A section 1244 stock is a type of equity named after the portion of the Internal Revenue Code that describes its treatment under tax law. Section 1244 of the tax code allows losses from the sale of shares of small, domestic corporations to be deducted as ordinary losses instead of as capital losses up to a maximum of $50,000 for individual tax returns or $100,000 for joint returns.

To qualify for section 1244 treatment, the corporation, the stock and the shareholders must meet certain requirements. The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation must not derive more than 50% of its income from passive investments. The shareholder must have paid for the stock and not received it as compensation, and only individual shareholders who purchase the stock directly from the company qualify for the special tax treatment. This is a simplified overview of section 1244 rules; because the rules are complex, individuals are advised to consult a tax professional for assistance with this matter.

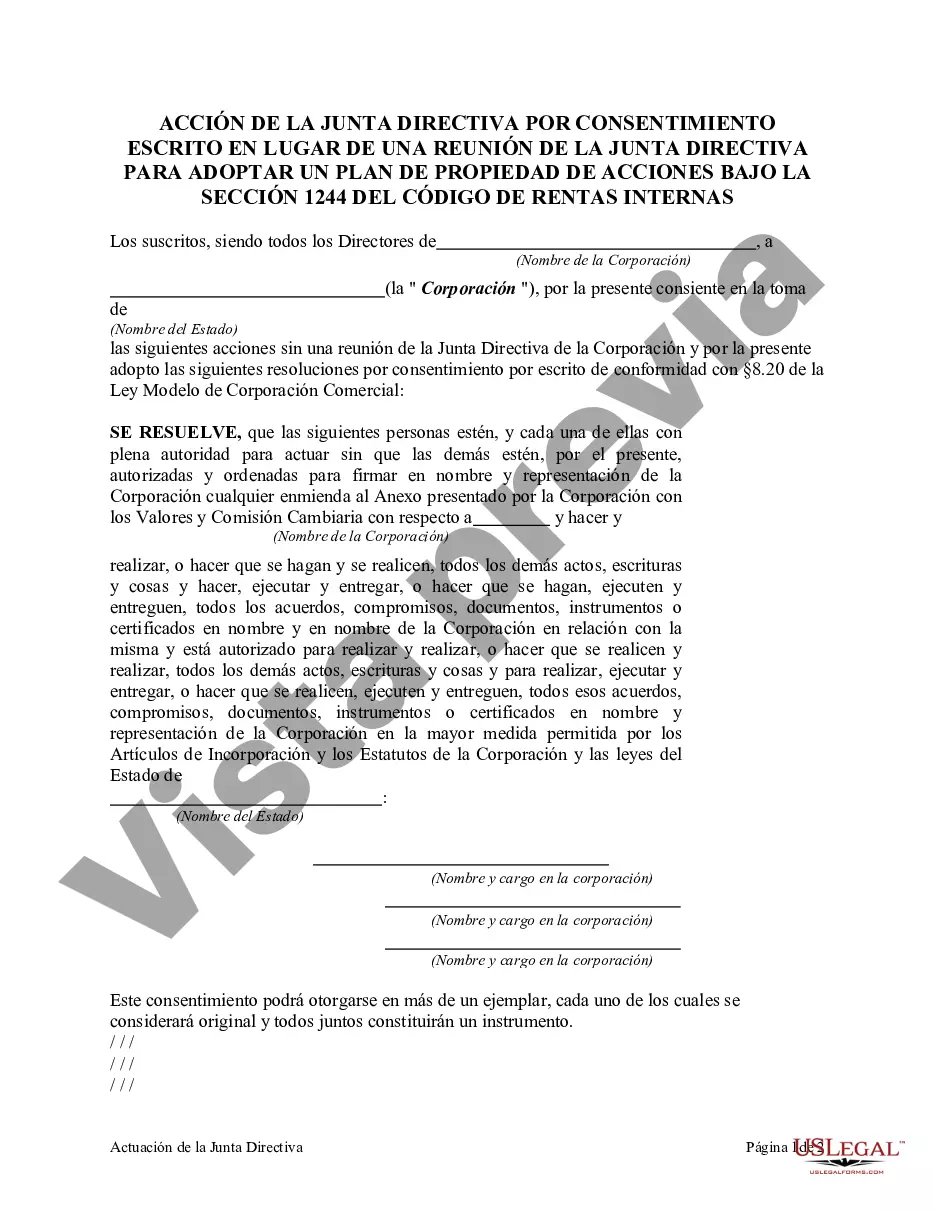

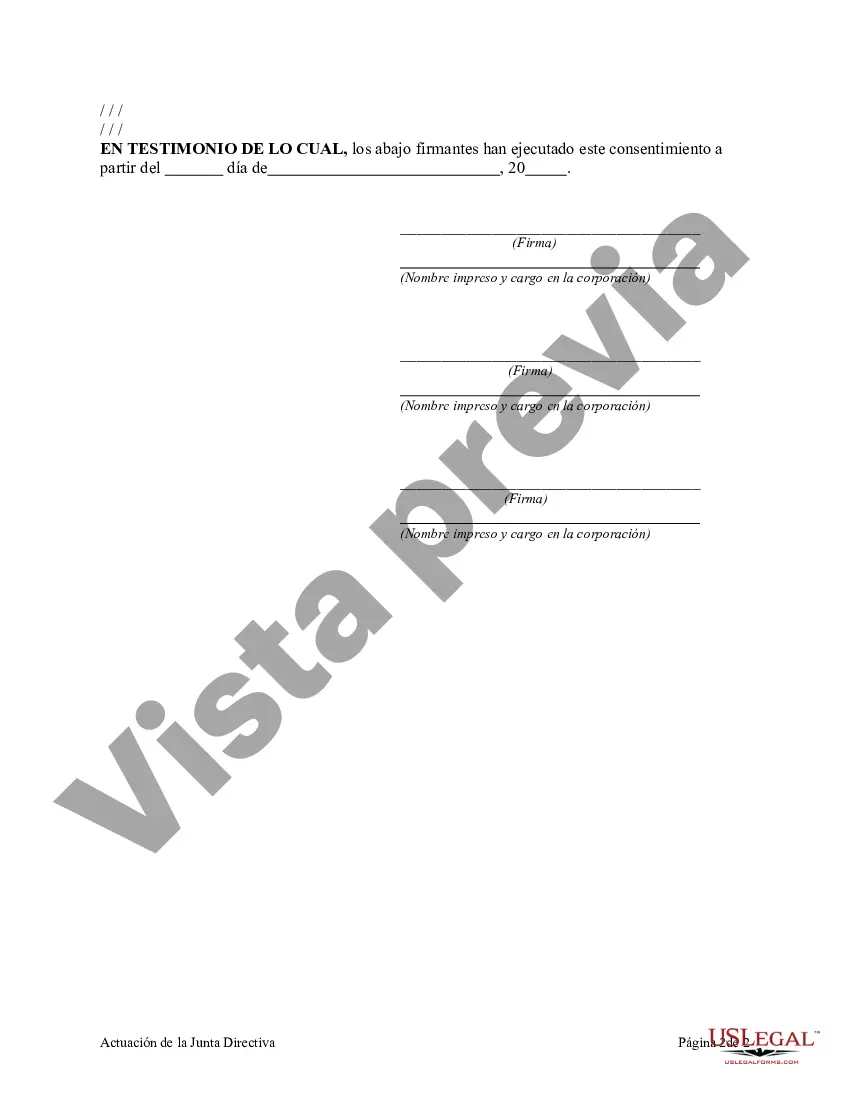

San Bernardino, California is a vibrant city located in the Inland Empire region of Southern California. Known for its stunning natural beauty, diverse culture, and historical significance, San Bernardino attracts both residents and tourists alike. One important aspect of business operations that takes place in San Bernardino is the Action of the Board of Directors by Written Consent in Lieu of Meeting to Adopt IRS Code. This refers to a legal process in which the company's board of directors can take action and make decisions without physically convening for a formal meeting. Instead, the directors express their agreement and adopt the IRS code through written consent. This particular action by the board of directors is crucial for businesses in San Bernardino, as it helps them ensure compliance with the Internal Revenue Service (IRS) regulations. By adopting the IRS code, companies can effectively manage their tax obligations, stay up-to-date with tax laws, and make informed financial decisions. There are various types of this action that can be undertaken by the board of directors in San Bernardino, California. Some key variations include: 1. Action of the Board of Directors by Unanimous Written Consent: This entails all directors expressing their consent and agreement in writing, which results in the adoption of the IRS code. This approach is commonly chosen when time is limited, and the directors need to make quick decisions without convening a physical meeting. 