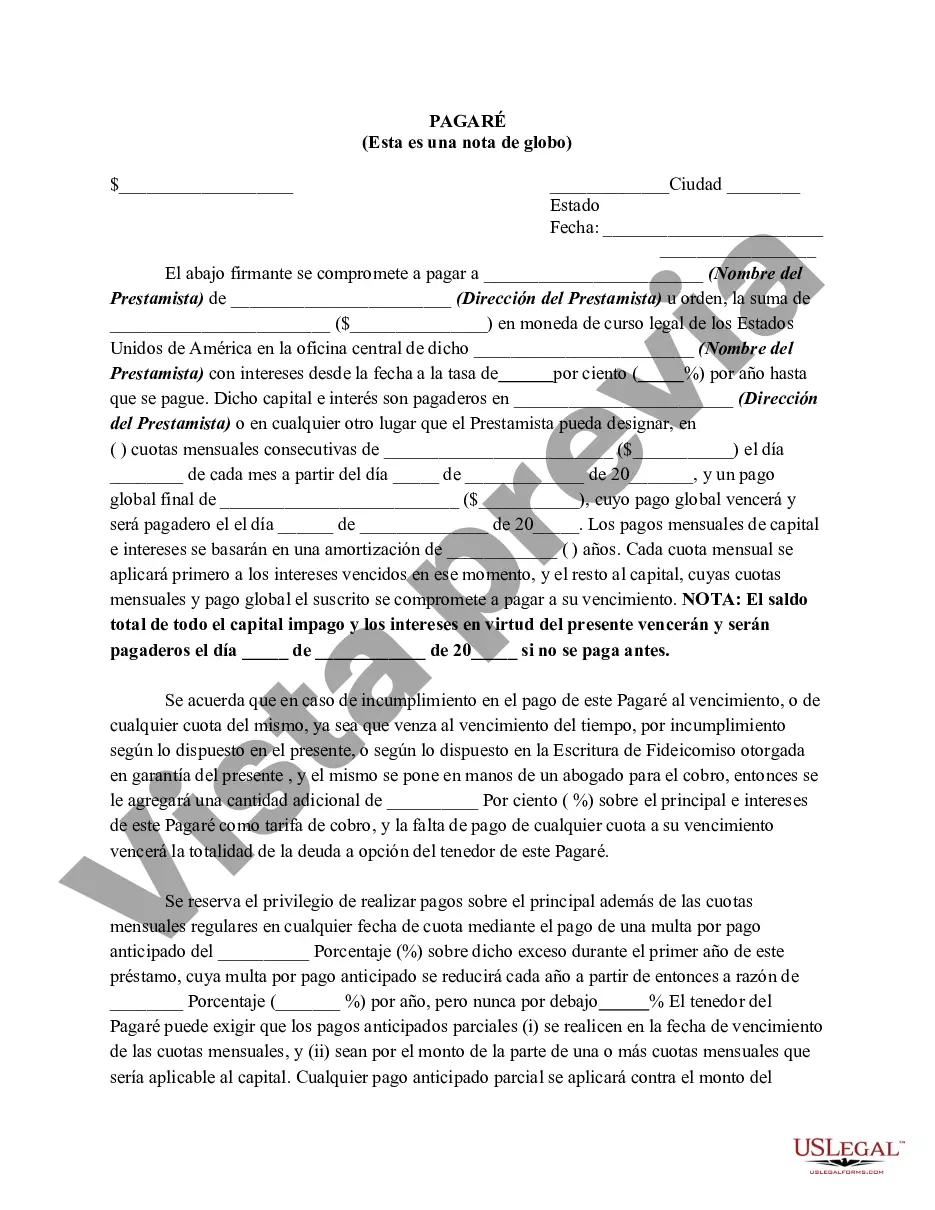

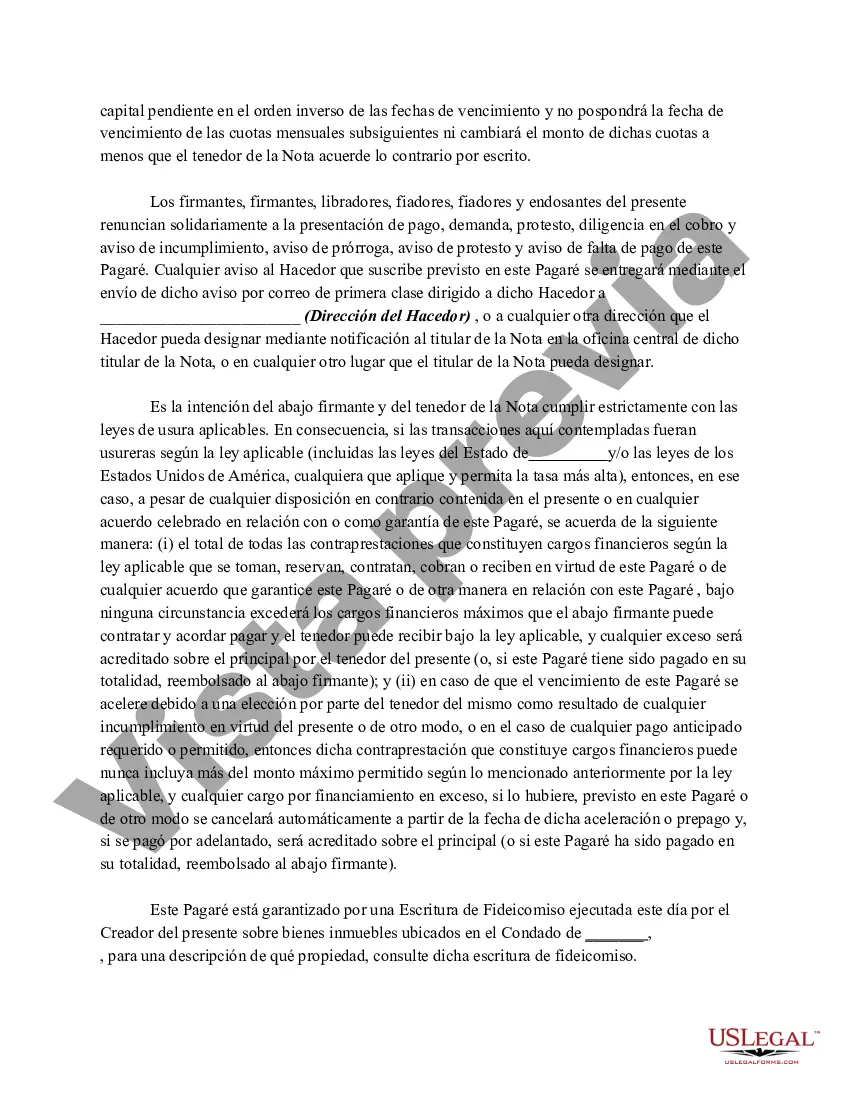

A Fulton Georgia Promissory Note — Balloon Note is a legal document used in Fulton County, Georgia, to outline the terms and conditions of a loan agreement between a borrower and a lender. Specifically, a Balloon Note refers to a special type of Promissory Note where the borrower agrees to make smaller periodic payments over a set period and then pay off the remaining balance in a lump sum, known as a balloon payment, at the end. The Fulton Georgia Promissory Note — Balloon Note typically includes essential details such as the names and addresses of the borrower and lender, the loan amount, the interest rate, the repayment schedule, and the due date for the balloon payment. It serves as evidence of the loan and safeguards the rights and obligations of both parties involved. There are different types of Fulton Georgia Promissory Note — Balloon Note that cater to varying loan agreements and circumstances. These include: 1. Fixed-Rate Balloon Note: This type of balloon note features a fixed interest rate throughout the loan term, ensuring that the borrower knows their exact interest obligations. With fixed-rate balloon notes, the borrower has the advantage of predictable payments over the agreed-upon period. 2. Adjustable-Rate Balloon Note: Unlike fixed-rate balloon notes, adjustable-rate balloon notes have an interest rate that may fluctuate over the loan term. This rate is often tied to an index such as the U.S. Prime Rate, meaning the borrower's payments may increase or decrease based on market conditions. 3. Secured Balloon Note: This type of balloon note is secured by collateral, typically an asset or property provided by the borrower. If the borrower fails to fulfill the repayment terms, the lender has the right to seize the collateral as a means of recouping the outstanding balance. 4. Unsecured Balloon Note: In contrast to a secured balloon note, an unsecured balloon note does not require collateral. Instead, the lender relies solely on the borrower's creditworthiness and trust to ensure repayment. However, due to the higher risk involved for the lender, unsecured balloon notes often carry higher interest rates. When drafting a Fulton Georgia Promissory Note — Balloon Note, it is essential to consult legal counsel or utilize a reputable template to ensure compliance with Fulton County laws and regulations. This document plays a crucial role in setting clear expectations and protecting the rights of both borrowers and lenders throughout the loan agreement term.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Pagaré - Pagaré Globo - Promissory Note - Balloon Note

