- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

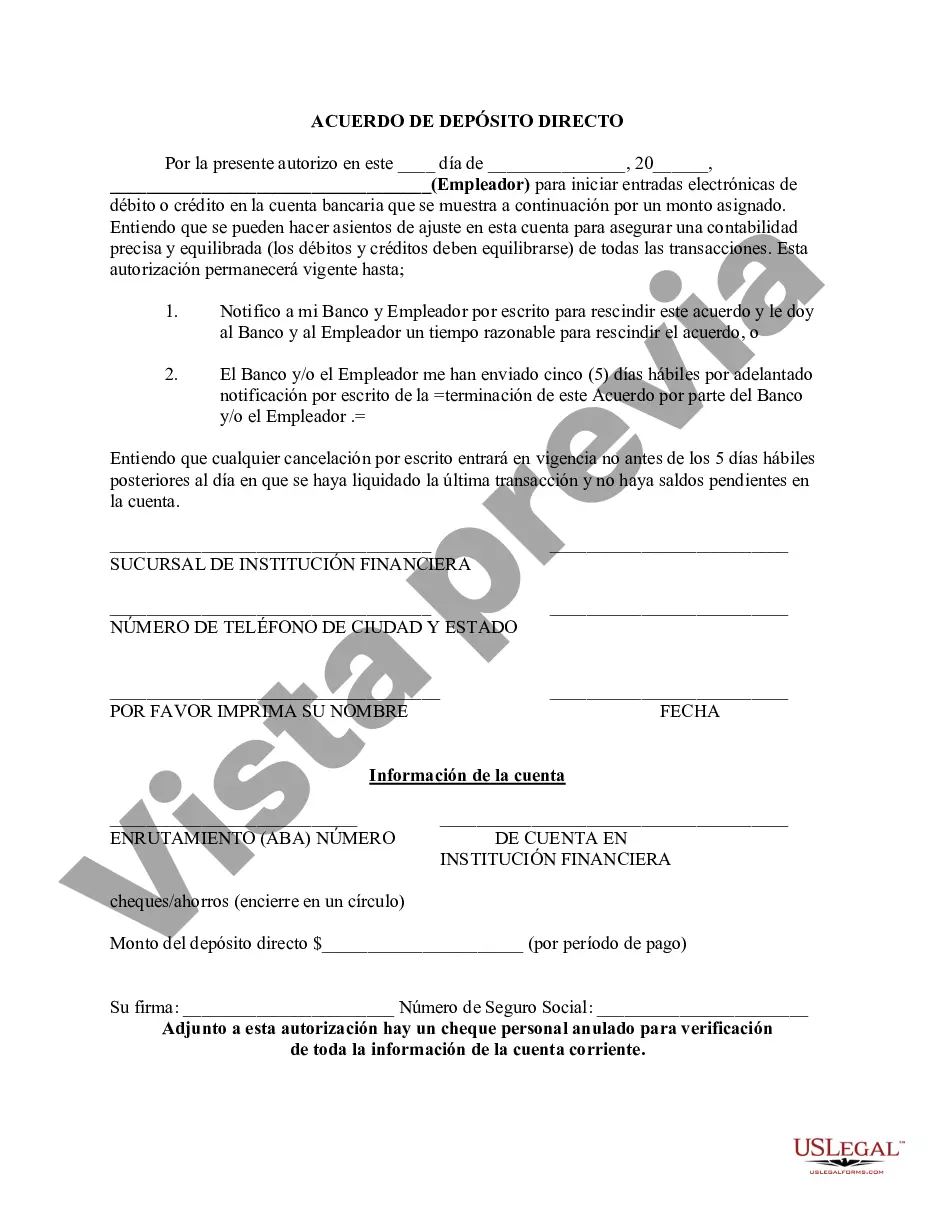

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Dallas Texas Direct Deposit Agreement is a legal document which outlines the terms and conditions between an employee and their employer regarding the direct deposit of their wages into their bank account in Dallas, Texas. This agreement ensures a smooth and convenient process of receiving salary payments electronically, eliminating the need for paper checks and reducing administrative tasks for both parties involved. The Dallas Texas Direct Deposit Agreement typically includes the following key elements: 1. Employee Information: This section captures the personal and contact details of the employee, such as name, address, phone number, social security number, and bank account information. 2. Employer Information: This part includes the name, address, and contact information of the employer or the company, ensuring accurate identification. 3. Authorization and Consent: This clause states that the employee voluntarily authorizes their employer to initiate direct deposits to their designated bank account, authorizing the financial institution to credit the deposited amount accordingly. 4. Confidentiality: This provision ensures the confidentiality and security of the employee's banking information, emphasizing the employer's responsibility to keep the information safe and protected. 5. Change of Account: In case the employee wishes to change their bank account information, this clause provides instructions for officially updating the details with the employer. 6. Responsibilities and Liabilities: This section outlines the responsibilities and liabilities of both the employer and the employee, including any potential issues with the direct deposit process, such as incorrect deposits, account closures, or discrepancies. Different types of Dallas Texas Direct Deposit Agreements may exist based on various factors, such as: 1. Employee Classification: Some companies may have distinct agreements for full-time employees, part-time employees, or contractors. 2. Financial Institution: The type of agreement may depend on the specific bank or financial institution where the employer maintains their accounts. 3. Pay Frequency: Different agreements may exist based on the frequency of pay, such as weekly, biweekly, or monthly direct deposits. 4. Additional Services: Some agreements may include provisions for other financial services, such as split deposits, where the employee can allocate their wages among multiple accounts. In conclusion, the Dallas Texas Direct Deposit Agreement is a crucial document that promotes efficiency and convenience in salary payments for both employers and employees in Dallas, Texas. It ensures a secure and hassle-free process while outlining the obligations, rights, and responsibilities of both parties involved, fostering transparency and effective communication.

