- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

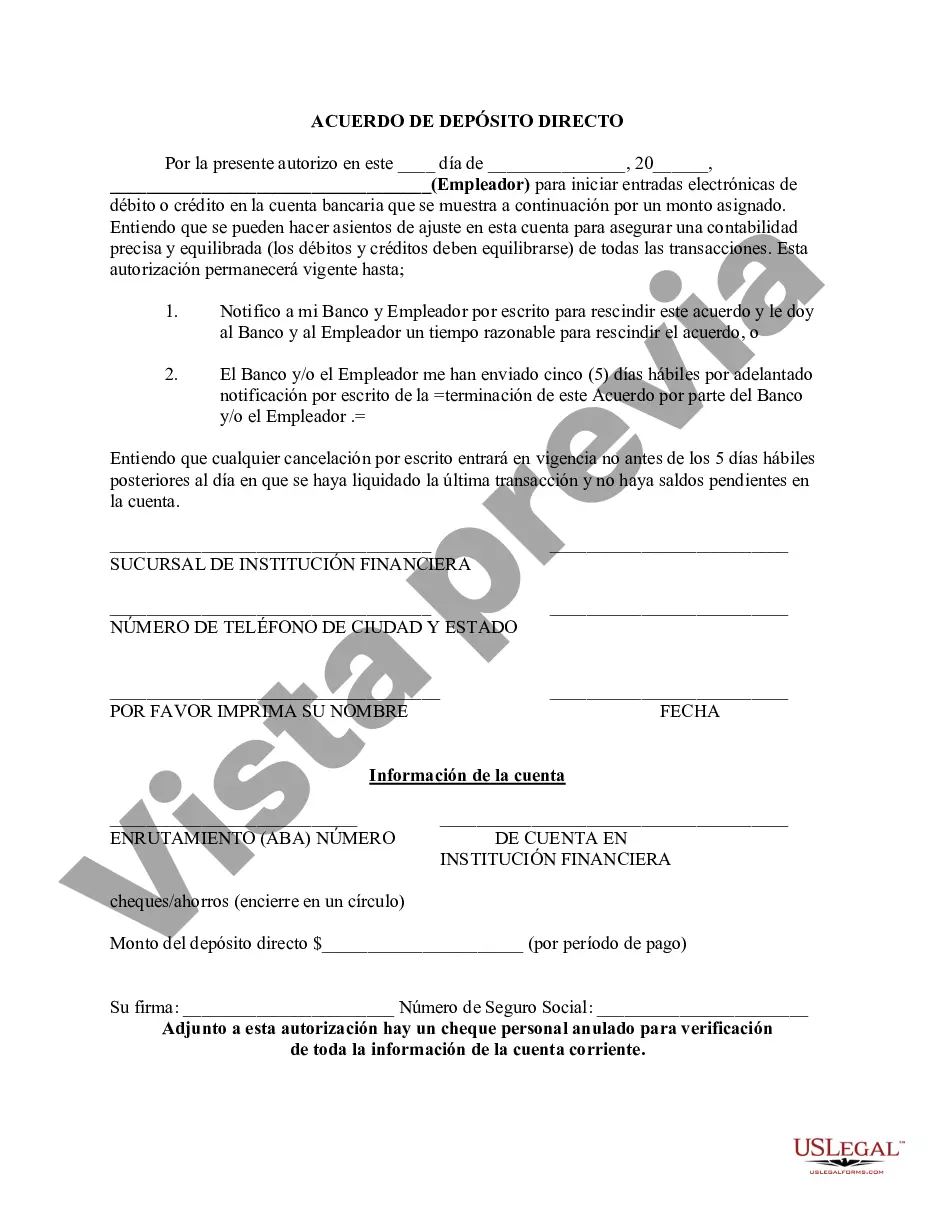

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Tarrant Texas Direct Deposit Agreement is a legal document that outlines the terms and conditions between an employer or a company and its employees regarding the direct deposit of their wages or salaries into their bank accounts. Direct deposit is a convenient and efficient method for employees to receive their payments electronically, eliminating the need for physical checks or cash. This agreement ensures transparency and clarity in the direct deposit process, protecting the rights and interests of both the employer and employees. The Tarrant Texas Direct Deposit Agreement typically includes important details such as: 1. Employee Information: This section will require employees to provide their full name, employee identification number, social security number, address, and bank account details. 2. Authorization: The agreement will outline the employee's consent and authorization for the employer to deposit their pay directly into their designated bank account. 3. Financial Institution Details: This part of the agreement will require employees to provide the name of their financial institution, the bank's routing number, and their account number. 4. Deposit Execution: The agreement will specify the frequency of deposits, whether it is weekly, bi-weekly, or monthly, and the specific dates the payments will be made. 5. Payment Verification: This section will detail how employees can verify their payments, such as reviewing bank statements or online banking portals, and the steps they should take in case of any discrepancies. 6. Termination or Modification: The agreement will provide information on how employees can request changes or terminate their direct deposit arrangement. It is important to note that there may be different types of Tarrant Texas Direct Deposit Agreements tailored to specific situations or industries. For instance: 1. Employee Direct Deposit Agreement: This agreement is used for employees of a company who wish to receive their wages or salaries via direct deposit. 2. Contractor Direct Deposit Agreement: This agreement is for independent contractors or freelancers who have a direct deposit arrangement with their clients or employers. 3. Government Assistance Direct Deposit Agreement: This type of agreement is used for individuals or households receiving government assistance payments, such as unemployment benefits or social security, through direct deposit. Overall, the Tarrant Texas Direct Deposit Agreement offers a secure and efficient way for employers and employees to handle payment transactions, ensuring a smooth and hassle-free process for both parties involved.

Tarrant Texas Direct Deposit Agreement is a legal document that outlines the terms and conditions between an employer or a company and its employees regarding the direct deposit of their wages or salaries into their bank accounts. Direct deposit is a convenient and efficient method for employees to receive their payments electronically, eliminating the need for physical checks or cash. This agreement ensures transparency and clarity in the direct deposit process, protecting the rights and interests of both the employer and employees. The Tarrant Texas Direct Deposit Agreement typically includes important details such as: 1. Employee Information: This section will require employees to provide their full name, employee identification number, social security number, address, and bank account details. 2. Authorization: The agreement will outline the employee's consent and authorization for the employer to deposit their pay directly into their designated bank account. 3. Financial Institution Details: This part of the agreement will require employees to provide the name of their financial institution, the bank's routing number, and their account number. 4. Deposit Execution: The agreement will specify the frequency of deposits, whether it is weekly, bi-weekly, or monthly, and the specific dates the payments will be made. 5. Payment Verification: This section will detail how employees can verify their payments, such as reviewing bank statements or online banking portals, and the steps they should take in case of any discrepancies. 6. Termination or Modification: The agreement will provide information on how employees can request changes or terminate their direct deposit arrangement. It is important to note that there may be different types of Tarrant Texas Direct Deposit Agreements tailored to specific situations or industries. For instance: 1. Employee Direct Deposit Agreement: This agreement is used for employees of a company who wish to receive their wages or salaries via direct deposit. 2. Contractor Direct Deposit Agreement: This agreement is for independent contractors or freelancers who have a direct deposit arrangement with their clients or employers. 3. Government Assistance Direct Deposit Agreement: This type of agreement is used for individuals or households receiving government assistance payments, such as unemployment benefits or social security, through direct deposit. Overall, the Tarrant Texas Direct Deposit Agreement offers a secure and efficient way for employers and employees to handle payment transactions, ensuring a smooth and hassle-free process for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.