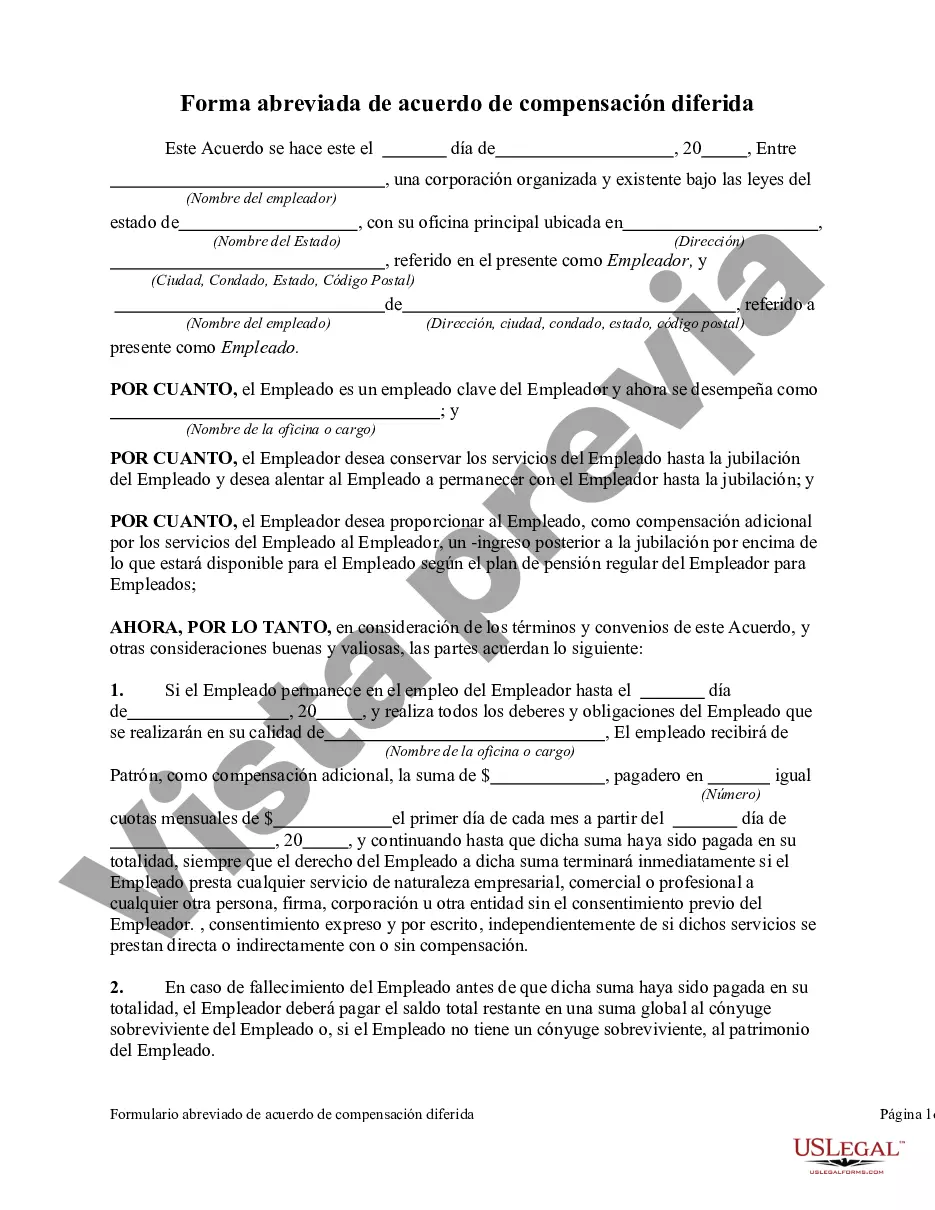

The Wayne Michigan Deferred Compensation Agreement — Short Form is a legally binding contract that deals with the deferred compensation program offered to employees of Wayne, Michigan. This agreement outlines the terms and conditions regarding the allocation and distribution of deferred compensation benefits. In simple terms, deferred compensation refers to a portion of an employee's salary or wages that is set aside on a pre-tax basis to be paid out at a later date, typically during retirement. The purpose of this agreement is to establish the rules and guidelines for the administration and management of this program. This agreement covers various aspects, including eligibility requirements, contribution limits, investment options, vesting schedules, and distribution rules. It is essential for employees to familiarize themselves with these terms to make informed decisions about their retirement planning. The Wayne Michigan Deferred Compensation Agreement — Short Form may have different variations depending on the specific plan and options made available to employees. Some possible variations and categories of the agreement could be: 1. Defined Contribution Plan: This type of deferred compensation agreement outlines a fixed or predetermined contribution made by both the employee and the employer. The employer may match a percentage of the employee's contribution, promoting savings and long-term financial stability. 2. Money Purchase Plan: This variation of the agreement guarantees a specific payout to the employee upon retirement, based on an allocated percentage or fixed sum contributed throughout their employment. 3. 401(k) Plan: A 401(k) plan is a widely recognized retirement savings plan governed by the Internal Revenue Service (IRS). It allows employees to contribute a portion of their earnings on a pre-tax basis, with potential employer matching contributions and various investment options. 4. Deferred Compensation Investment Options: This additional component of the agreement focuses on the available investment options, such as stocks, bonds, mutual funds, or other approved investment vehicles. The agreement specifies the range of choices and the associated risks, empowering employees to customize their investment strategy to align with their risk tolerance and retirement goals. The Wayne Michigan Deferred Compensation Agreement — Short Form serves as a critical document that protects the interests of both employees and employers. It ensures transparency, compliance with legal regulations, and equitable distribution of deferred compensation benefits. This agreement acts as a blueprint for employees to plan, build, and secure their financial future while providing employers with a structured framework for managing the deferred compensation program.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Acuerdo de Compensación Diferida - Forma Corta - Deferred Compensation Agreement - Short Form

Description

How to fill out Wayne Michigan Acuerdo De Compensación Diferida - Forma Corta?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Wayne Deferred Compensation Agreement - Short Form, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any activities associated with paperwork execution simple.

Here's how you can find and download Wayne Deferred Compensation Agreement - Short Form.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some documents.

- Examine the similar forms or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and buy Wayne Deferred Compensation Agreement - Short Form.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Wayne Deferred Compensation Agreement - Short Form, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you have to deal with an extremely complicated case, we recommend using the services of a lawyer to review your form before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!