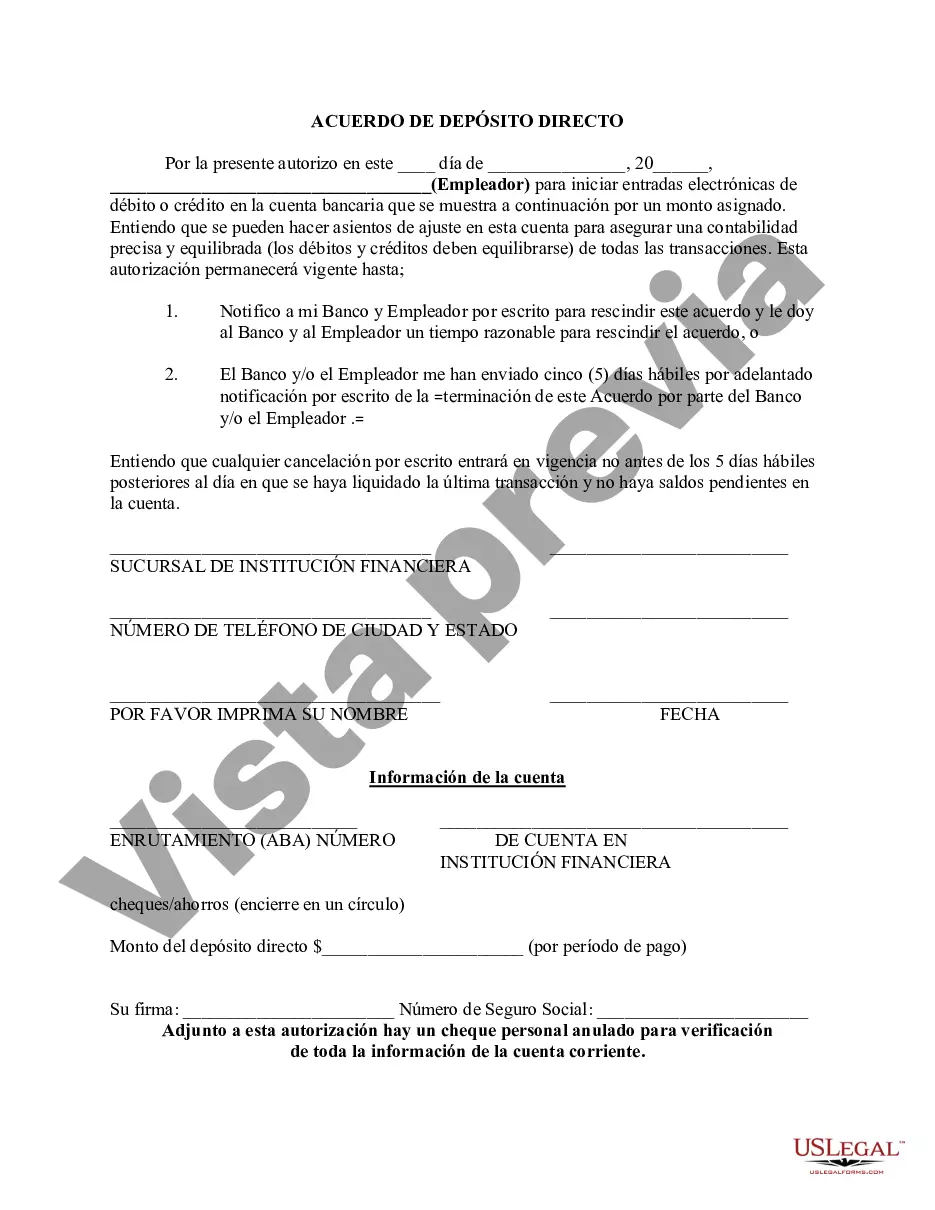

Cook Illinois Direct Deposit Form for Payroll is a document that enables employees of Cook Illinois Corporation to receive their salary directly into their bank account. This convenient and secure method eliminates the need for physical paychecks, allowing employees to access their funds quicker and more efficiently. With direct deposit, the employee's paycheck is automatically deposited into their chosen bank account on the designated payday. The Cook Illinois Direct Deposit Form for Payroll contains essential information required for initiating the direct deposit service. Employees must complete the form accurately and provide their personal and banking details. The form typically includes fields for the employee's full name, address, social security number, contact information, and employment details such as department and employee identification number. Additionally, employees need to provide their bank name, routing number, and account number where they wish their salary to be deposited. The Cook Illinois Direct Deposit Form for Payroll offers different types of direct deposit options to suit the preferences of its employees. These variations may include: 1. Standard Direct Deposit: This is the most common form of direct deposit, where the entire paycheck amount is deposited into the designated bank account. Employees receive their full salary without any deductions. 2. Split Direct Deposit: With this option, employees can split their paycheck between multiple bank accounts. For example, an employee can allocate a percentage of their salary to be deposited into a savings account while the remaining portion is sent to their primary checking account. 3. Partial Direct Deposit: In certain cases, employees may choose to receive only a portion of their salary via direct deposit. This option is helpful when an employee prefers to receive a specific amount as a physical paycheck or for any other specific requirements. By utilizing the Cook Illinois Direct Deposit Form for Payroll, employees can enjoy a streamlined and hassle-free process for receiving their wages. This form ensures accurate and efficient distribution of payment, minimizes the risk of lost or stolen checks, and provides employees with timely access to their funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Formulario de Depósito Directo para Nómina - Direct Deposit Form for Payroll

Description

How to fill out Cook Illinois Formulario De Depósito Directo Para Nómina?

Creating paperwork, like Cook Direct Deposit Form for Payroll, to manage your legal matters is a tough and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms crafted for different scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Cook Direct Deposit Form for Payroll template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Cook Direct Deposit Form for Payroll:

