San Diego California Deferred Compensation Agreement — Short Form is a legal document that outlines the terms and conditions of a deferred compensation plan in San Diego, California. This agreement allows employees to defer a portion of their salary or wages, which are then invested and paid out at a later date, typically after retirement. This arrangement offers employees a tax-advantaged way to save for the future while also providing employers with valuable retention and recruitment benefits. Keywords: San Diego, California, deferred compensation agreement, short form, employees, salary, wages, investment, retirement, tax-advantaged, future, retention, recruitment. There are several types of San Diego California Deferred Compensation Agreement — Short Form, differentiated based on the specific conditions and provisions they include. These variations may accommodate different employee needs and employer preferences, promoting flexibility and customization within the plan. Some common types include: 1. Basic Deferred Compensation Agreement: This version focuses on the fundamental terms of the plan, such as contribution limits, vesting schedules, investment options, and payout provisions. It provides a straightforward structure for employees to defer a portion of their earnings and receive the benefits at a later date. 2. Supplemental Executive Deferred Compensation Agreement: This agreement is specifically designed for key executives or highly compensated individuals within an organization. It offers additional benefits and more generous contribution limits to incentivize and retain top talent. 3. Roth Deferred Compensation Agreement: This variation allows employees to make after-tax contributions to their deferred compensation plan. While these contributions are not tax-deductible, the earnings and payout amounts are tax-free, offering potential tax advantages for employees who anticipate being in a higher tax bracket during retirement. 4. Employer-Matching Deferred Compensation Agreement: This agreement includes provisions where the employer matches a percentage of the employee's deferred contributions, providing an additional incentive for employees to participate in the plan. This type of agreement enhances employee engagement and encourages long-term savings. These various forms of the San Diego California Deferred Compensation Agreement — Short Form cater to diverse employee categories, such as executives, general employees seeking tax advantages, and those interested in employer matching. The flexibility of these agreements ensures that organizations can design a deferred compensation plan that suits their specific workforce and business objectives. Keywords: Basic Deferred Compensation Agreement, Supplemental Executive Deferred Compensation Agreement, Roth Deferred Compensation Agreement, Employer-Matching Deferred Compensation Agreement, executive, highly compensated, after-tax contributions, tax-deductible, tax-free, employee engagement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Acuerdo de Compensación Diferida - Forma Corta - Deferred Compensation Agreement - Short Form

Description

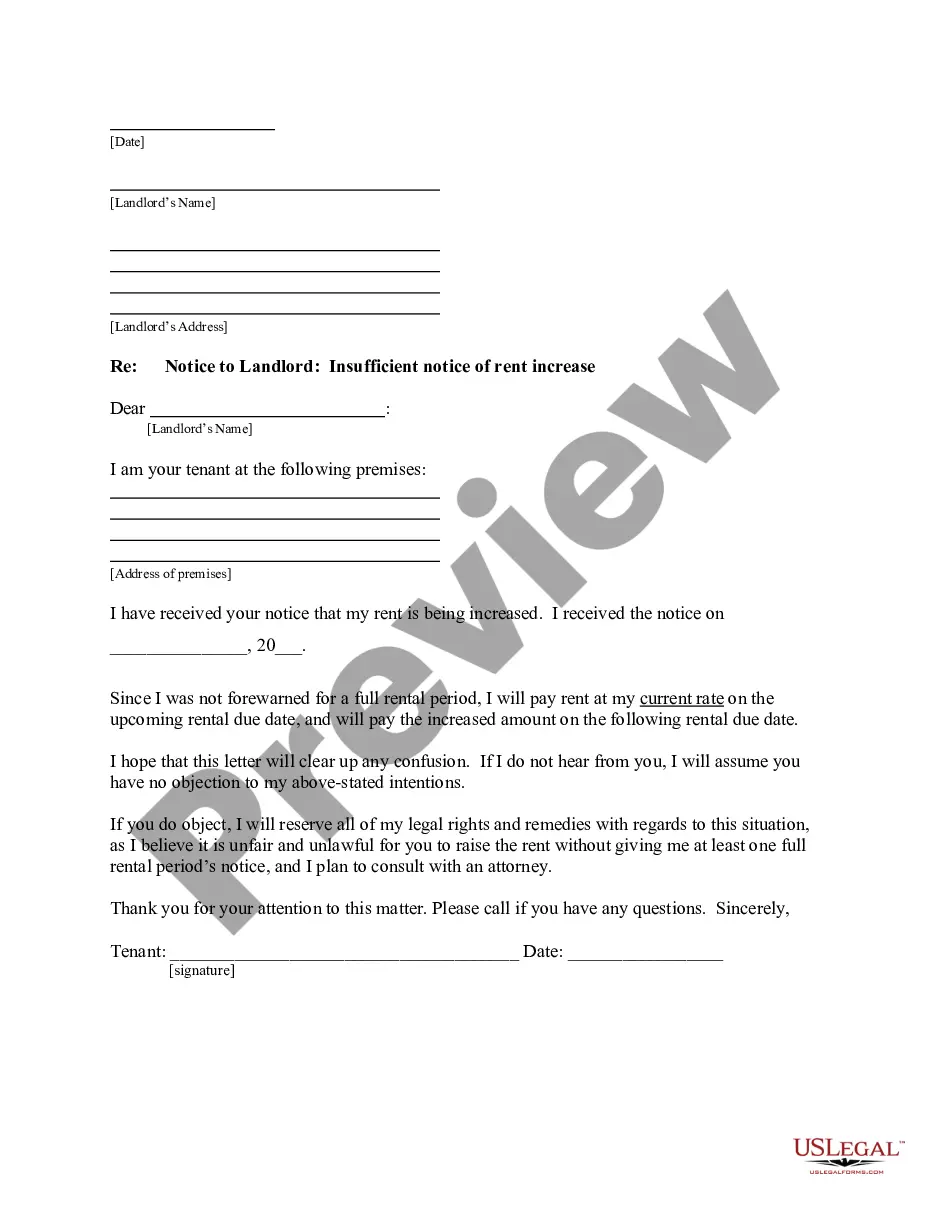

How to fill out San Diego California Acuerdo De Compensación Diferida - Forma Corta?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a San Diego Deferred Compensation Agreement - Short Form meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Aside from the San Diego Deferred Compensation Agreement - Short Form, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your San Diego Deferred Compensation Agreement - Short Form:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Diego Deferred Compensation Agreement - Short Form.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!