- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

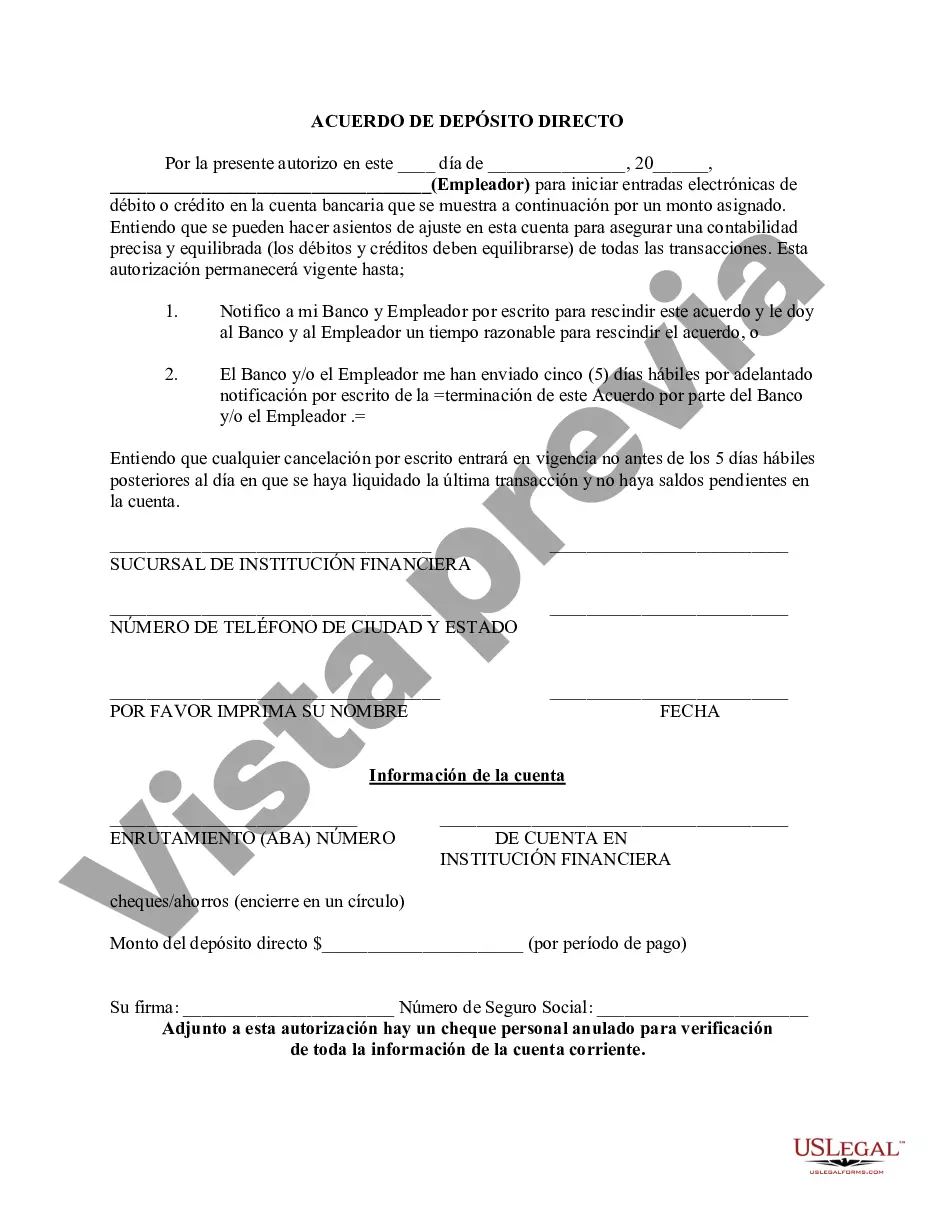

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. San Bernardino California Direct Deposit Agreement is a contractual relationship between an individual or business entity and a financial institution in the city of San Bernardino, California. Direct deposit refers to the electronic transfer of funds from a payer (employer or government agency) directly into the recipient's bank account. This agreement outlines the terms and conditions related to the direct deposit service provided by the financial institution to the account holder. In San Bernardino, there are various types of Direct Deposit Agreements offered by different financial institutions. Some common types include: 1. Personal Direct Deposit Agreement: This type of agreement is for individuals who wish to receive their salary, pension, or other regular payments directly into their personal bank account. It ensures a convenient and secure way to access funds without the need for physical checks. 2. Business Direct Deposit Agreement: Designed for businesses, this agreement allows companies to electronically deposit payroll, pay vendors, and receive payments from customers directly into their business bank account. It streamlines financial transactions, reduces administrative efforts, and provides businesses with immediate access to funds. 3. Government Direct Deposit Agreement: Government agencies often offer this agreement to citizens who are eligible for governmental benefits such as social security, unemployment compensation, or tax refunds. By opting for direct deposit, recipients can receive their funds faster and eliminate the risk of lost or stolen checks. 4. Payment Direct Deposit Agreement: Financial institutions offer this agreement to facilitate recurring payments made by individuals or businesses to a specific recipient, such as rent payments, loan repayments, or subscription fees. It automates the payment process, ensuring timely and efficient transactions. Key components of a San Bernardino California Direct Deposit Agreement typically include the account holder's information, account details (including routing number), the frequency of deposits, the authorization to deposit funds, potential fees or charges, and the rights and responsibilities of both parties involved. It is important to note that various financial institutions may have their own specific terms and conditions, such as minimum balance requirements, transaction limits, and deadlines for making changes to the account. Therefore, it is essential for individuals or businesses in San Bernardino, California, to carefully review and understand the terms outlined in their respective direct deposit agreements to make informed decisions about the financial services they opt for.

San Bernardino California Direct Deposit Agreement is a contractual relationship between an individual or business entity and a financial institution in the city of San Bernardino, California. Direct deposit refers to the electronic transfer of funds from a payer (employer or government agency) directly into the recipient's bank account. This agreement outlines the terms and conditions related to the direct deposit service provided by the financial institution to the account holder. In San Bernardino, there are various types of Direct Deposit Agreements offered by different financial institutions. Some common types include: 1. Personal Direct Deposit Agreement: This type of agreement is for individuals who wish to receive their salary, pension, or other regular payments directly into their personal bank account. It ensures a convenient and secure way to access funds without the need for physical checks. 2. Business Direct Deposit Agreement: Designed for businesses, this agreement allows companies to electronically deposit payroll, pay vendors, and receive payments from customers directly into their business bank account. It streamlines financial transactions, reduces administrative efforts, and provides businesses with immediate access to funds. 3. Government Direct Deposit Agreement: Government agencies often offer this agreement to citizens who are eligible for governmental benefits such as social security, unemployment compensation, or tax refunds. By opting for direct deposit, recipients can receive their funds faster and eliminate the risk of lost or stolen checks. 4. Payment Direct Deposit Agreement: Financial institutions offer this agreement to facilitate recurring payments made by individuals or businesses to a specific recipient, such as rent payments, loan repayments, or subscription fees. It automates the payment process, ensuring timely and efficient transactions. Key components of a San Bernardino California Direct Deposit Agreement typically include the account holder's information, account details (including routing number), the frequency of deposits, the authorization to deposit funds, potential fees or charges, and the rights and responsibilities of both parties involved. It is important to note that various financial institutions may have their own specific terms and conditions, such as minimum balance requirements, transaction limits, and deadlines for making changes to the account. Therefore, it is essential for individuals or businesses in San Bernardino, California, to carefully review and understand the terms outlined in their respective direct deposit agreements to make informed decisions about the financial services they opt for.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.