- Ensure that your form is specific to your state/county since the rules for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Cook Direct Deposit Form for Payroll isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start using our website and get the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

¿Como funciona el deposito directo? Proceso automatico. Cuando recibes fondos a traves de un deposito directo, los fondos se agregan a tu cuenta sin que debas realizar ninguna accion.Sin papel.Mas ahorros.Paga tus facturas a tiempo.Pago mas rapido.

¿ Que informacion tengo que proporcionar para configurar un deposito directo? El nombre y la direccion de tu empleador o depositante. Tu identificacion de empleado o numero de cuenta del depositante. Tu numero de cuenta. Tu numero ABA/de transito interbancario.

El Deposito Directo es un servicio gratuito mediante el cual se depositan automaticamente los ingresos recurrentes que califican en cualquier cuenta de cheques, de ahorros o de tarjeta prepagada de Wells Fargo que usted elija.

¿ Que informacion tengo que proporcionar para configurar un deposito directo? El nombre y la direccion de tu empleador o depositante. Tu identificacion de empleado o numero de cuenta del depositante. Tu numero de cuenta. Tu numero ABA/de transito interbancario.

Como registrarse Debe registrarse en linea para el deposito directo. Registrese cuando solicite beneficios por desempleo. Necesitara su cuenta bancaria o cooperativa de credito y numeros de identificacion del banco o cooperativa de credito. Esta informacion se muestra en su cheque.

Un dia habil no incluye sabados ni domingos, ni dias festivos, aunque el banco o la cooperativa de credito este abierto.

Este formulario es para cambiar pagos de cheque a deposito directo de ciertos tipos de beneficios federales designados en la Caja C. Si utiliza esta forma para cualquier otro proposito causara que la forma sea rechazada.

Interesting Questions

More info

Check online. The cost of a service or repairs at any building repair or rehab company. A loan calculator can help you find information you do not know. A business can pay you a lump sum for an unpaid account receivable. Or, you can get your money with no further action for up to five years when you get the money in an installment plan. Online: Use PayByMail.com to pay your bills automatically and receive your payment each month. You can set up your own e-payment system if you don't like using PayByMail.com. Read more. Online: Get an installment loan, or auto loan, by phone, mail or in person; with many lenders offering loan installment plans. Some companies specialize in mortgage, home equity line of credit and short term finance. Call or visit your local library or phone customer service number and choose the option that best suits you. Pay me by mail. Make multiple checks payable to me: 0.00. Mail them to a Post Office box. This is a way more convenient way to pay me.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.