- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. The Allegheny Pennsylvania Direct Deposit Agreement is a binding contract between an individual or business entity and a financial institution in the Allegheny County, Pennsylvania area. This agreement outlines the terms, conditions, and procedures associated with setting up and utilizing direct deposit services provided by the financial institution. Under this agreement, customers can authorize their employer or any other entity that owes them regular payments to deposit these funds directly into their designated bank account. This eliminates the need for paper checks and helps ensure timely and convenient access to funds. Direct deposit is widely used for various payment purposes, including payroll, government benefit payments, pension payments, and any other recurring deposits. The Allegheny Pennsylvania Direct Deposit Agreement typically includes key provisions such as account information, routing numbers, and ACH (Automated Clearing House) details necessary for initiating the electronic transfer of funds. It also outlines the rights and responsibilities of the account holder and the financial institution, providing clarity on issues like liability for incorrect deposits, unauthorized transactions, and dispute resolution processes. Different types of Allegheny Pennsylvania Direct Deposit Agreements may exist depending on the financial institution and the specific services they provide. Some banks or credit unions may offer special agreements tailored to various customer segments, such as personal banking customers, business banking customers, or government agencies. For individual customers, the agreement might cover provisions related to salary direct deposit, tax refund direct deposit, and Social Security direct deposit. Business customers, on the other hand, might have more complex agreements that include options for vendor direct deposit, employee payroll direct deposit, and ACH debit or credit services. In summary, the Allegheny Pennsylvania Direct Deposit Agreement is a formal document facilitating the seamless transfer of funds directly into a designated bank account. It serves as a fundamental component of modern banking, enabling both individuals and businesses to enjoy the convenience, security, and efficiency of electronic payments.

The Allegheny Pennsylvania Direct Deposit Agreement is a binding contract between an individual or business entity and a financial institution in the Allegheny County, Pennsylvania area. This agreement outlines the terms, conditions, and procedures associated with setting up and utilizing direct deposit services provided by the financial institution. Under this agreement, customers can authorize their employer or any other entity that owes them regular payments to deposit these funds directly into their designated bank account. This eliminates the need for paper checks and helps ensure timely and convenient access to funds. Direct deposit is widely used for various payment purposes, including payroll, government benefit payments, pension payments, and any other recurring deposits. The Allegheny Pennsylvania Direct Deposit Agreement typically includes key provisions such as account information, routing numbers, and ACH (Automated Clearing House) details necessary for initiating the electronic transfer of funds. It also outlines the rights and responsibilities of the account holder and the financial institution, providing clarity on issues like liability for incorrect deposits, unauthorized transactions, and dispute resolution processes. Different types of Allegheny Pennsylvania Direct Deposit Agreements may exist depending on the financial institution and the specific services they provide. Some banks or credit unions may offer special agreements tailored to various customer segments, such as personal banking customers, business banking customers, or government agencies. For individual customers, the agreement might cover provisions related to salary direct deposit, tax refund direct deposit, and Social Security direct deposit. Business customers, on the other hand, might have more complex agreements that include options for vendor direct deposit, employee payroll direct deposit, and ACH debit or credit services. In summary, the Allegheny Pennsylvania Direct Deposit Agreement is a formal document facilitating the seamless transfer of funds directly into a designated bank account. It serves as a fundamental component of modern banking, enabling both individuals and businesses to enjoy the convenience, security, and efficiency of electronic payments.

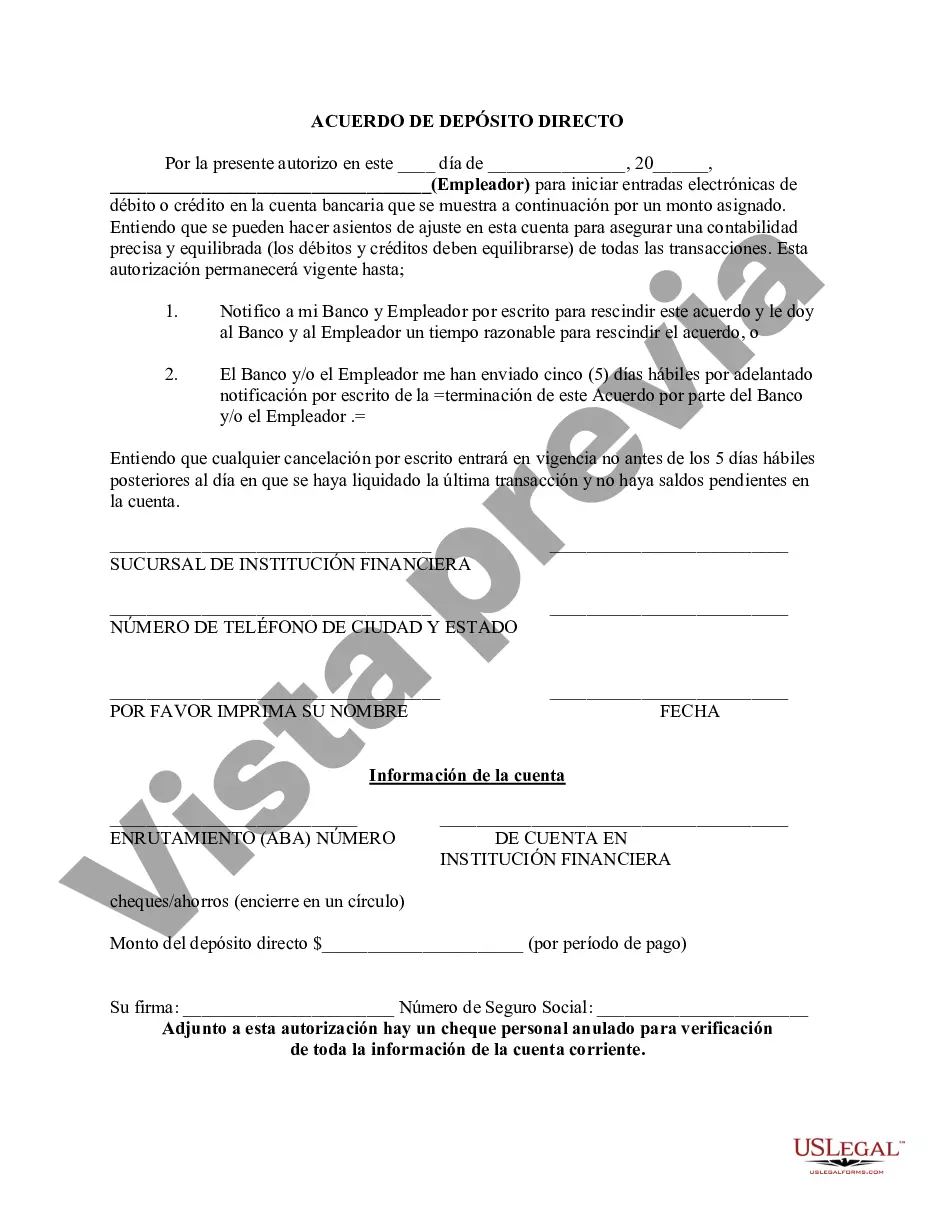

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.