Harris Texas Donation or Gift to Charity of Personal Property is a legal process through which individuals can donate or gift their personal property to registered charitable organizations in Harris County, Texas. This act of giving allows individuals to contribute to their chosen cause while potentially receiving tax benefits. The donation or gifting of personal property in Harris Texas includes a wide range of items, such as clothing, furniture, electronics, vehicles, artwork, collectibles, household goods, and more. By donating these items, individuals can declutter their homes, support worthy causes, and make a positive impact on their community. There are several types of Harris Texas Donation or Gift to Charity of Personal Property, each with its own unique benefits and considerations: 1. Direct Donations: This involves directly donating personal property to a charitable organization based in Harris County. It is crucial to choose a qualified organization that will issue a receipt for tax purposes. 2. Gift-in-Kind: Rather than selling or disposing of personal property, individuals can gift these items to a charitable organization as a form of support. Gifting in-kind can include various items of value, from electronics and books to vehicles and real estate. 3. Estate Donations: Individuals can choose to include personal property in their estate plans, ensuring that their assets are donated to charitable organizations upon their passing. This type of donation is often done through wills, trusts, or beneficiary designations. 4. Vehicle Donations: If you have a vehicle that you no longer need or want to upgrade, you can donate it to a charity in Harris Texas. Many organizations accept car donations, allowing donors to support causes they care about while potentially enjoying tax deductions. 5. Art and Collectible Donations: If you possess valuable artwork, antiques, or collectibles, you can donate these items to a charitable organization in Harris County. Such donations can help support artistic and cultural initiatives in the community. It is important to note that individuals interested in donating or gifting their personal property in Harris Texas should consult with a tax advisor or attorney to understand the specific tax benefits, appraisal requirements, and legal procedures involved. Additionally, researching and choosing trustworthy and registered charitable organizations is essential to ensure that your donations are put to good use.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Donación o regalo a la caridad de propiedad personal - Donation or Gift to Charity of Personal Property

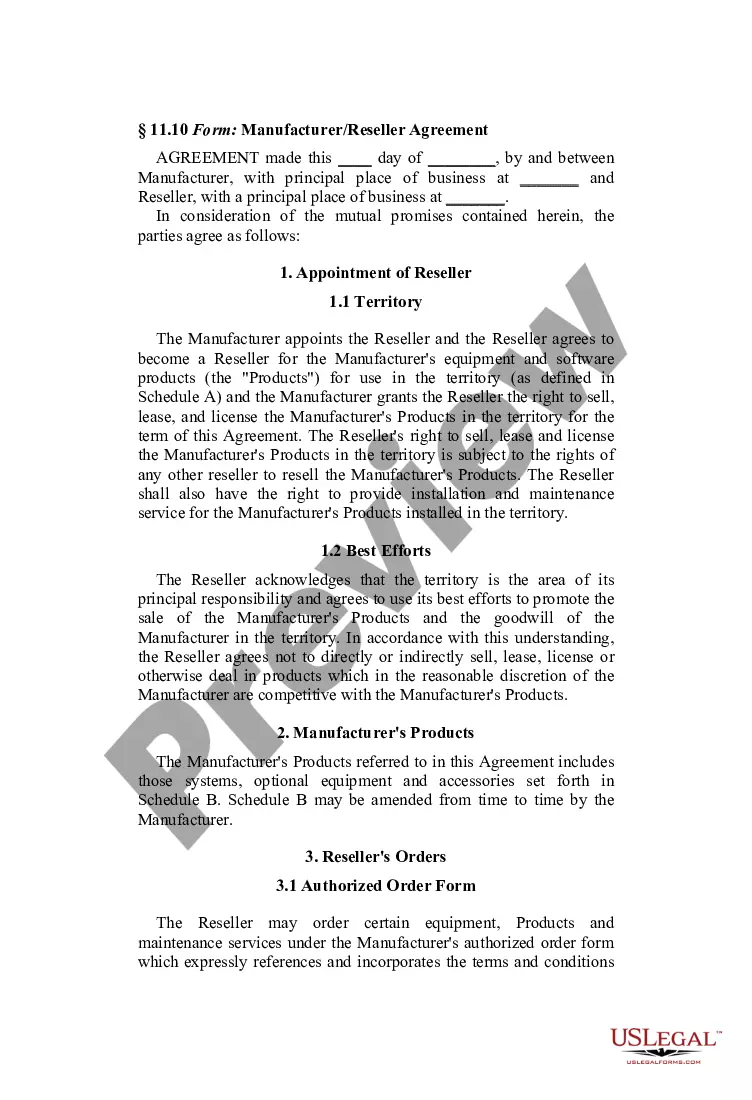

Description

How to fill out Harris Texas Donación O Regalo A La Caridad De Propiedad Personal?

Do you need to quickly create a legally-binding Harris Donation or Gift to Charity of Personal Property or maybe any other document to take control of your own or business affairs? You can go with two options: hire a professional to draft a legal paper for you or create it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without paying sky-high fees for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific document templates, including Harris Donation or Gift to Charity of Personal Property and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, carefully verify if the Harris Donation or Gift to Charity of Personal Property is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Harris Donation or Gift to Charity of Personal Property template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the documents we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!