Wayne, Michigan Donation or Gift to Charity of Personal Property: A Comprehensive Guide Introduction: In Wayne, Michigan, individuals have the opportunity to give back to society by making donations or gifts of personal property to charitable organizations. This act not only benefits those in need but also provides tax advantages for the donors. This detailed description aims to outline the types of donations or gifts available, the benefits they offer, and the process involved. Types of Wayne, Michigan Donation or Gift to Charity of Personal Property: 1. Cash Donations: Donating money to a charitable organization in Wayne, Michigan allows donors to claim a tax deduction on their federal tax returns. Cash donations can support various causes ranging from educational programs and healthcare services to environmental initiatives and poverty alleviation efforts. 2. Vehicle Donations: People in Wayne, Michigan can donate their cars, trucks, motorcycles, or boats to eligible nonprofit organizations. These vehicles are usually sold by the charity to provide funds for their programs. Donors can benefit from tax deductions based on the fair market value of the donated vehicle. 3. Real Estate Donations: Those owning real estate in Wayne, Michigan can donate residential, commercial, or vacant properties to charitable organizations. This type of donation provides significant tax advantages, including deductions for the fair market value of the property at the time of donation. 4. Stock or Securities Donations: Donating appreciated stocks, bonds, or other securities to qualified charitable organizations in Wayne, Michigan can result in two-fold benefits. Donors can avoid capital gains tax on the appreciated value of the securities and claim a deduction for the fair market value of the securities on their tax returns. 5. Clothing and Household Item Donations: Individuals can donate unwanted clothing, furniture, appliances, or other household items to local charities, thrift stores, or donation centers in Wayne, Michigan. These donations help nonprofits generate funds through reselling or provide direct assistance to those in need. Benefits of Wayne, Michigan Donation or Gift to Charity of Personal Property: 1. Tax Deductions: All eligible donation types allow individuals to deduct the fair market value of the donated property on their federal tax returns. This deduction helps reduce the overall taxable income, potentially resulting in significant tax savings. 2. Social Impact: Donations make a positive impact on the community, supporting various causes and charitable organizations that work towards improving the lives of individuals in Wayne, Michigan. 3. Environmental Sustainability: By donating or recycling used items, individuals contribute to reducing waste and promoting a sustainable lifestyle within Wayne, Michigan. Process for Wayne, Michigan Donation or Gift to Charity of Personal Property: 1. Choose a Charitable Organization: Select a reputable nonprofit organization that aligns with your philanthropic goals and focus areas. 2. Determine the Eligibility: Ensure that both the donor and the chosen charity meet the eligibility criteria for donation or gift valuation purposes. Some organizations may have specific guidelines or restrictions on the types of donations accepted. 3. Document the Donation: Maintain proper documentation of the donated property, including photographs, appraisals (if necessary), and written acknowledgments from the receiving charity. 4. Consult a Tax Professional: Seek advice from a qualified tax professional or accountant to understand the tax implications and eligibility for deductions. 5. Complete IRS Forms: Fill out the required IRS forms, such as Form 8283 (Noncash Charitable Contributions) or Schedule A (Itemized Deductions), depending on the type and value of the donated property. 6. Keep Records: Maintain records of all relevant documents, including receipts, tax forms, and acknowledgment letters, for future reference and documentation. In conclusion, the Wayne, Michigan Donation or Gift to Charity of Personal Property offers various avenues for individuals to contribute to the betterment of society while enjoying tax benefits. Whether through cash donations, vehicle or real estate donations, stock contributions, or clothing and household item donations, residents of Wayne, Michigan have numerous opportunities to make a positive impact on their community and support causes close to their hearts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Donación o regalo a la caridad de propiedad personal - Donation or Gift to Charity of Personal Property

