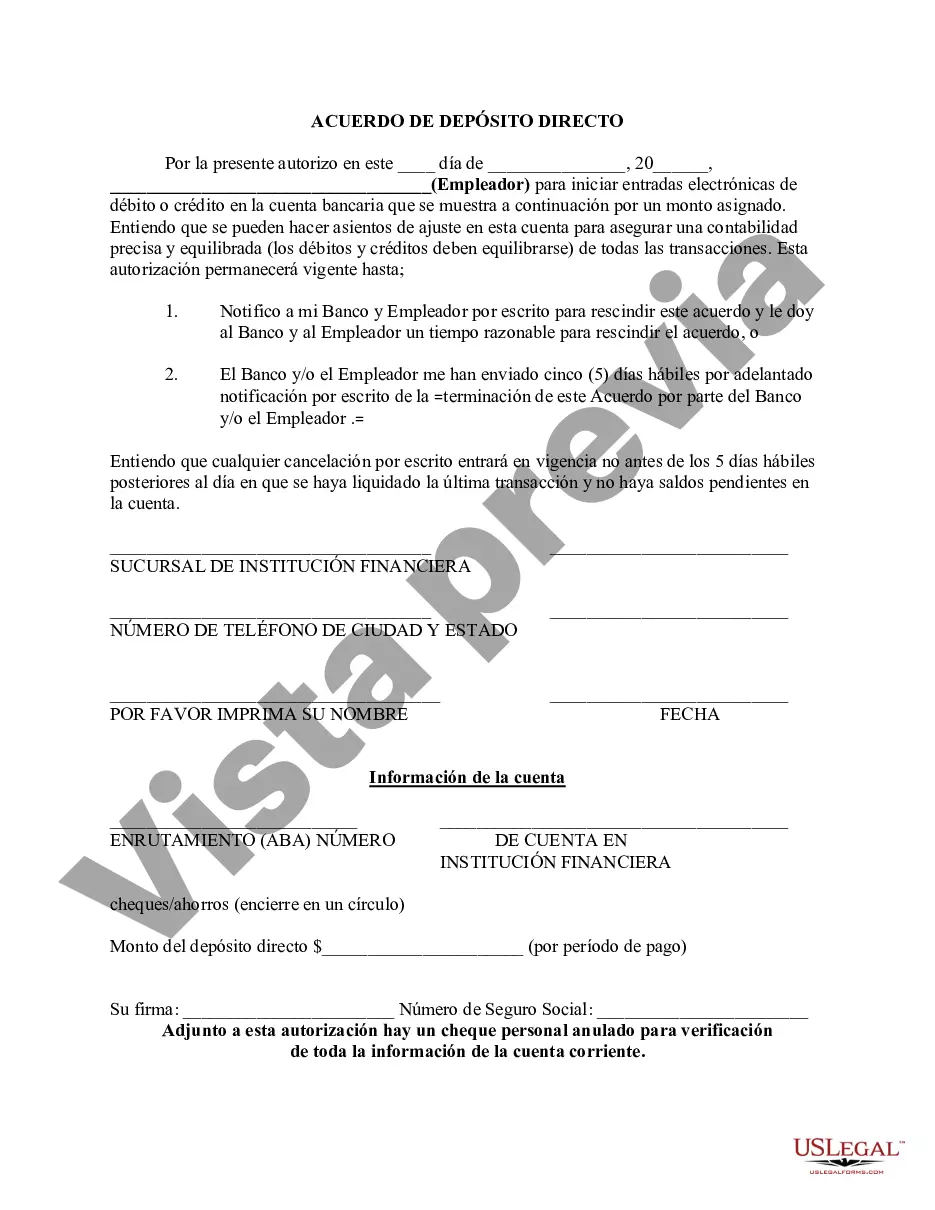

Santa Clara, California Direct Deposit Form for Payroll: A Comprehensive Guide In Santa Clara, California, the direct deposit form for payroll is an essential document for employees looking to receive their wages electronically. This form allows employers to securely transfer funds directly into their employees' bank accounts, eliminating the need for physical checks and providing a convenient and efficient way to manage payroll. The Santa Clara direct deposit form for payroll includes various sections that capture necessary information to facilitate successful deposits. These sections typically include: 1. Employee Information: This section gathers essential details about the employee, such as their full name, address, contact information, and social security number. This data aids in accurately identifying the employee and ensuring the funds are delivered correctly. 2. Bank Details: Here, employees are required to provide their bank account information. This includes the name of the bank, the branch's address, the account number, and the routing number. Providing accurate bank details is crucial to avoid any delays or mismatches in depositing funds. 3. Type of Account: Employees may need to specify the type of account they hold, such as a checking account or a savings account. This information helps employers ensure that funds are being deposited into the correct account type based on the employee's preference. 4. Authorization: The form also includes an authorization section where employees grant their consent to the direct deposit process. By signing this section, employees acknowledge that they understand and agree to the terms and conditions associated with direct deposit. It is important to note that while the content of the direct deposit form remains relatively consistent across organizations, slight variations may exist depending on the specific requirements and policies of different employers in Santa Clara, California. Some organizations might utilize customized forms with additional sections or fields tailored to their internal processes. For instance, some companies may require employees to provide a voided check along with the direct deposit form to verify the accuracy of bank account information. Other employers may offer multiple direct deposit options, such as splitting paycheck amounts into different accounts or depositing funds into prepaid debit cards. In conclusion, the Santa Clara, California direct deposit form for payroll is a critical document that enables employees to receive their wages electronically. By providing accurate employee and bank account information, employees can enjoy the efficiency and convenience of direct deposit, eliminating the need for physical checks and helping streamline the payroll process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Formulario de Depósito Directo para Nómina - Direct Deposit Form for Payroll

