- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Kings New York Direct Deposit Agreement is a contractual agreement between Kings New York bank and its customers that allows for the automatic deposit of funds into a designated bank account. This agreement streamlines the process of receiving payments, such as salaries, benefits, or other recurring income, without the need for physical checks or manual interventions. It provides a secure and convenient way for individuals and businesses to have quick access to their funds, ensuring timely transactions and reducing the risk of lost or stolen checks. The Kings New York Direct Deposit Agreement offers various types of direct deposit services to cater to the diverse needs of its customers. Some commonly known types of Kings New York Direct Deposit Agreements include: 1. Payroll Direct Deposit Agreement: This agreement is typically utilized by employees to receive their wages directly into their Kings New York bank account. By providing their employer with their bank account details, employees can have their salaries deposited automatically and promptly on the agreed-upon payday. 2. Government Direct Deposit Agreement: This type of agreement is suitable for individuals who receive government benefits, such as Social Security, Veterans Affairs, or other entitlement programs. By enrolling in this service and linking their Kings New York bank account, beneficiaries can avoid any delays or inconvenience associated with receiving physical checks in the mail. 3. Vendor Direct Deposit Agreement: Kings New York offers this agreement to facilitate businesses or organizations that regularly receive payments from vendors or clients. By opting for vendor direct deposit, businesses can simplify their account receivables process, ensuring prompt and hassle-free transactions. 4. Pension Direct Deposit Agreement: This agreement is designed specifically for retirees or individuals receiving pension payments. By utilizing this service, retirees can enjoy the convenience of having their pension funds directly deposited into their Kings New York bank account, eliminating the need for manual check deposits. 5. Dividend Direct Deposit Agreement: Stockholders and investors who receive dividends from their investments can take advantage of this agreement. Kings New York allows them to conveniently receive dividend payments directly into their bank account, ensuring faster access to their investment earnings. By offering a comprehensive array of direct deposit agreements, Kings New York aims to cater to its customers' specific needs and create a seamless banking experience. These agreements enhance ease of access, security, and efficiency, revolutionizing traditional payment methods and ensuring a smooth financial journey for its customers.

Kings New York Direct Deposit Agreement is a contractual agreement between Kings New York bank and its customers that allows for the automatic deposit of funds into a designated bank account. This agreement streamlines the process of receiving payments, such as salaries, benefits, or other recurring income, without the need for physical checks or manual interventions. It provides a secure and convenient way for individuals and businesses to have quick access to their funds, ensuring timely transactions and reducing the risk of lost or stolen checks. The Kings New York Direct Deposit Agreement offers various types of direct deposit services to cater to the diverse needs of its customers. Some commonly known types of Kings New York Direct Deposit Agreements include: 1. Payroll Direct Deposit Agreement: This agreement is typically utilized by employees to receive their wages directly into their Kings New York bank account. By providing their employer with their bank account details, employees can have their salaries deposited automatically and promptly on the agreed-upon payday. 2. Government Direct Deposit Agreement: This type of agreement is suitable for individuals who receive government benefits, such as Social Security, Veterans Affairs, or other entitlement programs. By enrolling in this service and linking their Kings New York bank account, beneficiaries can avoid any delays or inconvenience associated with receiving physical checks in the mail. 3. Vendor Direct Deposit Agreement: Kings New York offers this agreement to facilitate businesses or organizations that regularly receive payments from vendors or clients. By opting for vendor direct deposit, businesses can simplify their account receivables process, ensuring prompt and hassle-free transactions. 4. Pension Direct Deposit Agreement: This agreement is designed specifically for retirees or individuals receiving pension payments. By utilizing this service, retirees can enjoy the convenience of having their pension funds directly deposited into their Kings New York bank account, eliminating the need for manual check deposits. 5. Dividend Direct Deposit Agreement: Stockholders and investors who receive dividends from their investments can take advantage of this agreement. Kings New York allows them to conveniently receive dividend payments directly into their bank account, ensuring faster access to their investment earnings. By offering a comprehensive array of direct deposit agreements, Kings New York aims to cater to its customers' specific needs and create a seamless banking experience. These agreements enhance ease of access, security, and efficiency, revolutionizing traditional payment methods and ensuring a smooth financial journey for its customers.

