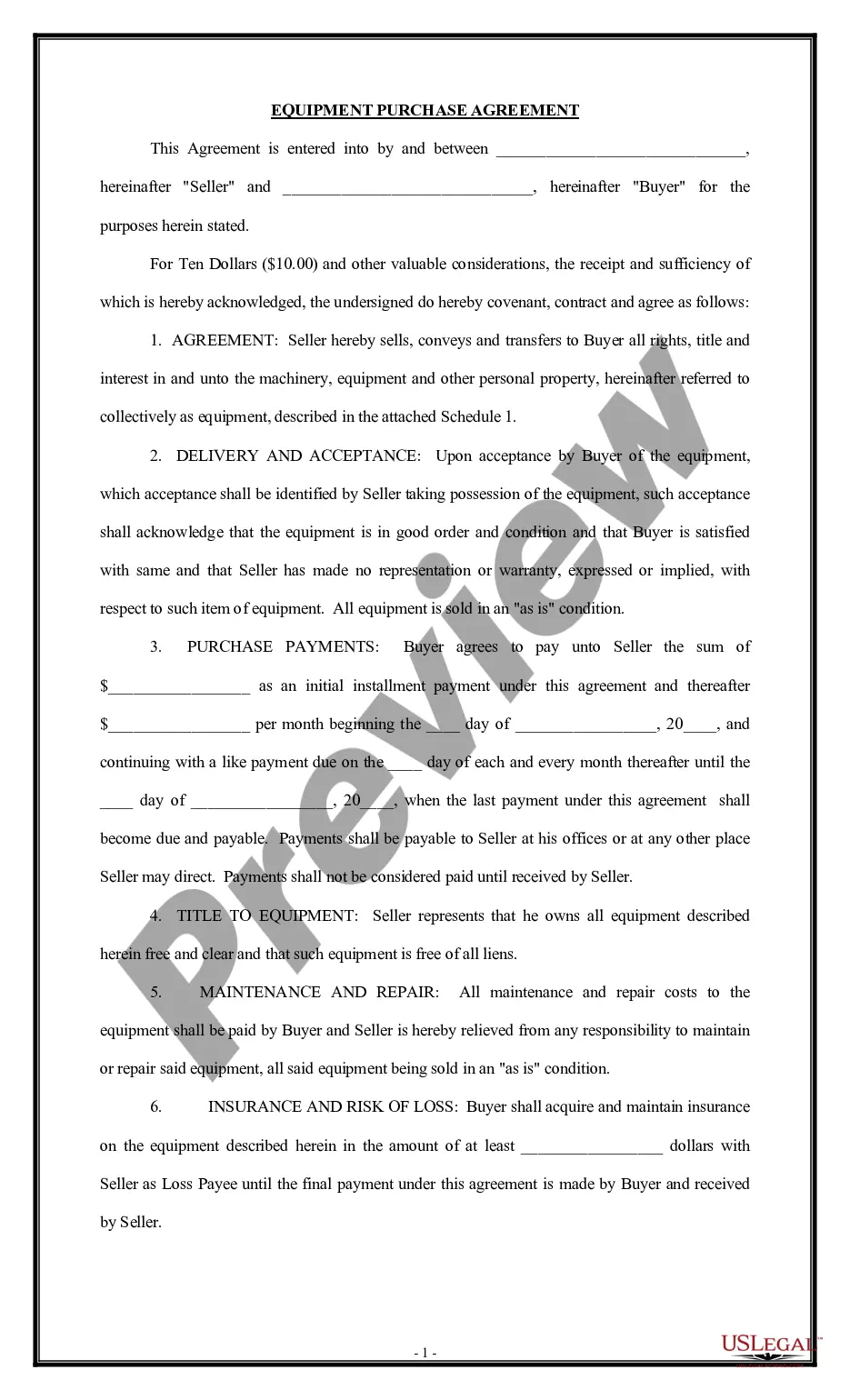

A Chicago, Illinois Buy-Sell Agreement between shareholders and a corporation is a legally binding contract that outlines the conditions under which shareholders can buy or sell their ownership interests in a company. This agreement aims to provide a framework for the smooth transfer of shares, protect the interests of shareholders, and maintain the continuity of the business in the event of unexpected circumstances such as death, disability, retirement, or disagreements among shareholders. The Chicago, Illinois Buy-Sell Agreement specifies various terms and conditions that govern the sale, transfer, and valuation of shares. It typically outlines the triggering events that would require a shareholder to sell or buy shares, including death, disability, voluntary retirement, termination of employment, divorce, bankruptcy, or disagreement between shareholders. By addressing these contingencies, the agreement helps to prevent potential conflicts and uncertainty in the future. In Chicago, Illinois, there are different types of Buy-Sell Agreements that can be established between shareholders and a corporation. These types include: 1. Cross-Purchase Buy-Sell Agreement: This type of agreement allows the remaining shareholders to purchase the shares of a departing shareholder. Each remaining shareholder may have a separate agreement with each other shareholder, indicating the terms under which they would buy and sell shares upon the occurrence of a triggering event. 2. Stock Redemption Buy-Sell Agreement: In this arrangement, the corporation agrees to buy the shares of a departing shareholder. The corporation is typically funded through life insurance policies taken out on the lives of the shareholders, ensuring that sufficient funds are available to facilitate the transaction. 3. One-Way Buy-Sell Agreement: Also known as a unilateral or optional buy-sell agreement, this type of agreement provides the existing shareholders with the option to purchase a departing shareholder's shares, but not the obligation. Upon the occurrence of a triggering event, the remaining shareholders can decide individually whether to exercise their right to purchase the shares. 4. Two-Way Buy-Sell Agreement: This agreement allows both the corporation and the remaining shareholders to purchase the shares of a departing shareholder. The departing shareholder can choose whether they want to sell their shares to the corporation or to the other shareholders. This agreement provides flexibility to the parties involved and ensures that the departing shareholder's interests are considered. While these types of Buy-Sell Agreements differ in their structures and methods of execution, their primary goal remains the same — to establish a clear mechanism for the transfer of shares and maintain the stability and continuity of the business. The specifics of each agreement can be tailored to the unique needs and circumstances of the shareholders and the corporation. Consulting with a Chicago, Illinois-based corporate attorney is highly recommended ensuring that the Buy-Sell Agreement aligns with state laws, facilitates a seamless transition of ownership, and protects the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de compra venta entre accionistas y una corporación - Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out Chicago Illinois Acuerdo De Compra Venta Entre Accionistas Y Una Corporación?

Creating forms, like Chicago Buy Sell Agreement Between Shareholders and a Corporation, to manage your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s participation, which also makes this task expensive. However, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms created for different scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Chicago Buy Sell Agreement Between Shareholders and a Corporation template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Chicago Buy Sell Agreement Between Shareholders and a Corporation:

- Ensure that your template is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Chicago Buy Sell Agreement Between Shareholders and a Corporation isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and download the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!