Description

How to fill out Santa Clara California Formulario De Depósito Directo Para Nómina?

Preparing paperwork for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Santa Clara Direct Deposit Form for Payroll without expert help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Santa Clara Direct Deposit Form for Payroll by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Santa Clara Direct Deposit Form for Payroll:

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

¿ Que informacion tengo que proporcionar para configurar un deposito directo? El nombre y la direccion de tu empleador o depositante. Tu identificacion de empleado o numero de cuenta del depositante. Tu numero de cuenta. Tu numero ABA/de transito interbancario.

La ficha de deposito se utiliza en las entidades bancarias para realizar el deposito de una cantidad estipulada de dinero. Algunas tiendas comerciales, pueden aceptar fichas de deposito correctamente tramitadas y legalizadas, verificando que se ha depositado la cantidad de dinero, al momento de vender un producto.

R: El deposito directo tiene lugar inmediatamente. La excepcion es: si se registra despues de las 5 p.m. en un dia habil y ya tenemos un pago listo para enviarle, recibira el pago a traves de su metodo anterior. Luego, su proximo pago se depositara directamente en su cuenta.

¿Como funciona el deposito directo? Proceso automatico. Cuando recibes fondos a traves de un deposito directo, los fondos se agregan a tu cuenta sin que debas realizar ninguna accion.Sin papel.Mas ahorros.Paga tus facturas a tiempo.Pago mas rapido.

¿ Que informacion tengo que proporcionar para configurar un deposito directo? El nombre y la direccion de tu empleador o depositante. Tu identificacion de empleado o numero de cuenta del depositante. Tu numero de cuenta. Tu numero ABA/de transito interbancario.

Como registrarse Debe registrarse en linea para el deposito directo. Registrese cuando solicite beneficios por desempleo. Necesitara su cuenta bancaria o cooperativa de credito y numeros de identificacion del banco o cooperativa de credito. Esta informacion se muestra en su cheque.

El Deposito Directo es un servicio gratuito mediante el cual se depositan automaticamente los ingresos recurrentes que califican en cualquier cuenta de cheques, de ahorros o de tarjeta prepagada de Wells Fargo que usted elija.

Este formulario es para cambiar pagos de cheque a deposito directo de ciertos tipos de beneficios federales designados en la Caja C. Si utiliza esta forma para cualquier otro proposito causara que la forma sea rechazada.