- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

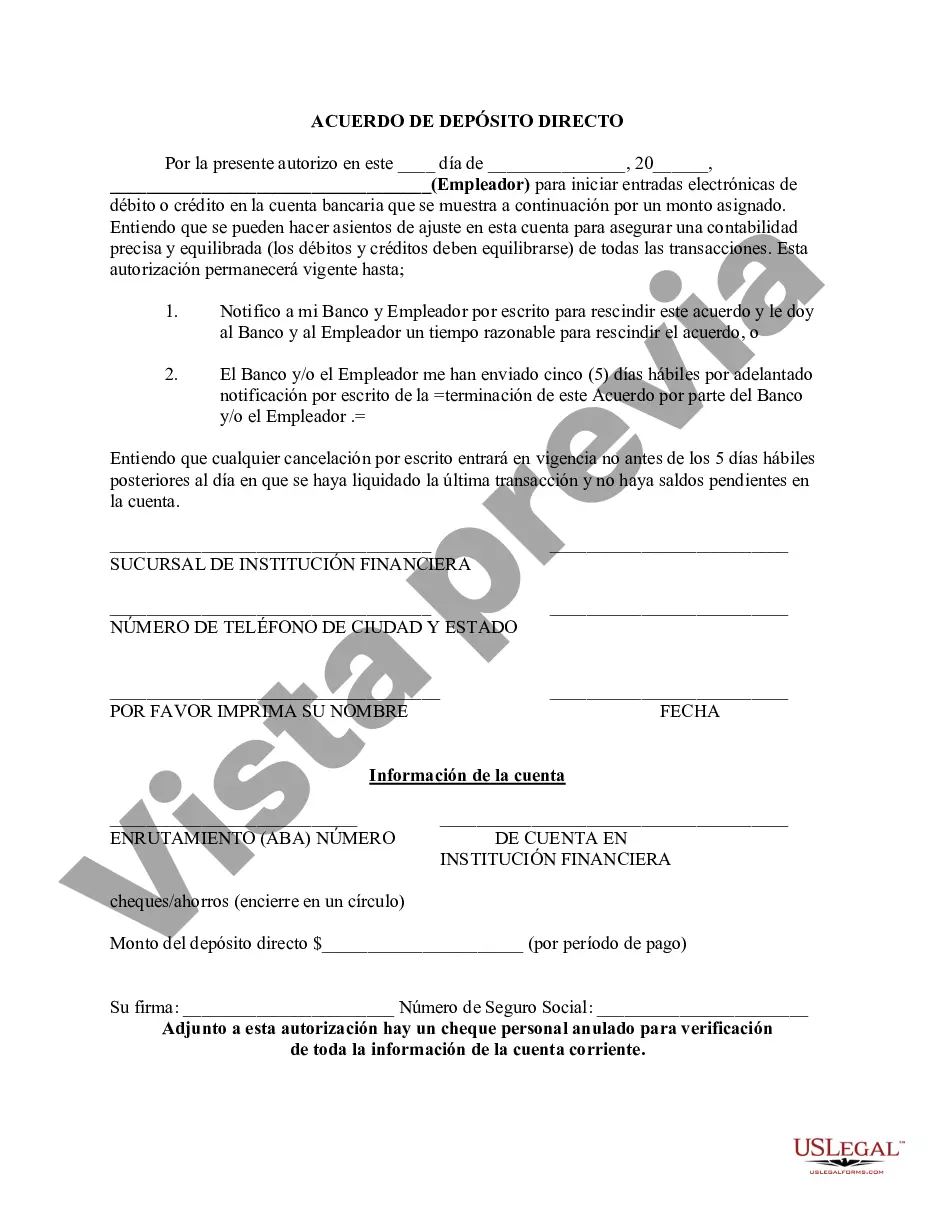

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Suffolk New York Direct Deposit Agreement is a formal arrangement between an individual or a business entity and a financial institution that enables the direct deposit of funds into a designated bank account. This agreement streamlines the process of receiving payments, such as salaries, pensions, government benefits, or other regular income, by electronically depositing the funds directly into the recipient's account. The Suffolk New York Direct Deposit Agreement provides a secure and convenient method to access funds without the need for physical paper checks. By utilizing direct deposit services, individuals can avoid the hassle of visiting a bank branch or waiting for checks to clear. There are various types of Suffolk New York Direct Deposit Agreements tailored to meet different needs: 1. Personal Direct Deposit Agreement: Designed for individuals who wish to have their salaries or other income directly deposited into their personal bank accounts. This agreement ensures seamless and timely payment transfers, eliminating the risk of lost or stolen paper checks. 2. Business Direct Deposit Agreement: Suited for businesses and organizations, this type of agreement enables the direct deposit of employee wages, vendor payments, and other business-related transactions into the chosen bank account. It simplifies payroll management, improves efficiency, and reduces administrative costs associated with distributing physical checks. 3. Government Direct Deposit Agreement: This agreement is specifically for individuals who receive government benefits such as Social Security, Medicare, or Veterans Affairs (VA) payments. By opting for direct deposit, beneficiaries can enjoy the convenience of automatic deposits while minimizing the chances of payment delays or lost checks. The Suffolk New York Direct Deposit Agreement typically contains several key elements, including the account holder's personal or business details, bank account information, payment amounts, frequency of deposits, and authorization for the financial institution to initiate the electronic fund transfers. Additionally, the agreement may outline any bank fees associated with the direct deposit service. In summary, Suffolk New York Direct Deposit Agreement is a contractual arrangement that facilitates timely and secure electronic transfer of funds into designated bank accounts. It is available in various types, including personal, business, and government agreements, catering to the needs of individuals, organizations, and government beneficiaries. By utilizing direct deposit services, one can enjoy the benefits of convenience, efficiency, and enhanced financial security.