Dallas Texas Direct Deposit Agreement is a legal document which outlines the terms and conditions between an employee and their employer regarding the direct deposit of their wages into their bank account in Dallas, Texas. This agreement ensures a smooth and convenient process of receiving salary payments electronically, eliminating the need for paper checks and reducing administrative tasks for both parties involved. The Dallas Texas Direct Deposit Agreement typically includes the following key elements: 1. Employee Information: This section captures the personal and contact details of the employee, such as name, address, phone number, social security number, and bank account information. 2. Employer Information: This part includes the name, address, and contact information of the employer or the company, ensuring accurate identification. 3. Authorization and Consent: This clause states that the employee voluntarily authorizes their employer to initiate direct deposits to their designated bank account, authorizing the financial institution to credit the deposited amount accordingly. 4. Confidentiality: This provision ensures the confidentiality and security of the employee's banking information, emphasizing the employer's responsibility to keep the information safe and protected. 5. Change of Account: In case the employee wishes to change their bank account information, this clause provides instructions for officially updating the details with the employer. 6. Responsibilities and Liabilities: This section outlines the responsibilities and liabilities of both the employer and the employee, including any potential issues with the direct deposit process, such as incorrect deposits, account closures, or discrepancies. Different types of Dallas Texas Direct Deposit Agreements may exist based on various factors, such as: 1. Employee Classification: Some companies may have distinct agreements for full-time employees, part-time employees, or contractors. 2. Financial Institution: The type of agreement may depend on the specific bank or financial institution where the employer maintains their accounts. 3. Pay Frequency: Different agreements may exist based on the frequency of pay, such as weekly, biweekly, or monthly direct deposits. 4. Additional Services: Some agreements may include provisions for other financial services, such as split deposits, where the employee can allocate their wages among multiple accounts. In conclusion, the Dallas Texas Direct Deposit Agreement is a crucial document that promotes efficiency and convenience in salary payments for both employers and employees in Dallas, Texas. It ensures a secure and hassle-free process while outlining the obligations, rights, and responsibilities of both parties involved, fostering transparency and effective communication.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.