2. Action of the Board of Directors by Majority Written Consent: In this scenario, the majority of directors express their consent through written documentation, leading to the adoption of the IRS code. This approach is typically used when there is a need for broader consensus among the directors. 3. Action of the Board of Directors by Unanimous Written Consent in Agreement with Shareholders: This involves the board of directors and the shareholders reaching a unanimous agreement through written consent to adopt the IRS code. This type of action ensures alignment between the board and the shareholders regarding important tax-related matters. 4. Action of the Board of Directors by Written Consent in Lieu of Meeting for Emergency Situations: Sometimes, urgent situations may arise that require the prompt adoption of the IRS code. In such cases, the board of directors can take necessary action through written consent, making quick decisions to address the emergency effectively. Overall, the Action of the Board of Directors by Written Consent in Lieu of Meeting to Adopt IRS Code is a crucial process in San Bernardino, California. By leveraging this method, businesses in the city can efficiently manage their tax-related responsibilities, ensure compliance with IRS regulations, and make well-informed financial decisions.San Bernardino, California is a vibrant city located in the Inland Empire region of Southern California. Known for its stunning natural beauty, diverse culture, and historical significance, San Bernardino attracts both residents and tourists alike. One important aspect of business operations that takes place in San Bernardino is the Action of the Board of Directors by Written Consent in Lieu of Meeting to Adopt IRS Code. This refers to a legal process in which the company's board of directors can take action and make decisions without physically convening for a formal meeting. Instead, the