A section 1244 stock is a type of equity named after the portion of the Internal Revenue Code that describes its treatment under tax law. Section 1244 of the tax code allows losses from the sale of shares of small, domestic corporations to be deducted as ordinary losses instead of as capital losses up to a maximum of $50,000 for individual tax returns or $100,000 for joint returns.

To qualify for section 1244 treatment, the corporation, the stock and the shareholders must meet certain requirements. The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation must not derive more than 50% of its income from passive investments. The shareholder must have paid for the stock and not received it as compensation, and only individual shareholders who purchase the stock directly from the company qualify for the special tax treatment. This is a simplified overview of section 1244 rules; because the rules are complex, individuals are advised to consult a tax professional for assistance with this matter.

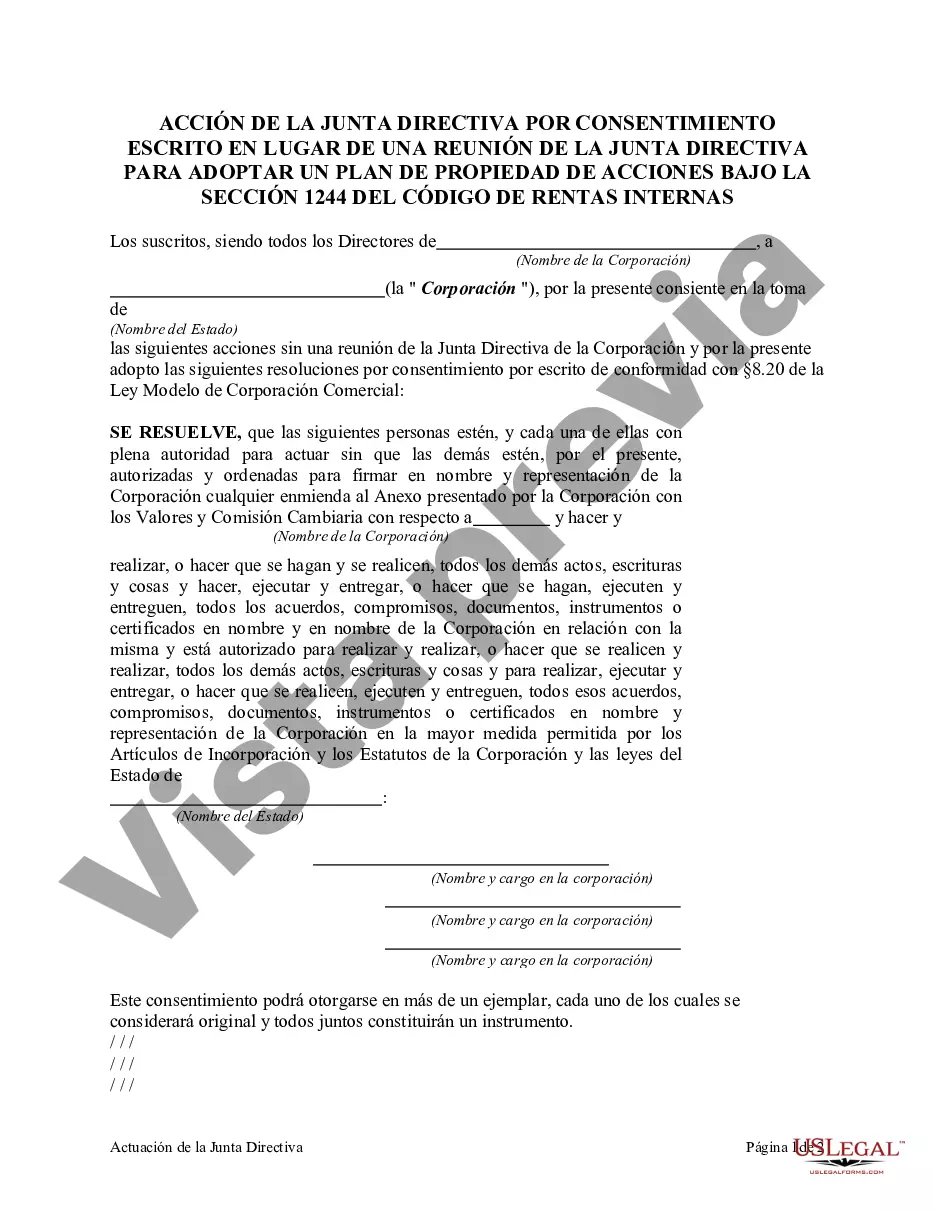

Nassau New York is a region located in the eastern part of New York State. It includes various cities, towns, and villages, such as Garden City, Hempstead, and Freeport. The region is known for its vibrant culture, beautiful landscapes, and rich history. When it comes to the Action of the Board of Directors by Written Consent in Lieu of Meeting to Adopt IRS Code in Nassau New York, there are a few different types that can be named. These types include: 1. Nonprofit Organizations: Nonprofit organizations located in Nassau New York may take action by written consent in lieu of a meeting to adopt the IRS Code. This allows them to ensure compliance with the tax regulations and maintain their tax-exempt status. 