- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. San Diego Direct Deposit Agreement is a crucial financial document that outlines the terms and conditions of electronic fund transfers to be made into a San Diego resident's account. This agreement establishes a relationship between the account holder and the financial institution, serving as a reliable method for receiving payments securely and efficiently. With a direct deposit agreement, individuals can avoid the hassle of physical checks and enjoy the convenience of automatic and timely money transfers. Several types of San Diego California Direct Deposit Agreements exist to cater to various needs and preferences: 1. Employer Direct Deposit Agreement: This type of agreement is commonly used by employees to authorize their employers to deposit their salaries or wages directly into their bank accounts. The employee provides their account details to the employer, granting permission for the electronic transfer of funds on scheduled paydays. 2. Government Benefit Direct Deposit Agreement: This agreement is specifically designed for individuals who receive government benefits, such as Social Security, Medicare, unemployment, or disability payments. Government agencies encourage beneficiaries to set up direct deposit to ensure prompt and secure receipt of their funds. By signing a San Diego California Direct Deposit Agreement, beneficiaries allow the government to deposit their benefits directly into their bank accounts. 3. Rental Income Direct Deposit Agreement: This agreement is suitable for landlords who collect monthly rent payments from their tenants. By establishing a direct deposit arrangement, landlords can ensure consistent and hassle-free rent transfers, eliminating the need for physical checks or the risk of late payments. 4. Pension Direct Deposit Agreement: Retirees who receive a pension can opt for a direct deposit agreement to simplify the process of receiving their monthly pension payments. By enrolling in direct deposit, pensioners can avoid delays that may occur due to postal services or lost checks, ensuring a timely arrival of their pension income. 5. Business Direct Deposit Agreement: Business owners can take advantage of this agreement to help streamline their financial operations. By signing up for direct deposit, businesses can facilitate the electronic transfer of funds related to payroll, vendor payments, or even customer refunds. This reduces paperwork, saves time, and enables organizations to maintain accurate financial records. In summary, a San Diego California Direct Deposit Agreement is a legally binding document that serves as a convenient, secure, and efficient method for receiving various forms of income electronically. The agreement type may vary depending on the purpose, such as employer deposits, government benefits, rental income, pension payments, or business transactions.

San Diego Direct Deposit Agreement is a crucial financial document that outlines the terms and conditions of electronic fund transfers to be made into a San Diego resident's account. This agreement establishes a relationship between the account holder and the financial institution, serving as a reliable method for receiving payments securely and efficiently. With a direct deposit agreement, individuals can avoid the hassle of physical checks and enjoy the convenience of automatic and timely money transfers. Several types of San Diego California Direct Deposit Agreements exist to cater to various needs and preferences: 1. Employer Direct Deposit Agreement: This type of agreement is commonly used by employees to authorize their employers to deposit their salaries or wages directly into their bank accounts. The employee provides their account details to the employer, granting permission for the electronic transfer of funds on scheduled paydays. 2. Government Benefit Direct Deposit Agreement: This agreement is specifically designed for individuals who receive government benefits, such as Social Security, Medicare, unemployment, or disability payments. Government agencies encourage beneficiaries to set up direct deposit to ensure prompt and secure receipt of their funds. By signing a San Diego California Direct Deposit Agreement, beneficiaries allow the government to deposit their benefits directly into their bank accounts. 3. Rental Income Direct Deposit Agreement: This agreement is suitable for landlords who collect monthly rent payments from their tenants. By establishing a direct deposit arrangement, landlords can ensure consistent and hassle-free rent transfers, eliminating the need for physical checks or the risk of late payments. 4. Pension Direct Deposit Agreement: Retirees who receive a pension can opt for a direct deposit agreement to simplify the process of receiving their monthly pension payments. By enrolling in direct deposit, pensioners can avoid delays that may occur due to postal services or lost checks, ensuring a timely arrival of their pension income. 5. Business Direct Deposit Agreement: Business owners can take advantage of this agreement to help streamline their financial operations. By signing up for direct deposit, businesses can facilitate the electronic transfer of funds related to payroll, vendor payments, or even customer refunds. This reduces paperwork, saves time, and enables organizations to maintain accurate financial records. In summary, a San Diego California Direct Deposit Agreement is a legally binding document that serves as a convenient, secure, and efficient method for receiving various forms of income electronically. The agreement type may vary depending on the purpose, such as employer deposits, government benefits, rental income, pension payments, or business transactions.