directors express their agreement and adopt the IRS code through written consent. This particular action by the board of directors is crucial for businesses in San Bernardino, as it helps them ensure compliance with the Internal Revenue Service (IRS) regulations. By adopting the IRS code, companies can effectively manage their tax obligations, stay up-to-date with tax laws, and make informed financial decisions. There are various types of this action that can be undertaken by the board of directors in San Bernardino, California. Some key variations include: 1. Action of the Board of Directors by Unanimous Written Consent: This entails all directors expressing their consent and agreement in writing, which results in the adoption of the IRS code. This approach is commonly chosen when time is limited, and the directors need to make quick decisions without convening a physical meeting. 2. Action of the Board of Directors by Majority Written Consent: In this scenario, the majority of directors express their consent through written documentation, leading to the adoption of the IRS code. This approach is typically used when there is a need for broader consensus among the directors. 3. Action of the Board of Directors by Unanimous Written Consent in Agreement with Shareholders: This involves the board of directors and the shareholders reaching a unanimous agreement through written consent to adopt the IRS code. This type of action ensures alignment between the board and the shareholders regarding important tax-related matters. 4. Action of the Board of Directors by Written Consent in Lieu of Meeting for Emergency Situations: Sometimes, urgent situations may arise that require the prompt adoption of the IRS code. In such cases, the board of directors can take necessary action through written consent, making quick decisions to address the emergency effectively. Overall, the Action of the Board of Directors by Written Consent in Lieu of Meeting to Adopt IRS Code is a crucial process in San Bernardino, California. By leveraging this method, businesses in the city can efficiently manage their tax-related responsibilities, ensure compliance with IRS regulations, and make well-informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.