- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

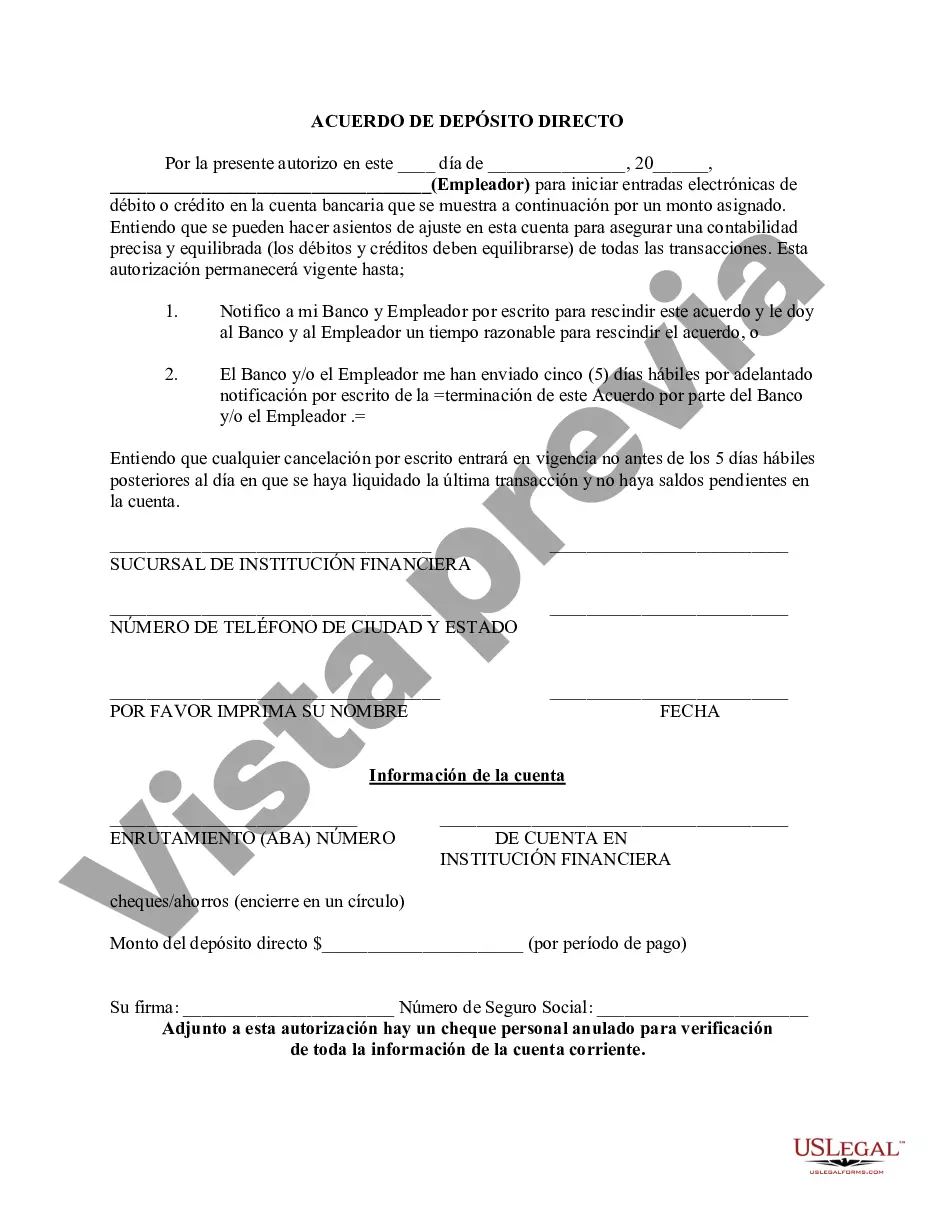

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. The Salt Lake Utah Direct Deposit Agreement is a financial contract that enables individuals or businesses to receive their payments directly into their bank accounts instead of receiving paper checks. It provides a convenient, secure, and efficient method for receiving funds. This agreement serves as a legal document between the account holder and the financial institution, outlining the terms and conditions of the direct deposit service. It typically includes important information such as the account holder's name, account number, bank routing number, and the amount and frequency of the deposits. By opting for direct deposit, individuals can enjoy numerous benefits. It eliminates the hassle of physically depositing checks by automating the process, saving time and effort. It ensures prompt payment as funds are deposited directly into the account on the scheduled date, minimizing any delays or risks associated with receiving physical checks. Direct deposit also enhances security by reducing the chances of misplacing or losing paper checks. There are different types of Salt Lake Utah Direct Deposit Agreements available based on the purpose and usage. These include: 1. Personal Direct Deposit Agreement: This agreement is used by individuals who wish to set up direct deposit for their salary, pension, social security, or other recurring payments. 2. Business Direct Deposit Agreement: This agreement is designed for businesses to receive payments from clients or customers directly into their bank accounts. It streamlines the payment process, improves cash flow, and reduces administrative overhead. 3. Government Direct Deposit Agreement: This type of agreement is specifically for government agencies and organizations that provide benefits, allowances, or grants to eligible individuals or entities. It ensures efficient and reliable payment distribution. 4. Non-Profit Direct Deposit Agreement: Non-profit organizations often utilize this agreement to receive donations, sponsorships, or funding directly into their bank accounts. It enables these organizations to manage their finances effectively and transparently. In conclusion, the Salt Lake Utah Direct Deposit Agreement enables individuals and businesses to streamline their payment processes by receiving funds directly into their bank accounts. It offers convenience, security, and efficiency while eliminating the need for paper checks. The various types of agreements cater to different purposes, ensuring tailored solutions for diverse financial needs.

The Salt Lake Utah Direct Deposit Agreement is a financial contract that enables individuals or businesses to receive their payments directly into their bank accounts instead of receiving paper checks. It provides a convenient, secure, and efficient method for receiving funds. This agreement serves as a legal document between the account holder and the financial institution, outlining the terms and conditions of the direct deposit service. It typically includes important information such as the account holder's name, account number, bank routing number, and the amount and frequency of the deposits. By opting for direct deposit, individuals can enjoy numerous benefits. It eliminates the hassle of physically depositing checks by automating the process, saving time and effort. It ensures prompt payment as funds are deposited directly into the account on the scheduled date, minimizing any delays or risks associated with receiving physical checks. Direct deposit also enhances security by reducing the chances of misplacing or losing paper checks. There are different types of Salt Lake Utah Direct Deposit Agreements available based on the purpose and usage. These include: 1. Personal Direct Deposit Agreement: This agreement is used by individuals who wish to set up direct deposit for their salary, pension, social security, or other recurring payments. 2. Business Direct Deposit Agreement: This agreement is designed for businesses to receive payments from clients or customers directly into their bank accounts. It streamlines the payment process, improves cash flow, and reduces administrative overhead. 3. Government Direct Deposit Agreement: This type of agreement is specifically for government agencies and organizations that provide benefits, allowances, or grants to eligible individuals or entities. It ensures efficient and reliable payment distribution. 4. Non-Profit Direct Deposit Agreement: Non-profit organizations often utilize this agreement to receive donations, sponsorships, or funding directly into their bank accounts. It enables these organizations to manage their finances effectively and transparently. In conclusion, the Salt Lake Utah Direct Deposit Agreement enables individuals and businesses to streamline their payment processes by receiving funds directly into their bank accounts. It offers convenience, security, and efficiency while eliminating the need for paper checks. The various types of agreements cater to different purposes, ensuring tailored solutions for diverse financial needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.