2. For-profit Corporations: For-profit corporations based in Nassau New York can also use the action of the Board of Directors by written consent to adopt the IRS Code. This enables them to implement tax strategies and stay up-to-date with the latest tax laws and regulations. 3. Small Businesses: Small businesses operating in Nassau New York can utilize the action of the Board of Directors by written consent to adopt the IRS Code. This helps them align their financial practices with the requirements outlined by the IRS, ensuring accurate reporting and compliance. 4. Special Interest Groups: Special interest groups, such as homeowner associations or community-based organizations in Nassau New York, may also choose to adopt the IRS Code through the action of the Board of Directors by written consent. This allows them to establish appropriate tax structures, benefits, and responsibilities for their members. By adopting the IRS Code through the written consent of the Board of Directors in lieu of a meeting, organizations and businesses in Nassau New York can conveniently ensure compliance with tax regulations, minimize potential risks, and maintain their financial health. It is important for these entities to consult legal professionals or tax experts to ensure that they follow the appropriate procedures and utilize the most suitable strategies for their specific circumstances.

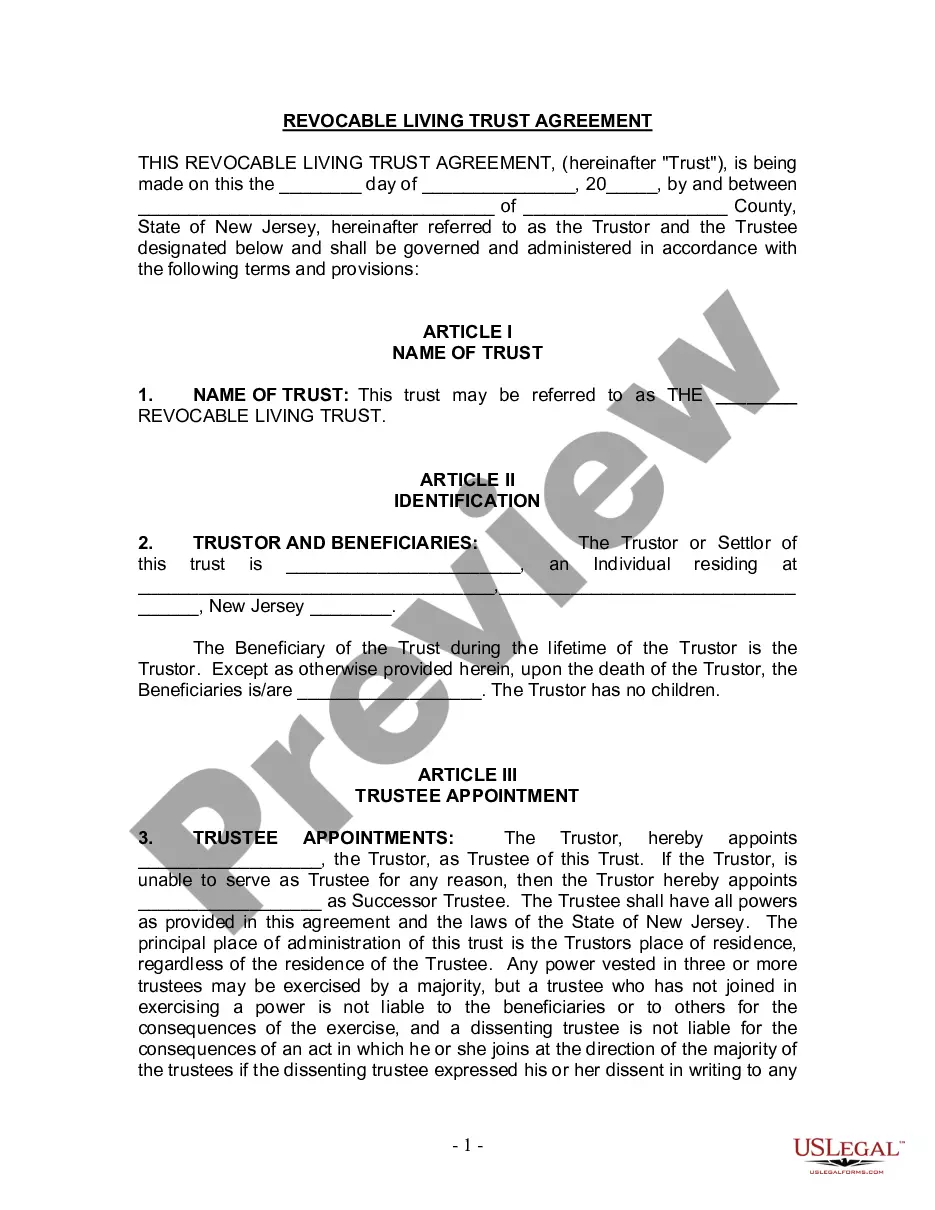

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.