- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

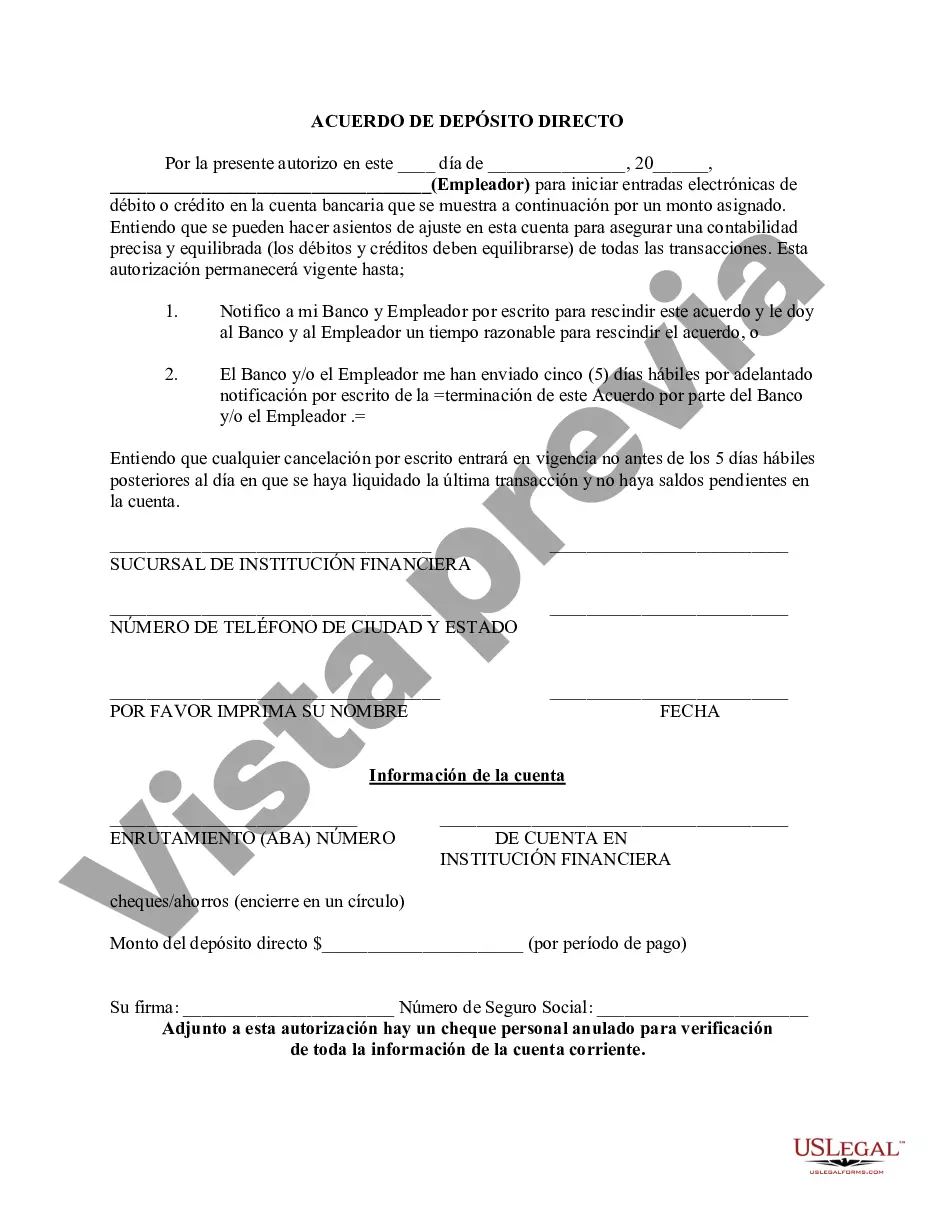

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Houston Texas Direct Deposit Agreement is a binding document that outlines the terms and conditions for initiating and managing electronic fund transfers between a depositor and a financial institution in Houston, Texas. This agreement is commonly used by individuals and businesses to authorize the direct deposit of funds into an account, providing a secure and convenient way to receive payments. The Houston Texas Direct Deposit Agreement typically covers various aspects related to the direct deposit process, including the responsibilities of both the depositor and the financial institution. It specifies the procedures for setting up and terminating direct deposit, as well as any fees or charges associated with the service. In addition to establishing the basic framework for direct deposit, there may be different types or variations of the Houston Texas Direct Deposit Agreement, depending on the specific needs and preferences of the parties involved. Some potential variations may include: 1. Personal Direct Deposit Agreement: Designed for individuals who wish to have their paychecks, government benefits, or other income directly deposited into their personal bank accounts located in Houston, Texas. This type of agreement might include provisions for income tax refunds, retirement benefits, or other recurring payments. 2. Business Direct Deposit Agreement: Tailored to meet the needs of businesses in Houston, Texas, this type of agreement enables employers to deposit employee wages and other business-related payments directly into employee accounts. It may also include provisions for vendor or supplier payments, tax refunds, and other financial transactions. 3. Government Direct Deposit Agreement: Specifically designed for government agencies, this type of agreement allows for the direct deposit of benefits, grants, and other payments to eligible individuals or entities located in Houston, Texas. It ensures a faster and more efficient method of distributing funds, reducing the need for paper checks. 4. Financial Institution Direct Deposit Agreement: This variation of the Houston Texas Direct Deposit Agreement is applicable to financial institutions operating in Houston, Texas. It outlines the terms and conditions under which the institution will process and handle direct deposit transactions on behalf of its customers. This may include guidelines for customer setup, transaction processing, and customer support. Overall, the Houston Texas Direct Deposit Agreement serves as a vital tool for streamlining financial transactions, enhancing convenience, and ensuring the secure transfer of funds between parties in Houston, Texas. It establishes a framework that protects the rights and responsibilities of both the depositor and the financial institution involved in the direct deposit process.

