The Nassau New York Deferred Compensation Agreement — Short Form is a legal document that outlines the arrangements between an employer and an employee for deferring a portion of the employee's income. It is applicable to employees working in Nassau County, New York, and it offers tax advantages and enhanced retirement savings options. This agreement allows the employee to defer a certain percentage of their income, either on a pre-tax or post-tax basis, to be received at a future date. By deferring part of their earnings, employees can reduce their current taxable income and potentially benefit from lower tax brackets, resulting in overall tax savings. The Nassau New York Deferred Compensation Agreement — Short Form provides flexibility regarding the investment options for the deferred funds. Employees may have various options, including different investment funds, stocks, bonds, or other assets, depending on the agreement type. These investment options are designed to help the employee maximize their investment growth over time. One type of Nassau New York Deferred Compensation Agreement — Short Form is a fixed deferred compensation agreement, where the employee chooses a predetermined interest rate for their deferred funds. This ensures a consistent return on investment, regardless of market fluctuations. Another type of agreement is an equity-based deferred compensation agreement where the employee's funds are invested in stocks or other equity vehicles. This option allows the employee to potentially benefit from higher investment returns but also carries a higher level of risk. Employees may also have the option to select a combination of both fixed and equity-based investments, depending on their risk tolerance and retirement goals. The Nassau New York Deferred Compensation Agreement — Short Form clearly defines the terms and conditions for the deferment, including any vesting periods, withdrawal restrictions, and penalties for early withdrawals, if applicable. This agreement aims to protect both the employee and the employer, ensuring transparency and compliance with relevant tax laws and regulations. Employees considering participating in a Nassau New York Deferred Compensation Agreement — Short Form should carefully review the terms and seek advice from financial advisors or tax professionals to make informed decisions. It is crucial to understand the potential tax implications, investment options, and the overall impact on retirement planning. Overall, the Nassau New York Deferred Compensation Agreement — Short Form is a beneficial tool that provides employees with the opportunity to build additional retirement savings while enjoying potential tax advantages. By deferring a portion of their income, employees can secure their financial future and potentially achieve a more comfortable retirement lifestyle.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de Compensación Diferida - Forma Corta - Deferred Compensation Agreement - Short Form

Description

How to fill out Nassau New York Acuerdo De Compensación Diferida - Forma Corta?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Nassau Deferred Compensation Agreement - Short Form, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the current version of the Nassau Deferred Compensation Agreement - Short Form, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Nassau Deferred Compensation Agreement - Short Form:

- Look through the page and verify there is a sample for your region.

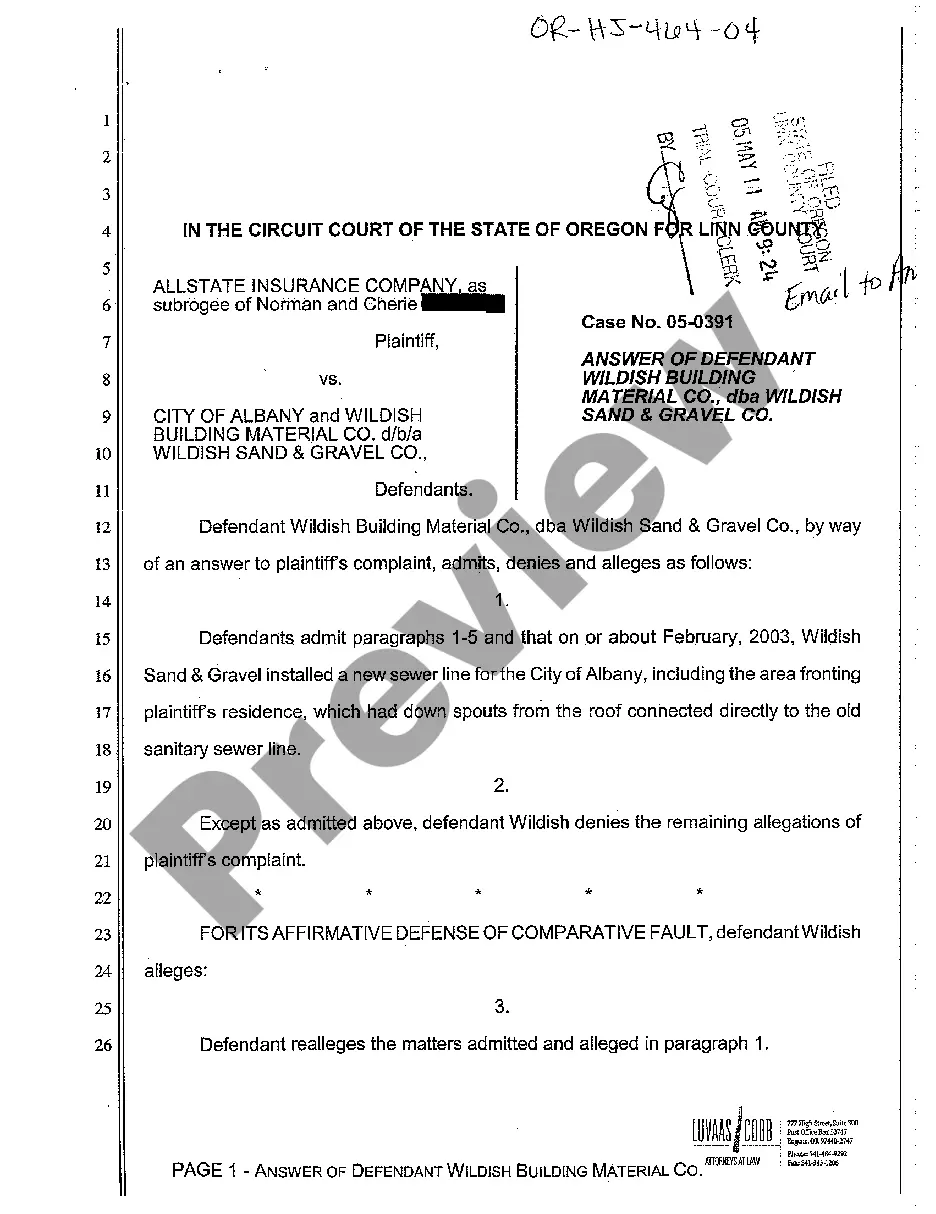

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Nassau Deferred Compensation Agreement - Short Form and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!