- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Sacramento California Direct Deposit Agreement is a legally binding document between an employer and an employee that outlines the terms and conditions of electronic funds transfer for payroll purposes. This agreement enables an employer to directly deposit an employee's wages or salary into their designated bank account on a regular basis, eliminating the need for paper checks. The primary purpose of the Sacramento California Direct Deposit Agreement is to provide convenience and efficiency for both employers and employees. By opting for direct deposit, employees can access their funds more quickly and securely, without having to visit a bank or worry about lost or stolen checks. Employers, on the other hand, can streamline their payroll processes, reduce administrative costs, and ensure timely payment. The Sacramento California Direct Deposit Agreement typically includes important information such as the employee's full name, employee identification number, bank name, account number, and routing number. It also describes the frequency of deposits, whether it is weekly, bi-weekly, or monthly, and specifies the start date of direct deposit services. Moreover, the agreement explains the employee's rights and responsibilities regarding direct deposit, including their ability to withdraw or change the deposit amount or designated account. It also outlines any fees associated with the direct deposit service, such as insufficient funds or account closure fees. It is essential to note that Sacramento California Direct Deposit Agreements may vary depending on the employer's policies and practices. Some employers may offer the option for employees to split their direct deposit amounts into multiple accounts, such as allocation towards savings, checking, or retirement accounts. Others may provide additional options for individuals who do not have access to traditional banking services, like prepaid debit cards. In conclusion, a Sacramento California Direct Deposit Agreement is a vital and common practice in modern payroll management. It ensures fast, secure, and efficient payment delivery for employees while providing administrative ease for employers. By electronically transferring funds to designated bank accounts, both parties can enjoy the many benefits offered by direct deposit services.

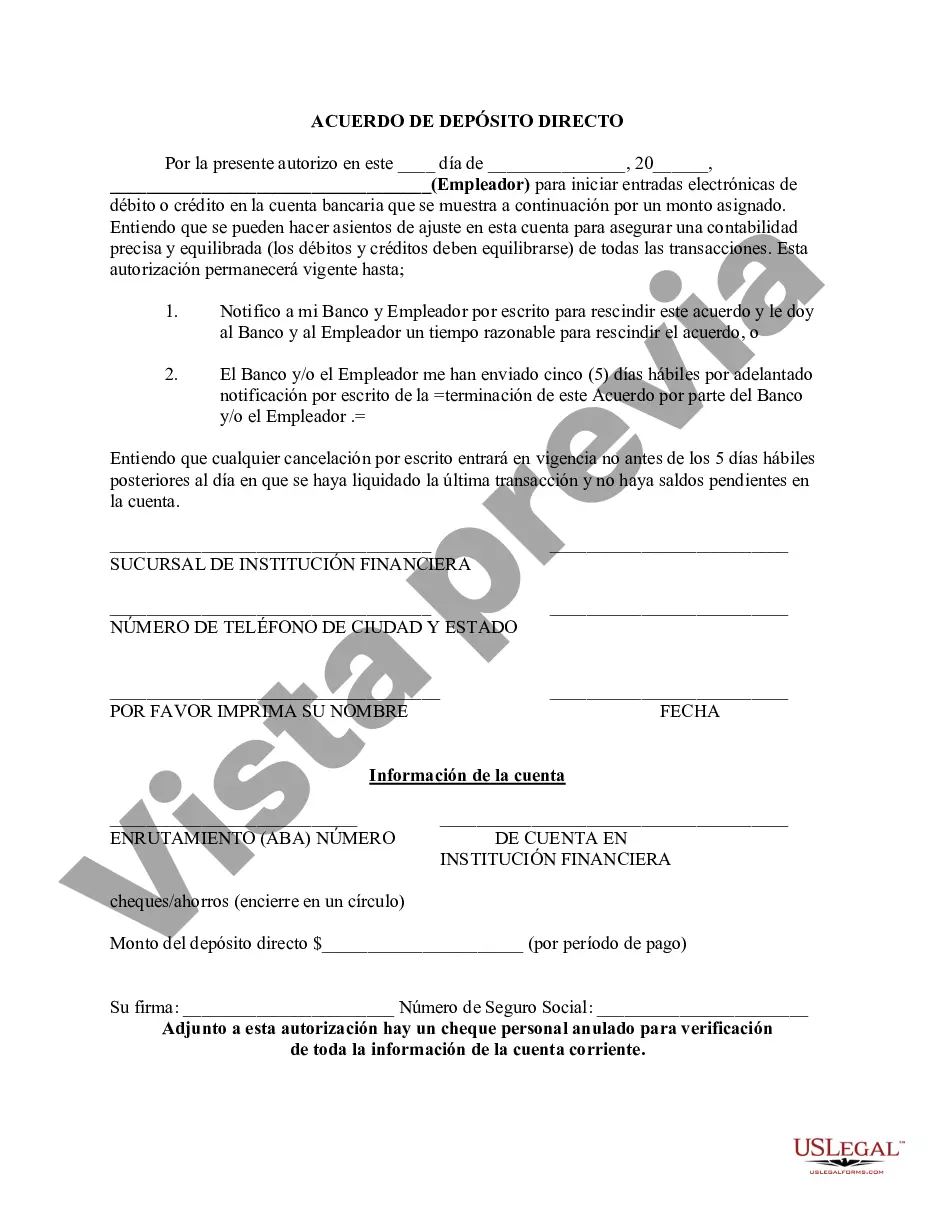

Sacramento California Direct Deposit Agreement is a legally binding document between an employer and an employee that outlines the terms and conditions of electronic funds transfer for payroll purposes. This agreement enables an employer to directly deposit an employee's wages or salary into their designated bank account on a regular basis, eliminating the need for paper checks. The primary purpose of the Sacramento California Direct Deposit Agreement is to provide convenience and efficiency for both employers and employees. By opting for direct deposit, employees can access their funds more quickly and securely, without having to visit a bank or worry about lost or stolen checks. Employers, on the other hand, can streamline their payroll processes, reduce administrative costs, and ensure timely payment. The Sacramento California Direct Deposit Agreement typically includes important information such as the employee's full name, employee identification number, bank name, account number, and routing number. It also describes the frequency of deposits, whether it is weekly, bi-weekly, or monthly, and specifies the start date of direct deposit services. Moreover, the agreement explains the employee's rights and responsibilities regarding direct deposit, including their ability to withdraw or change the deposit amount or designated account. It also outlines any fees associated with the direct deposit service, such as insufficient funds or account closure fees. It is essential to note that Sacramento California Direct Deposit Agreements may vary depending on the employer's policies and practices. Some employers may offer the option for employees to split their direct deposit amounts into multiple accounts, such as allocation towards savings, checking, or retirement accounts. Others may provide additional options for individuals who do not have access to traditional banking services, like prepaid debit cards. In conclusion, a Sacramento California Direct Deposit Agreement is a vital and common practice in modern payroll management. It ensures fast, secure, and efficient payment delivery for employees while providing administrative ease for employers. By electronically transferring funds to designated bank accounts, both parties can enjoy the many benefits offered by direct deposit services.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.