- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

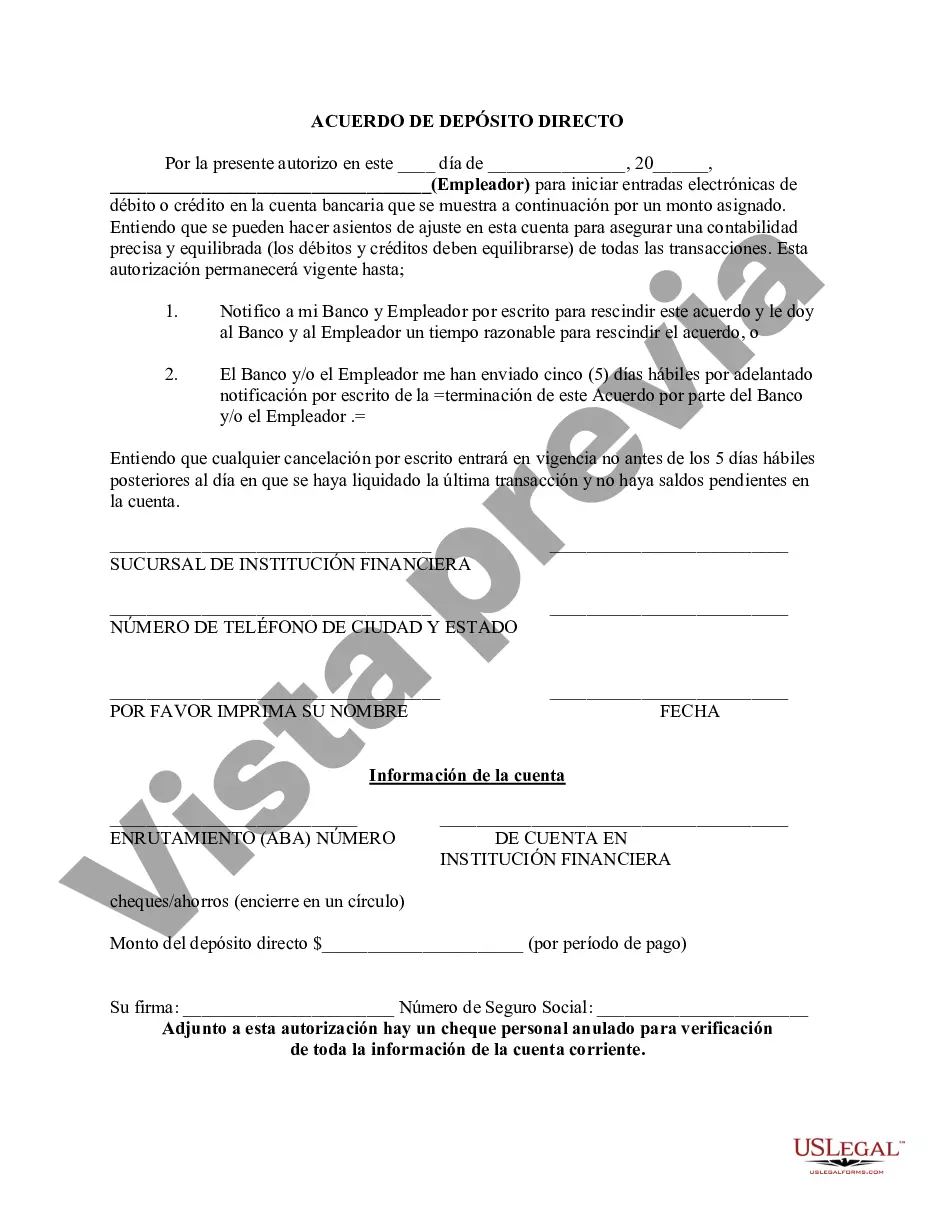

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Franklin Ohio Direct Deposit Agreement is a legal document that outlines the terms and conditions between an individual or a business and Franklin Ohio bank, governing the process of direct deposit. Direct deposit refers to the electronic transfer of funds from a payer's account to a payee's account, usually involving regular payments such as salaries, pensions, or government benefits. This agreement serves as a contractual agreement, ensuring both parties understand their obligations, rights, and responsibilities regarding direct deposit transactions. It provides a legally binding framework to safeguard the interests of both the depositor and the bank, promoting transparency and accountability. The Franklin Ohio Direct Deposit Agreement encompasses various essential components. First, it includes the depositor's information, such as name, address, contact details, and account number. Similarly, the agreement specifies the bank's details, including its name, address, and relevant contact information. The agreement details the depositor's consent and authorization for the bank to initiate direct deposits to their account. It may include specific language or clauses to protect the depositor against unauthorized transactions or fraud, requiring them to promptly notify the bank of any discrepancies. Furthermore, the agreement outlines the bank's responsibilities, including the timely processing of direct deposit transactions, ensuring funds are deposited securely and accurately into the depositor's account. It may also mention any fees or charges associated with the direct deposit service provided by the bank. Additionally, the Franklin Ohio Direct Deposit Agreement may cover other crucial aspects such as the depositor's right to modify or cancel the direct deposit arrangement, the bank's liability for errors or delays in processing, and the procedure for resolving disputes or disagreements between the parties. In terms of different types of Franklin Ohio Direct Deposit Agreement, there may be variations based on the nature of the depositor. For example, individual direct deposit agreements may differ from those of businesses or organizations. However, the fundamental purpose and key elements of the agreement remain consistent across all types. In summary, Franklin Ohio Direct Deposit Agreement acts as a fundamental document establishing the terms and conditions governing the direct deposit process between depositors and Franklin Ohio bank. It protects the rights and interests of both parties while ensuring efficient and secure money transfers.

Franklin Ohio Direct Deposit Agreement is a legal document that outlines the terms and conditions between an individual or a business and Franklin Ohio bank, governing the process of direct deposit. Direct deposit refers to the electronic transfer of funds from a payer's account to a payee's account, usually involving regular payments such as salaries, pensions, or government benefits. This agreement serves as a contractual agreement, ensuring both parties understand their obligations, rights, and responsibilities regarding direct deposit transactions. It provides a legally binding framework to safeguard the interests of both the depositor and the bank, promoting transparency and accountability. The Franklin Ohio Direct Deposit Agreement encompasses various essential components. First, it includes the depositor's information, such as name, address, contact details, and account number. Similarly, the agreement specifies the bank's details, including its name, address, and relevant contact information. The agreement details the depositor's consent and authorization for the bank to initiate direct deposits to their account. It may include specific language or clauses to protect the depositor against unauthorized transactions or fraud, requiring them to promptly notify the bank of any discrepancies. Furthermore, the agreement outlines the bank's responsibilities, including the timely processing of direct deposit transactions, ensuring funds are deposited securely and accurately into the depositor's account. It may also mention any fees or charges associated with the direct deposit service provided by the bank. Additionally, the Franklin Ohio Direct Deposit Agreement may cover other crucial aspects such as the depositor's right to modify or cancel the direct deposit arrangement, the bank's liability for errors or delays in processing, and the procedure for resolving disputes or disagreements between the parties. In terms of different types of Franklin Ohio Direct Deposit Agreement, there may be variations based on the nature of the depositor. For example, individual direct deposit agreements may differ from those of businesses or organizations. However, the fundamental purpose and key elements of the agreement remain consistent across all types. In summary, Franklin Ohio Direct Deposit Agreement acts as a fundamental document establishing the terms and conditions governing the direct deposit process between depositors and Franklin Ohio bank. It protects the rights and interests of both parties while ensuring efficient and secure money transfers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.