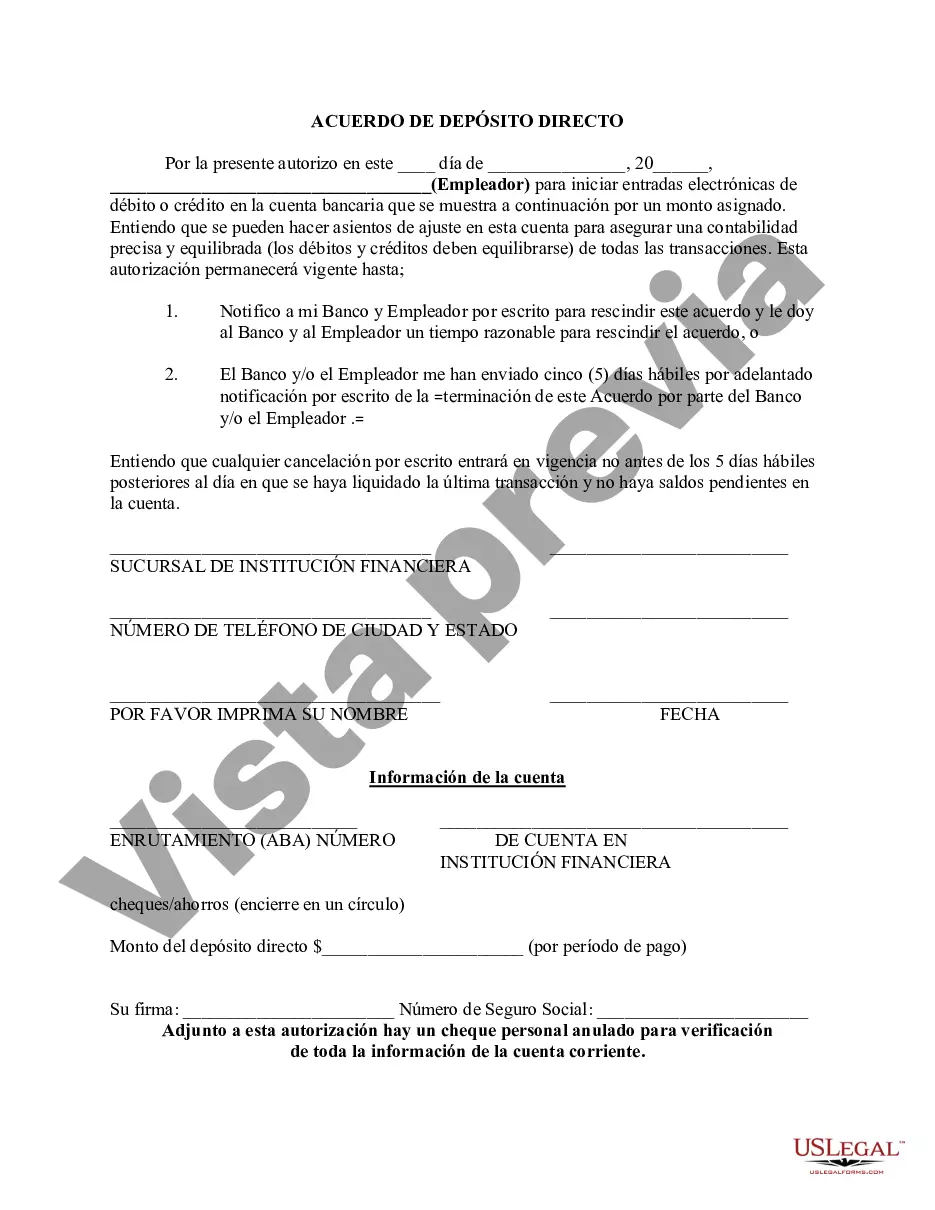

A San Diego California Direct Deposit Form for Payroll is a document that allows employees to set up a convenient and secure method of receiving their wages directly into their bank accounts. This form is widely used by employers in San Diego to streamline payroll processes and eliminate the need for issuing paper checks or providing cash payments. The purpose of the San Diego California Direct Deposit Form for Payroll is to authorize the employer to deposit the employee's earnings directly into his or her bank account, rather than delivering the payment physically. By utilizing this form, employees can enjoy several benefits such as faster access to their funds, reduced risk of lost or stolen checks, and hassle-free management of their finances. The form typically requires the employee to provide their personal information, including their full name, address, contact details, and Social Security number. Additionally, employees are required to input their banking information, such as the name of their bank, routing number, and account number, to ensure accurate transfer of funds. It is crucial for employees to double-check the accuracy of these details to avoid any issues with their direct deposits. In San Diego, there might be different variations or types of Direct Deposit Forms for Payroll, depending on the specific requirements of the employer or financial institution. Some common types include: 1. Standard Direct Deposit Form: This is the most basic form used by employers in San Diego for their regular payroll processing. It requires the employee to provide the necessary banking details and authorization for the direct deposit. 2. Multiple Account Direct Deposit Form: This form is designed for employees who wish to allocate their earnings into multiple bank accounts. It allows individuals to divide their paycheck into separate accounts, such as checking, savings, or investment accounts, according to their preferences and financial goals. 3. Change of Direct Deposit Form: This form is used whenever an employee needs to update or modify their existing direct deposit information. It typically requires the employee's signature and verification to ensure the accuracy of the changes. 4. Temporary Direct Deposit Form: Employers may provide this form to employees who require a temporary change in their direct deposit account details. This can be useful in situations where an employee needs to utilize a different bank account temporarily. 5. International Direct Deposit Form: For employees who hold bank accounts outside the United States, this specialized form is utilized. It usually includes additional details, such as international bank codes and account currency information, to facilitate international fund transfers. Ensuring timely and accurate payment is crucial for employees, and the San Diego California Direct Deposit Form for Payroll simplifies this process while providing greater convenience and security. By opting for direct deposit, employees can efficiently manage their finances, access funds sooner, and eliminate the hassle and risks associated with physical paychecks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Formulario de Depósito Directo para Nómina - Direct Deposit Form for Payroll

Description

How to fill out San Diego California Formulario De Depósito Directo Para Nómina?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including San Diego Direct Deposit Form for Payroll, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks associated with document completion simple.

Here's how you can find and download San Diego Direct Deposit Form for Payroll.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the validity of some records.

- Examine the similar document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy San Diego Direct Deposit Form for Payroll.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate San Diego Direct Deposit Form for Payroll, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you need to cope with an exceptionally complicated case, we recommend getting an attorney to review your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-compliant paperwork effortlessly!