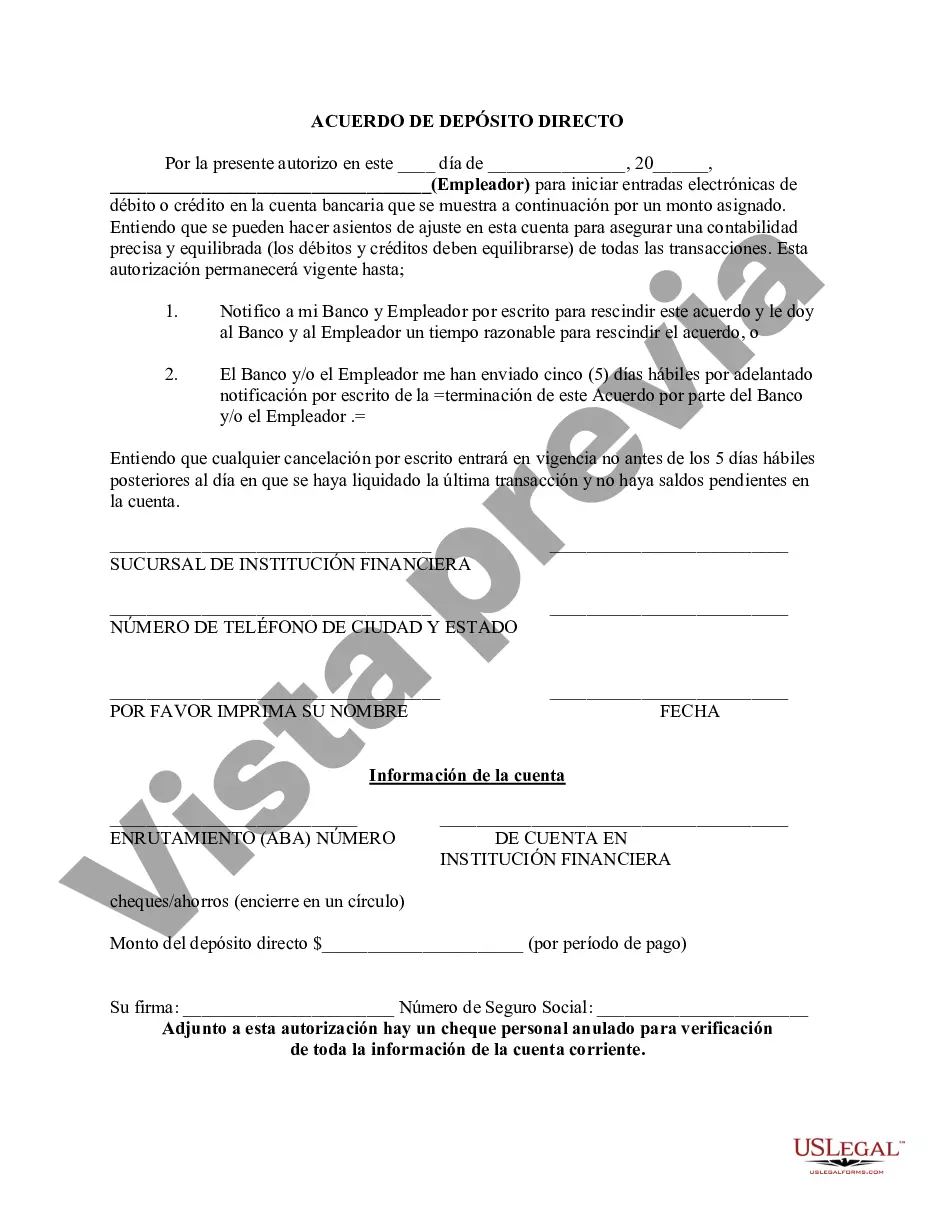

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.