- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Chicago Illinois Direct Deposit Agreement is a legally binding agreement between a financial institution and its customer, specifically relating to the deposit of funds directly into an individual's account. This agreement sets forth the terms and conditions governing the electronic transfer of payments, such as salaries, wages, pensions, or government benefits, into the customer's designated account. One type of Chicago Illinois Direct Deposit Agreement is the Standard Direct Deposit Agreement. This agreement outlines the basic provisions and procedures required for initiating and managing direct deposit transactions. It typically includes important details such as the customer's account information, the financial institution's responsibilities, the timeframes for deposit availability, and the customer's rights and responsibilities. Another type of Chicago Illinois Direct Deposit Agreement is the Payroll Direct Deposit Agreement. This agreement is specifically tailored for employers to facilitate the direct deposit of employees' wages or salaries. It establishes the agreement between the employer, the financial institution, and the employee, detailing the necessary information and procedures for seamless payroll processing. The Social Security Direct Deposit Agreement is yet another type of Chicago Illinois Direct Deposit Agreement. It is designed for individuals receiving Social Security benefits, whether retirement, disability, or survivor benefits. This agreement ensures the timely and secure transfer of funds from the Social Security Administration to the individual's designated financial institution. Chicago Illinois Direct Deposit Agreements typically include crucial keywords to clearly define the scope and purpose of the agreement. These may include keywords such as "direct deposit," "electronic transfer," "financial institution," "customer," "account information," "deposit availability," "employers," "payroll," "wages," "salaries," "Social Security benefits," "retirement benefits," "disability benefits," "survivor benefits," and more. In summary, a Chicago Illinois Direct Deposit Agreement is a comprehensive document that outlines the terms, responsibilities, and procedures associated with electronic funds transfer into a customer's account. It ensures a seamless process for employers, individuals receiving Social Security benefits, and other entities involved in direct deposit transactions.

Chicago Illinois Direct Deposit Agreement is a legally binding agreement between a financial institution and its customer, specifically relating to the deposit of funds directly into an individual's account. This agreement sets forth the terms and conditions governing the electronic transfer of payments, such as salaries, wages, pensions, or government benefits, into the customer's designated account. One type of Chicago Illinois Direct Deposit Agreement is the Standard Direct Deposit Agreement. This agreement outlines the basic provisions and procedures required for initiating and managing direct deposit transactions. It typically includes important details such as the customer's account information, the financial institution's responsibilities, the timeframes for deposit availability, and the customer's rights and responsibilities. Another type of Chicago Illinois Direct Deposit Agreement is the Payroll Direct Deposit Agreement. This agreement is specifically tailored for employers to facilitate the direct deposit of employees' wages or salaries. It establishes the agreement between the employer, the financial institution, and the employee, detailing the necessary information and procedures for seamless payroll processing. The Social Security Direct Deposit Agreement is yet another type of Chicago Illinois Direct Deposit Agreement. It is designed for individuals receiving Social Security benefits, whether retirement, disability, or survivor benefits. This agreement ensures the timely and secure transfer of funds from the Social Security Administration to the individual's designated financial institution. Chicago Illinois Direct Deposit Agreements typically include crucial keywords to clearly define the scope and purpose of the agreement. These may include keywords such as "direct deposit," "electronic transfer," "financial institution," "customer," "account information," "deposit availability," "employers," "payroll," "wages," "salaries," "Social Security benefits," "retirement benefits," "disability benefits," "survivor benefits," and more. In summary, a Chicago Illinois Direct Deposit Agreement is a comprehensive document that outlines the terms, responsibilities, and procedures associated with electronic funds transfer into a customer's account. It ensures a seamless process for employers, individuals receiving Social Security benefits, and other entities involved in direct deposit transactions.

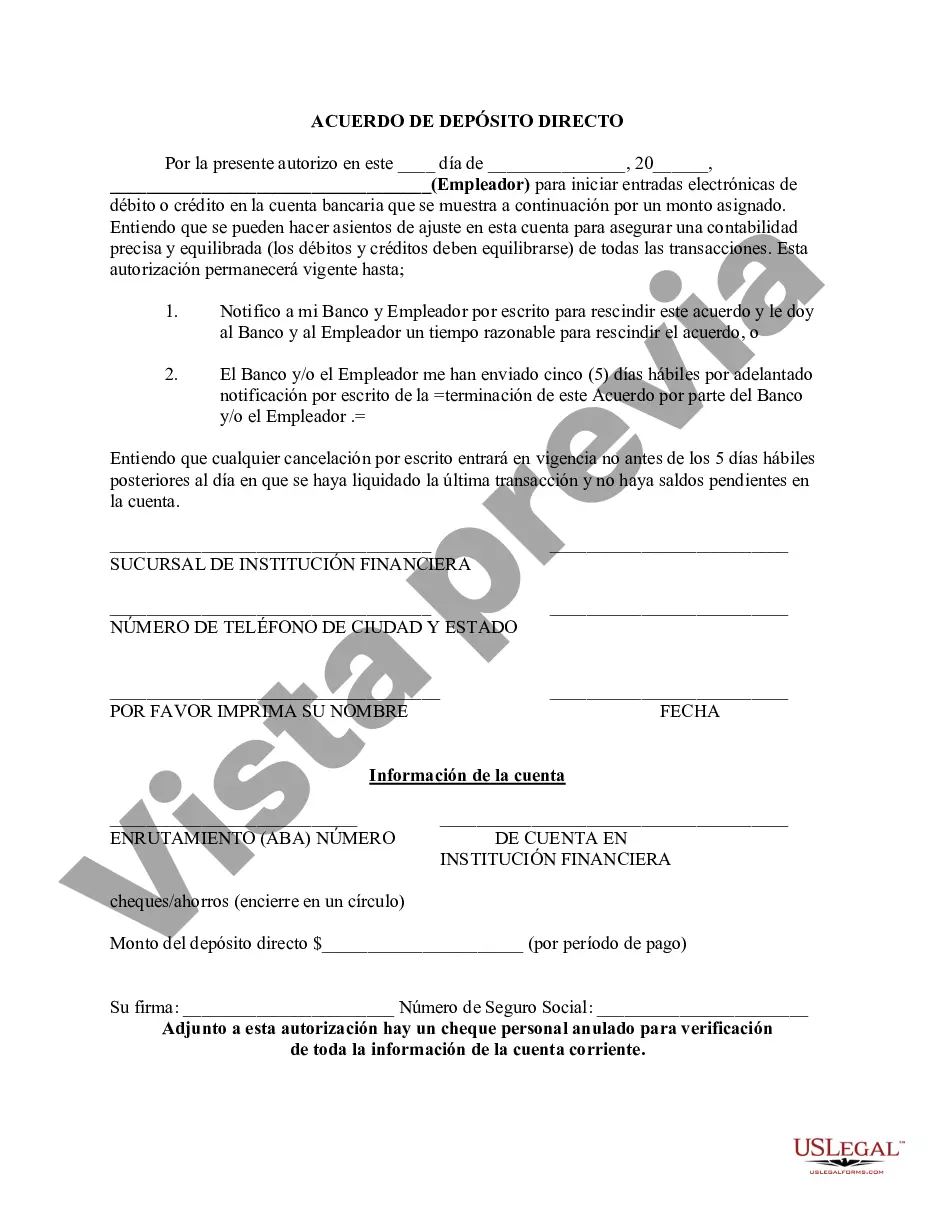

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.