refund process, with many taxpayers receiving their refunds within a few business days. Lastly, electronic direct deposit is more environmentally friendly, as it reduces paper waste associated with issuing physical checks. In conclusion, the Maricopa Arizona Direct Deposit Form for IRS is an essential tool that allows taxpayers to conveniently receive their tax refunds or other IRS-related payments. It streamlines the payment process, increases efficiency, and ensures the security of funds. By accurately completing this form, taxpayers can rest assured knowing their payments will be directly deposited into their designated bank accounts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Formulario de depósito directo para el IRS - Direct Deposit Form for IRS

Description

How to fill out Maricopa Arizona Formulario De Depósito Directo Para El IRS?

If you need to get a reliable legal form provider to get the Maricopa Direct Deposit Form for IRS, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to find and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to search or browse Maricopa Direct Deposit Form for IRS, either by a keyword or by the state/county the form is created for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Maricopa Direct Deposit Form for IRS template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less pricey and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or complete the Maricopa Direct Deposit Form for IRS - all from the convenience of your home.

Join US Legal Forms now!