Suffolk New York Direct Deposit Agreement is a formal arrangement between an individual or a business entity and a financial institution that enables the direct deposit of funds into a designated bank account. This agreement streamlines the process of receiving payments, such as salaries, pensions, government benefits, or other regular income, by electronically depositing the funds directly into the recipient's account. The Suffolk New York Direct Deposit Agreement provides a secure and convenient method to access funds without the need for physical paper checks. By utilizing direct deposit services, individuals can avoid the hassle of visiting a bank branch or waiting for checks to clear. There are various types of Suffolk New York Direct Deposit Agreements tailored to meet different needs: 1. Personal Direct Deposit Agreement: Designed for individuals who wish to have their salaries or other income directly deposited into their personal bank accounts. This agreement ensures seamless and timely payment transfers, eliminating the risk of lost or stolen paper checks. 2. Business Direct Deposit Agreement: Suited for businesses and organizations, this type of agreement enables the direct deposit of employee wages, vendor payments, and other business-related transactions into the chosen bank account. It simplifies payroll management, improves efficiency, and reduces administrative costs associated with distributing physical checks. 3. Government Direct Deposit Agreement: This agreement is specifically for individuals who receive government benefits such as Social Security, Medicare, or Veterans Affairs (VA) payments. By opting for direct deposit, beneficiaries can enjoy the convenience of automatic deposits while minimizing the chances of payment delays or lost checks. The Suffolk New York Direct Deposit Agreement typically contains several key elements, including the account holder's personal or business details, bank account information, payment amounts, frequency of deposits, and authorization for the financial institution to initiate the electronic fund transfers. Additionally, the agreement may outline any bank fees associated with the direct deposit service. In summary, Suffolk New York Direct Deposit Agreement is a contractual arrangement that facilitates timely and secure electronic transfer of funds into designated bank accounts. It is available in various types, including personal, business, and government agreements, catering to the needs of individuals, organizations, and government beneficiaries. By utilizing direct deposit services, one can enjoy the benefits of convenience, efficiency, and enhanced financial security.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.