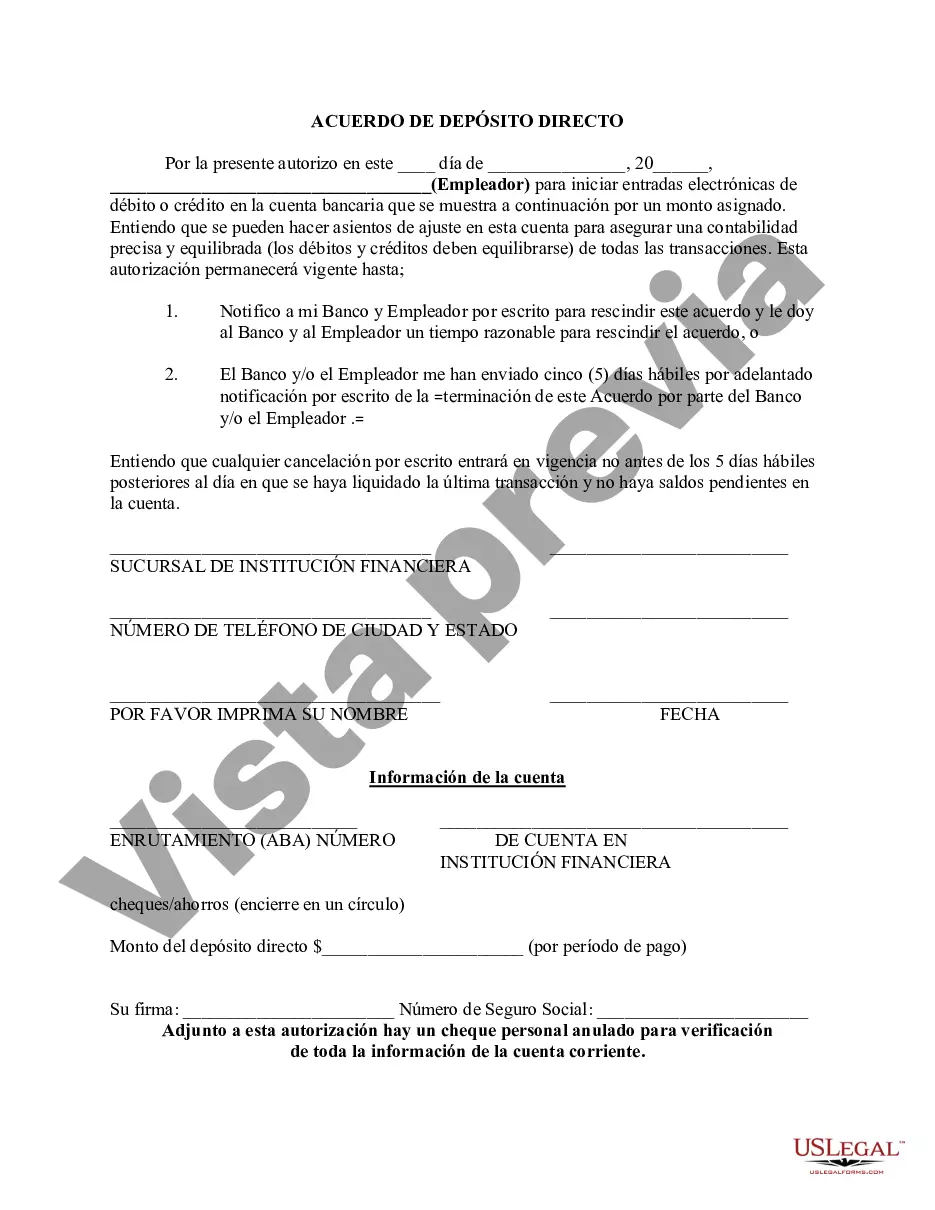

A Riverside California Direct Deposit Form for Payroll is a document that allows employers to initiate direct deposit payments to their employees' bank accounts. This form is an essential tool for streamlining the payroll process and ensuring secure and efficient salary payments. The Riverside California Direct Deposit Form for Payroll captures all the necessary information required to initiate direct deposit transactions. It eliminates the need for issuing paper checks, reduces manual processes, and minimizes the risk of errors or delays in payment delivery. This form facilitates a direct transfer of funds from the employer's bank account to the employee's bank account, enabling timely access to wages. There are different types of Riverside California Direct Deposit Forms for Payroll, depending on specific requirements or variations in the payroll process. These types may include: 1. Standard Riverside California Direct Deposit Form for Payroll: This is the most commonly used form for initiating direct deposit payments. It typically contains fields for the employee's name, employee identification number, Social Security number, bank account details (such as account number and routing number), and authorization signatures. 2. Riverside California Direct Deposit Authorization Form: This particular form emphasizes the employee's authorization to deposit funds directly into their designated bank account. It may include additional sections to capture the employee's consent, agreement to the terms and conditions, and voluntary enrollment in direct deposit programs. 3. Riverside California Direct Deposit Cancellation Form: This form is used to cancel or change an existing direct deposit arrangement. Employees may fill out this form if they wish to update their bank account information, switch banks, or discontinue using direct deposit for payroll purposes. It typically requires the employee's personal information, the effective date of cancellation, and the employee's signature. 4. Riverside California Direct Deposit Enrollment Form: This form is specifically designed for new employees who wish to enroll in direct deposit for payroll purposes. It gathers all the essential information needed from the employee, including their personal details, bank account information, and authorization to initiate direct deposits. By using the appropriate Riverside California Direct Deposit Form for Payroll, employers can ensure a seamless and efficient payment process, while providing their employees with the convenience and benefits of direct deposit. It not only saves time and effort but also maintains the confidentiality and security of sensitive financial information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Formulario de Depósito Directo para Nómina - Direct Deposit Form for Payroll

Description

How to fill out Riverside California Formulario De Depósito Directo Para Nómina?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Riverside Direct Deposit Form for Payroll, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how to purchase and download Riverside Direct Deposit Form for Payroll.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Riverside Direct Deposit Form for Payroll.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Riverside Direct Deposit Form for Payroll, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you have to cope with an exceptionally complicated situation, we recommend using the services of an attorney to examine your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!