Description

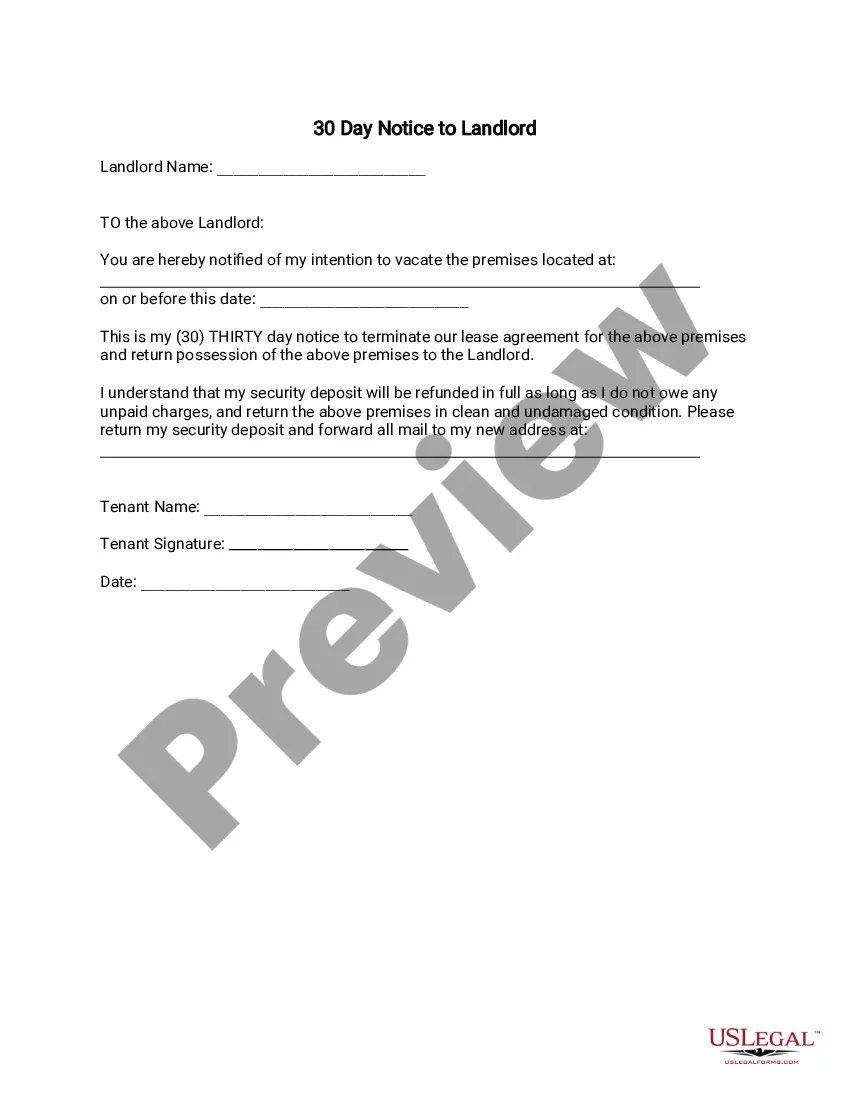

How to fill out Fulton Georgia Pagaré - Pagaré Globo?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fulton Promissory Note - Balloon Note, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the current version of the Fulton Promissory Note - Balloon Note, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Fulton Promissory Note - Balloon Note:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Fulton Promissory Note - Balloon Note and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!