The Houston Texas Deferred Compensation Agreement — Short Form is a contractual arrangement designed to provide employees with an option to defer a portion of their salary or compensation for retirement purposes. This agreement allows employees to set aside a certain amount of their income on a pre-tax basis, which can then be invested for growth until it is withdrawn at a later date, typically during retirement. Under this agreement, employees can choose to defer a percentage of their salary, bonuses, or other forms of compensation, enabling them to potentially benefit from tax savings and accumulate additional funds for retirement. The deferred amount is held in a separate account, often invested in various investment vehicles, such as mutual funds, bonds, or stocks, based on the employee's preference and risk tolerance. Houston Texas offers different types of Deferred Compensation Agreements — Short Form to cater to the specific needs and preferences of employees. These may include: 1. Basic Deferred Compensation Agreement: This is the standard short form agreement that allows employees to defer a portion of their salary or compensation on a pre-tax basis, with the funds invested in various investment options. 2. Matching Deferred Compensation Agreement: This agreement provides an additional incentive to employees by offering an employer match on the deferred contributions. For example, if an employee defers 3% of their salary, the employer may contribute an additional 3% into the account, effectively doubling the employee's contribution. 3. Roth Deferred Compensation Agreement: This type of agreement allows employees to defer a portion of their salary on an after-tax basis. While contributions to the account are not tax-deductible, qualified distributions, including earnings, can be tax-free at retirement, providing potential tax benefits. 4. Escrow Deferred Compensation Agreement: In certain cases, this agreement can be set up to create an escrow account for the deferred amount. This account may serve as collateral or security for a specific purpose, such as loan repayment or funding a particular business venture. The Houston Texas Deferred Compensation Agreement — Short Form is a valuable tool for employees seeking to supplement their retirement income, enhance savings, and potentially reduce their tax liability. It is important for employees to review and understand the terms and conditions of the agreement before deciding to participate, as the specific features and investment options may vary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Acuerdo de Compensación Diferida - Forma Corta - Deferred Compensation Agreement - Short Form

Description

How to fill out Houston Texas Acuerdo De Compensación Diferida - Forma Corta?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your county, including the Houston Deferred Compensation Agreement - Short Form.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Houston Deferred Compensation Agreement - Short Form will be accessible for further use in the My Forms tab of your profile.

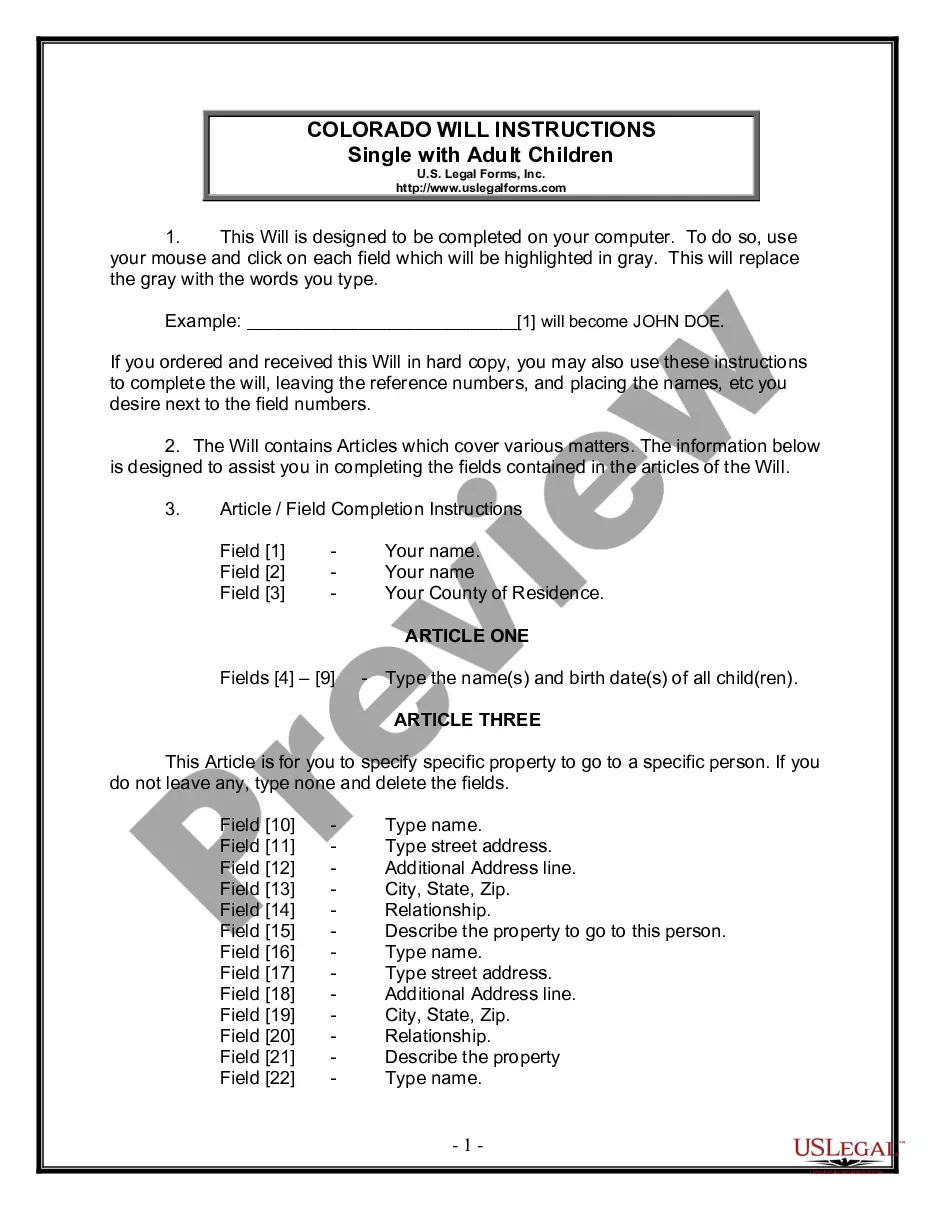

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Houston Deferred Compensation Agreement - Short Form:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Houston Deferred Compensation Agreement - Short Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!