Houston Texas Direct Deposit Agreement is a binding document that outlines the terms and conditions for initiating and managing electronic fund transfers between a depositor and a financial institution in Houston, Texas. This agreement is commonly used by individuals and businesses to authorize the direct deposit of funds into an account, providing a secure and convenient way to receive payments. The Houston Texas Direct Deposit Agreement typically covers various aspects related to the direct deposit process, including the responsibilities of both the depositor and the financial institution. It specifies the procedures for setting up and terminating direct deposit, as well as any fees or charges associated with the service. In addition to establishing the basic framework for direct deposit, there may be different types or variations of the Houston Texas Direct Deposit Agreement, depending on the specific needs and preferences of the parties involved. Some potential variations may include: 1. Personal Direct Deposit Agreement: Designed for individuals who wish to have their paychecks, government benefits, or other income directly deposited into their personal bank accounts located in Houston, Texas. This type of agreement might include provisions for income tax refunds, retirement benefits, or other recurring payments. 2. Business Direct Deposit Agreement: Tailored to meet the needs of businesses in Houston, Texas, this type of agreement enables employers to deposit employee wages and other business-related payments directly into employee accounts. It may also include provisions for vendor or supplier payments, tax refunds, and other financial transactions. 3. Government Direct Deposit Agreement: Specifically designed for government agencies, this type of agreement allows for the direct deposit of benefits, grants, and other payments to eligible individuals or entities located in Houston, Texas. It ensures a faster and more efficient method of distributing funds, reducing the need for paper checks. 4. Financial Institution Direct Deposit Agreement: This variation of the Houston Texas Direct Deposit Agreement is applicable to financial institutions operating in Houston, Texas. It outlines the terms and conditions under which the institution will process and handle direct deposit transactions on behalf of its customers. This may include guidelines for customer setup, transaction processing, and customer support. Overall, the Houston Texas Direct Deposit Agreement serves as a vital tool for streamlining financial transactions, enhancing convenience, and ensuring the secure transfer of funds between parties in Houston, Texas. It establishes a framework that protects the rights and responsibilities of both the depositor and the financial institution involved in the direct deposit process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.