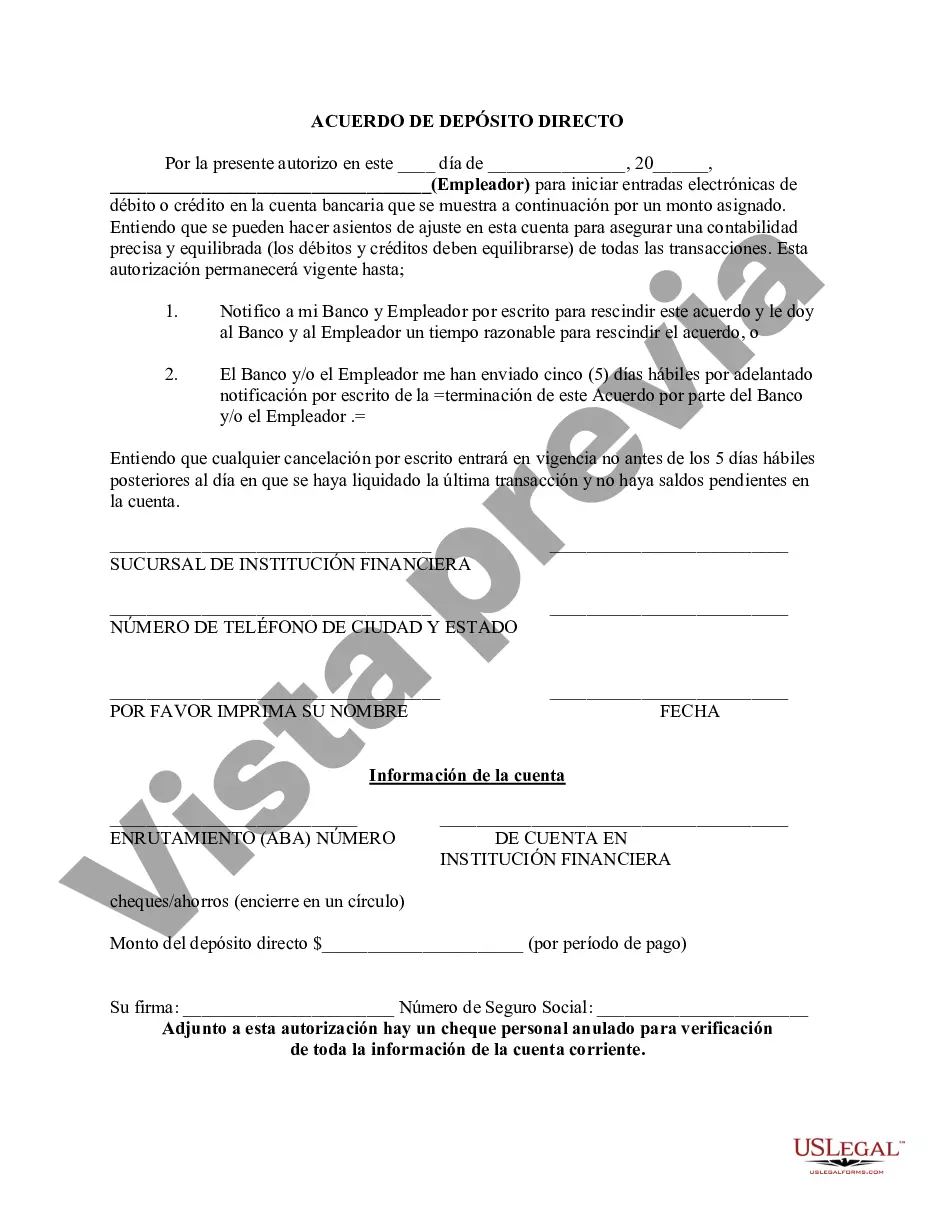

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.