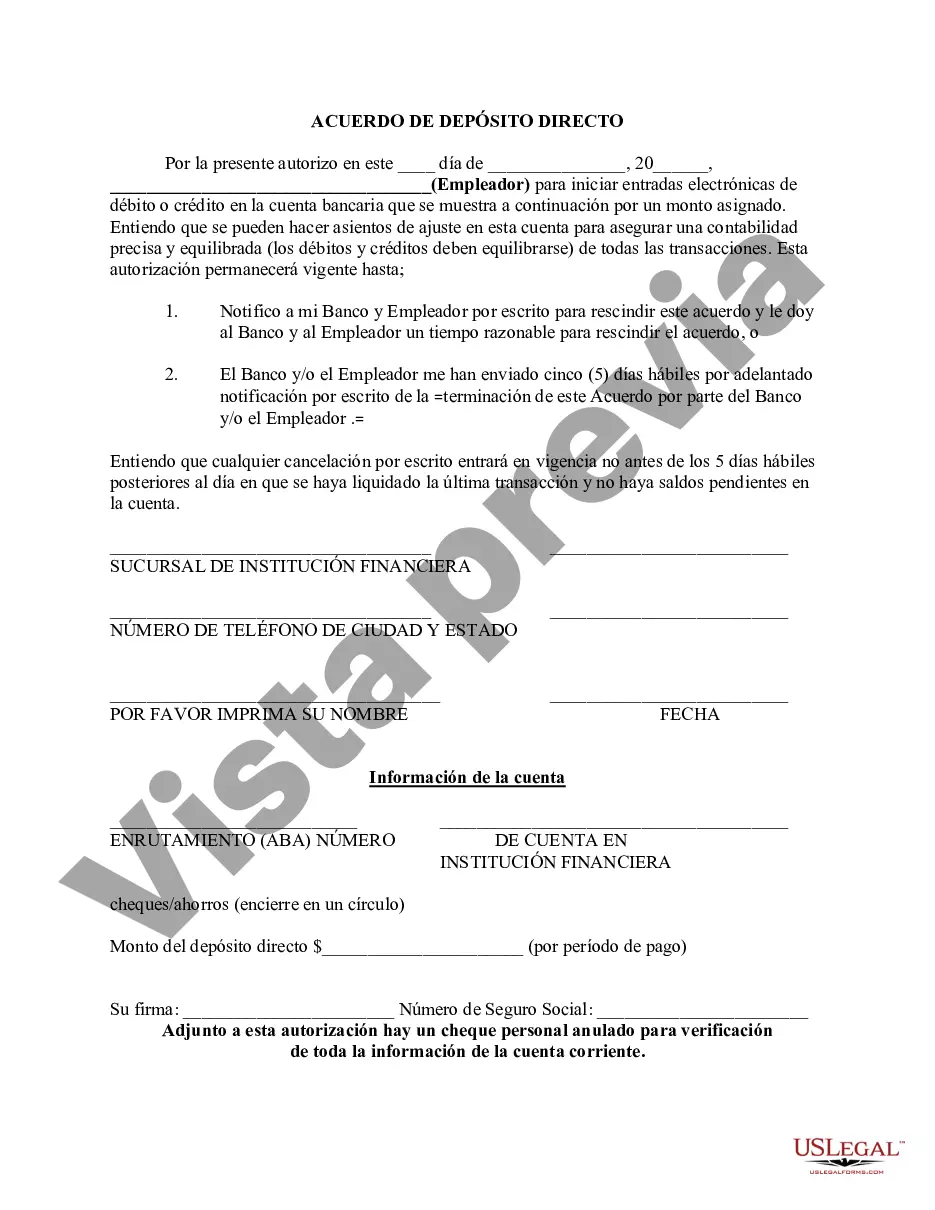

Palm Beach, Florida Direct Deposit Form for IRS is a financial document that allows taxpayers in Palm Beach County, Florida, to securely and conveniently receive their tax refunds and other payments directly into their bank accounts. This form enables individuals and businesses in Palm Beach, Florida, to utilize the benefits of electronic funds transfer provided by the Internal Revenue Service (IRS). Direct deposit offers several advantages over receiving paper checks. It eliminates the need for physical mail, reduces the chances of lost or stolen payments, and provides faster access to funds. By opting for direct deposit, taxpayers can ensure a seamless and efficient process of receiving their refunds or making tax payments. The Palm Beach, Florida Direct Deposit Form for IRS requires the taxpayer's personal information, including their name, address, social security number or employer identification number, and bank account details. The provided bank account must be a valid checking or savings account held at a financial institution that participates in the direct deposit program. It is essential to double-check all the information entered on the form to prevent any delays or errors in receiving the payment. Taxpayers in Palm Beach, Florida, must also indicate whether they want the direct deposit to apply to their tax refund, estimated tax payments, or other types of payments. There are no specific variations or different types of Palm Beach, Florida Direct Deposit Form for IRS. However, it is worth noting that the IRS offers different direct deposit forms for various types of tax-related payments, including tax refunds, estimated tax payments, and other federal tax liabilities. These different forms may have slightly varying requirements or fields to be completed, but the underlying purpose remains the same — facilitating the electronic transfer of funds. In conclusion, the Palm Beach, Florida Direct Deposit Form for IRS provides taxpayers with a convenient, secure, and efficient means to receive their tax-related payments directly into their bank accounts. By opting for direct deposit, individuals and businesses in Palm Beach can enjoy faster access to funds and avoid the hassles associated with traditional paper checks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Formulario de depósito directo para el IRS - Direct Deposit Form for IRS

Description

How to fill out Palm Beach Florida Formulario De Depósito Directo Para El IRS?

Draftwing paperwork, like Palm Beach Direct Deposit Form for IRS, to manage your legal matters is a challenging and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can get your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for a variety of scenarios and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Palm Beach Direct Deposit Form for IRS template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Palm Beach Direct Deposit Form for IRS:

- Make sure that your form is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Palm Beach Direct Deposit Form for IRS isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and get the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!