The Kings New York Deferred Compensation Agreement — Long Form is a comprehensive and detailed legal document that outlines the terms and conditions of deferred compensation plans offered to employees by Kings New York, a reputed company based in New York. This agreement serves as a binding contract that governs the employer-employee relationship in regard to deferred compensation. The purpose of the Kings New York Deferred Compensation Agreement — Long Form is to provide employees with the option to defer a portion of their income to be received in the future, typically upon retirement, in order to optimize tax benefits and secure their financial future. This form of compensation can be an attractive option for employees looking to maximize their retirement savings and minimize their immediate tax liability. The Kings New York Deferred Compensation Agreement — Long Form outlines various key elements, including eligibility criteria, contribution options, investment choices, vesting schedules, and payout options. It ensures that employees clearly understand the terms and conditions associated with their deferred compensation plan and makes informed decisions in regard to their financial well-being. There may be different types or variations of the Kings New York Deferred Compensation Agreement — Long Form, catering to the diverse needs and preferences of employees. Some variations may include: 1. Non-Qualified Deferred Compensation Plan: This type of plan falls outside the scope of the Employee Retirement Income Security Act (ERICA) and provides high-income employees with additional flexibility in deferring a portion of their compensation. 2. Qualified Deferred Compensation Plan: This type of plan complies with the requirements set forth by ERICA and provides tax benefits for both the employee and the employer. It typically includes features such as matching contributions, vesting schedules, and regulated withdrawal limits. 3. Elective Deferral Plan: This type of plan allows employees to choose the desired amount to defer from their income on a voluntary basis. It offers flexibility in terms of contribution amounts and can be an effective tool for tax planning. In conclusion, the Kings New York Deferred Compensation Agreement — Long Form is an essential legal document that governs the deferred compensation plans offered by Kings New York. By clearly outlining the terms and conditions associated with these plans, it ensures transparency and empowers employees to make informed decisions regarding their financial future. The various types or variations of this agreement cater to the differing needs and goals of employees, providing flexibility while ensuring compliance with relevant regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Acuerdo de Compensación Diferida - Forma Larga - Deferred Compensation Agreement - Long Form

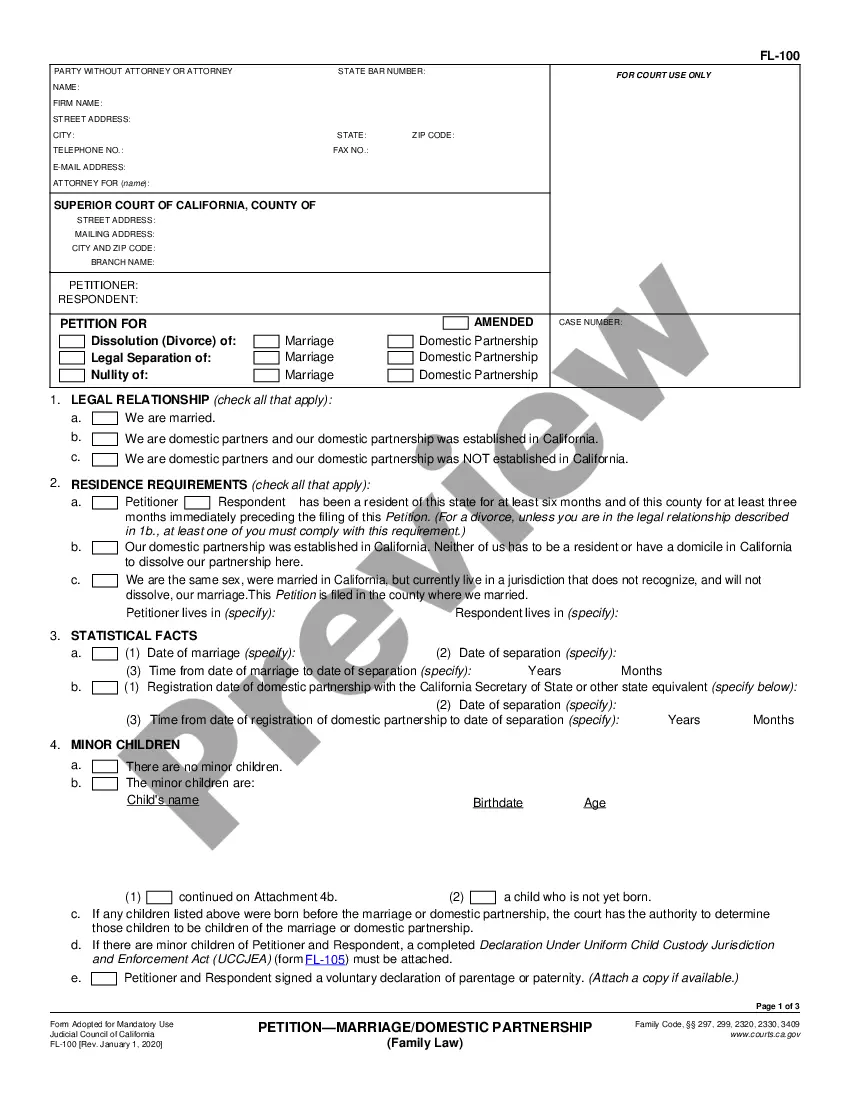

Description

How to fill out Kings New York Acuerdo De Compensación Diferida - Forma Larga?

Drafting papers for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Kings Deferred Compensation Agreement - Long Form without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Kings Deferred Compensation Agreement - Long Form on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Kings Deferred Compensation Agreement - Long Form:

- Examine the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!