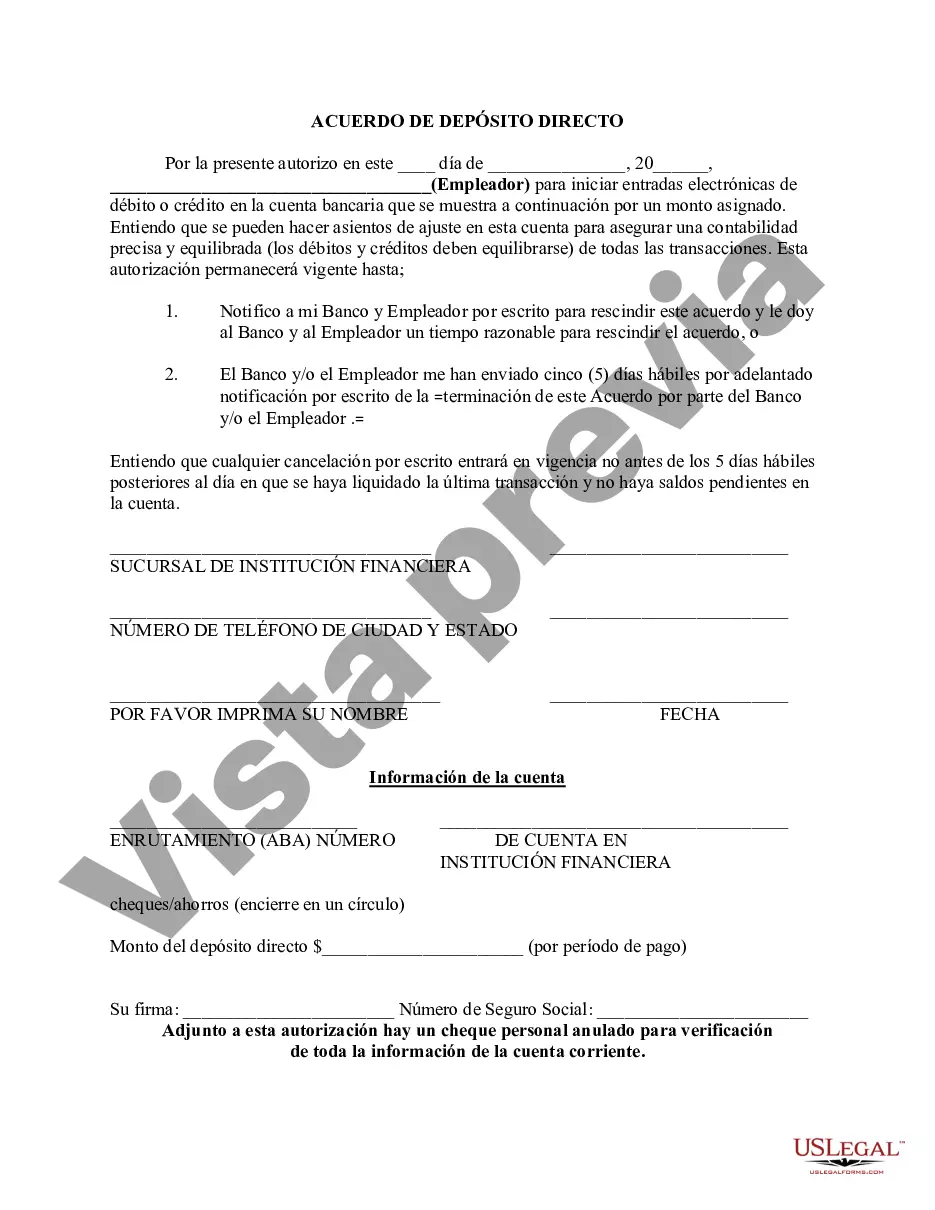

The Lima Arizona Direct Deposit Form for IRS is a document that allows individuals in the Lima, Arizona area to set up direct deposit with the Internal Revenue Service (IRS) for their tax refunds or other payments. By completing this form, Lima residents can provide their bank account information to the IRS, which enables the agency to deposit refunds or other payments directly into their preferred bank account. This ensures a faster, more secure, and convenient method of receiving funds from the IRS. The Lima Arizona Direct Deposit Form for IRS requires individuals to enter their personal information such as their name, address, Social Security number, and contact details. They also need to provide their bank account details, including the bank's routing number and the account number where they want the funds to be deposited. Ensuring accuracy when filling out the form is crucial to avoid any delays or errors in processing the direct deposit. Individuals must carefully review the information before submitting the form to ensure it matches the details associated with their bank account. It's worth noting that there are no different types of Lima Arizona Direct Deposit Forms for IRS specifically. However, there are various IRS forms related to direct deposit that may be applicable depending on the purpose. These include: 1. Form 8888: Allocation of Refund — This form allows taxpayers to divide their refund into multiple accounts, including checking, savings, and individual retirement accounts (IRAs). 2. Form 4852: Substitute for Form W-2 — In situations where taxpayers don't receive their W-2 form from their employer, this form can be filled out to estimate their wages, withholding, and credits for tax return purposes. 3. Form 8872: Political Organization Report of Contributions and Expenditures — This form is specifically for political organizations to report their contributions and expenses. While it's not directly related to direct deposit, it may be relevant in certain circumstances. Overall, the Lima Arizona Direct Deposit Form for IRS streamlines the process of receiving tax refunds or other payments by enabling direct deposit into a specified bank account. Filling out the form accurately and providing the necessary details will help ensure a seamless and efficient transfer of funds from the IRS to Lima residents.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Formulario de depósito directo para el IRS - Direct Deposit Form for IRS

Description

How to fill out Pima Arizona Formulario De Depósito Directo Para El IRS?

Draftwing documents, like Pima Direct Deposit Form for IRS, to take care of your legal matters is a difficult and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. However, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for a variety of cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Pima Direct Deposit Form for IRS form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before downloading Pima Direct Deposit Form for IRS:

- Make sure that your document is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Pima Direct Deposit Form for IRS isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start utilizing our website and get the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!