- Instant access to the funds via an ATM or check card;

- A check can be lost or stolen anywhere between the sender and the intended payee;

- Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check.

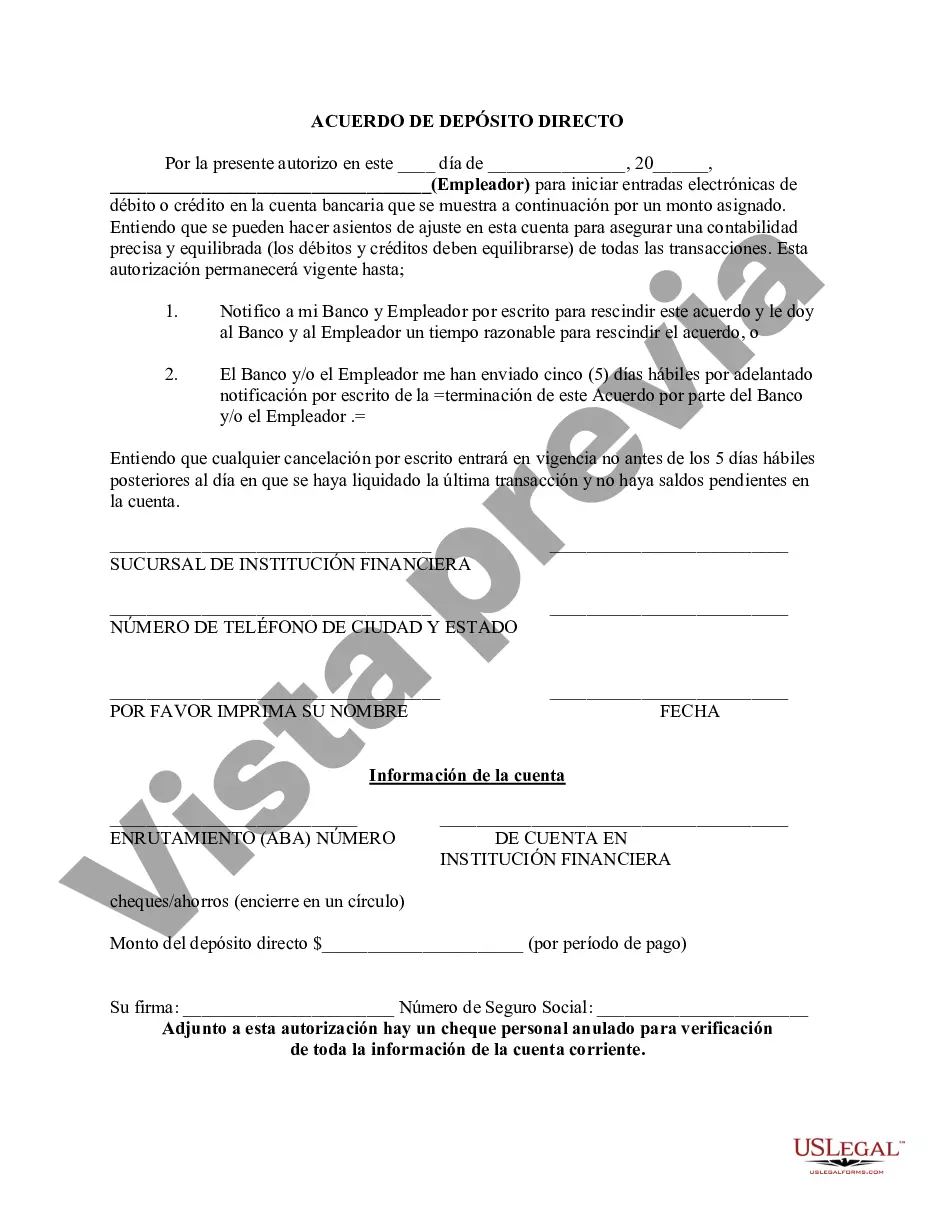

Montgomery Maryland Direct Deposit Agreement is a contractual agreement between an individual or a business entity and a financial institution that outlines the terms and conditions associated with establishing a direct deposit arrangement. Direct deposit is a convenient and secure method of electronically transferring funds from a payer (such as an employer or a government agency) directly into the recipient's bank account. The Montgomery Maryland Direct Deposit Agreement specifies the responsibilities and obligations of both parties involved in the direct deposit process. It covers essential aspects such as the initiation of the direct deposit request, processing timelines, applicable fees (if any), account information requirements, and the obligations of the financial institution to accurately execute the deposit. This agreement serves as the legal basis for facilitating regular deposits, ensuring the timely and seamless transfer of funds. In Montgomery Maryland, there may be various types of Direct Deposit Agreements available to cater to the diverse needs of individuals and businesses. Some notable variations may include: 1. Personal Direct Deposit Agreement: This type of agreement is typically used by individuals who receive payments, such as salaries or benefits, directly into their personal bank accounts. It outlines the terms of direct deposit for personal financial transactions. 2. Business Direct Deposit Agreement: This agreement is designed for businesses of all sizes that wish to receive payments directly into their corporate bank accounts. It provides guidelines that dictate how the business should handle direct deposits, including deposit limits and any specific requirements imposed by the financial institution. 3. Government Direct Deposit Agreement: This type of agreement is specific to government agencies or departments that process payments, such as Social Security or tax refunds, via direct deposit. It ensures compliance with federal regulations and outlines the procedures for direct deposit processing. 4. Non-profit Direct Deposit Agreement: Non-profit organizations may enter into this specific agreement to facilitate direct deposits for receiving donations or grants. It outlines the terms and conditions for receiving donations electronically and ensures transparency and accountability in financial transactions. In summary, the Montgomery Maryland Direct Deposit Agreement serves as a crucial legal document that governs the direct deposit process. It establishes the framework for secure and convenient fund transfers, whether for personal or business purposes. Having a comprehensive agreement in place ensures the smooth functioning of the direct deposit system and promotes financial efficiency for both individuals and organizations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.