Description

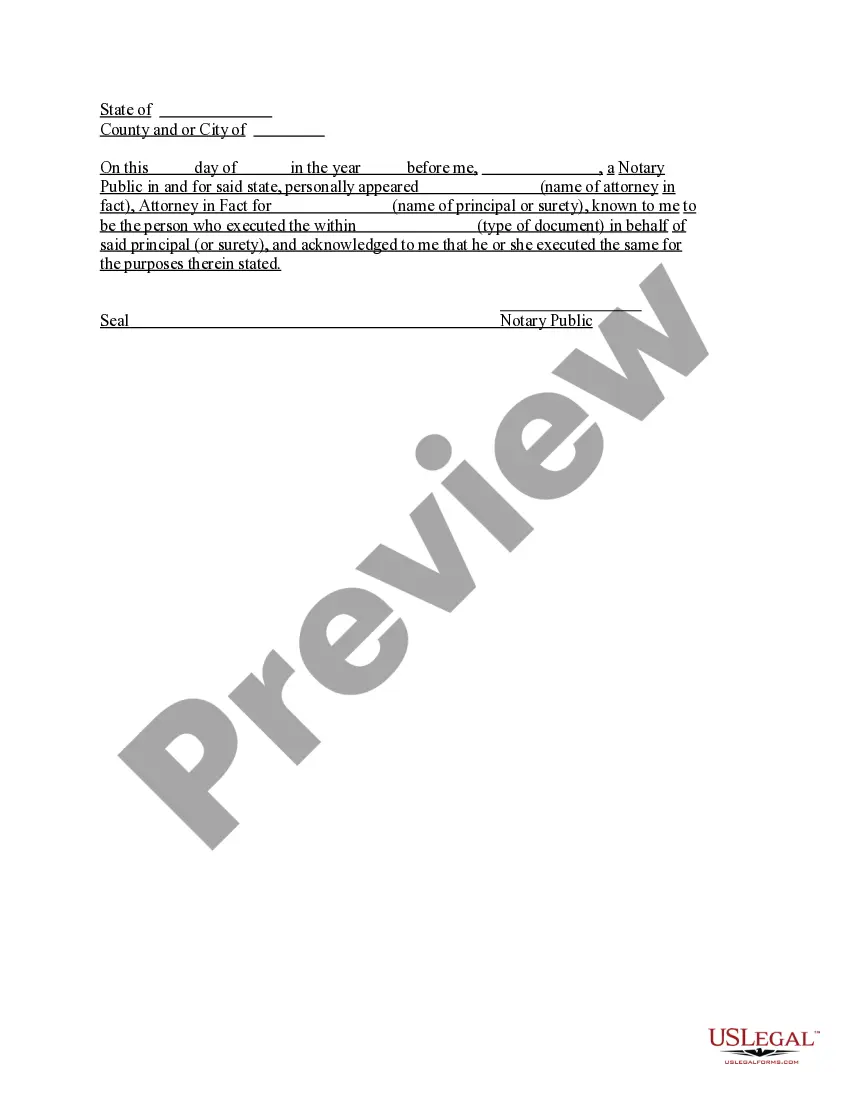

How to fill out Wayne Michigan Donación O Regalo A La Caridad De Propiedad Personal?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Wayne Donation or Gift to Charity of Personal Property, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any activities associated with document completion simple.

Here's how to find and download Wayne Donation or Gift to Charity of Personal Property.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related forms or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Wayne Donation or Gift to Charity of Personal Property.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Wayne Donation or Gift to Charity of Personal Property, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you need to cope with an extremely challenging situation, we recommend using the services of a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific documents effortlessly!

Form popularity

FAQ

Si usted recibe una llamada u otro tipo de comunicacion solicitando un pago que le parezca raro, esta puede ser senal de intento de fraude. Por ejemplo, si usted esta al dia con los pagos de su tarjeta de credito y recibe una llamada para hacer un pago por telefono, podria ser un intento de estafa.

Siete estrategias para que la recaudacion de fondos destinados a organizaciones beneficas sea un exito Habla con la organizacion benefica para la que estas recaudando fondos.Organiza tu propio evento.Organiza un concurso en las redes sociales.Convierte el trabajo de los voluntarios en fondos.

Ejemplos: ¿Haras una pequena donacion de $5 hoy? Una pequena donacion de $10 alimentara a un nino durante siete dias. Consejo profesional: asegurese de que la cantidad de donacion a la que se refiere sea considerada pequena por su publico objetivo.

Comparte la campana con amigos y familiares Informate de cual es la mejor manera de pedir donativos antes de comunicarselo a nadie. Dirigete primero a tus familiares y amigos cercanos; te sera menos incomodo empezar con ellos. Crea un hashtag de campana para facilitarle a la gente que se anime a apoyar tu causa.

Al morir, dona tu cuerpo a la UNAM Pre-registrarse en la pagina pdc.unam.mx o a los telefonos 5623 2269 y 5623 2412. Llevar a cabo una entrevista con personal integrante del Programa de Donacion de Cuerpos. Realizar la entrega de documentos solicitados y efectuar el registro oficial.

Crowdfunding personal y recaudacion de fondos para asociaciones sin fines de lucro GoFundMe.FundRazr.Fundly.CrowdRise.Classy.

Nuestros consejos sobre como pedir donaciones Recuerda contar tu historia.Adapta tu mensaje al momento adecuado.Explica lo que pasara si no se consiguen los donativos.Manten una actitud positiva y confia en que los donativos llegaran.Crea una buena relacion y fortalecela.

Estrategias para la recaudacion de fondos Crea una campana. Esta es tu oportunidad de compartir una historia unica.Conecta con los donantes con imagenes y videos.Promueve tu causa y desarrolla un sentido de comunidad.Ponte en contacto con los medios de comunicacion.Utiliza las redes sociales.

Consejos para antes de la donacion Bebe entre 4 y 6 vasos de ocho onzas de agua, jugo de frutas u otro liquido sin cafeina al menos 2 o 3 horas antes de la donacion. Evita las bebidas con cafeina. Evita el alcohol de cualquier tipo las 24 horas antes de donar. Come antes de tu donacion. Duerme bien (al menos 5 o 6 horas)

Nuestros consejos sobre como pedir donaciones Recuerda contar tu historia.Adapta tu mensaje al momento adecuado.Explica lo que pasara si no se consiguen los donativos.Manten una actitud positiva y confia en que los donativos llegaran.Crea una buena relacion y fortalecela.