Orange California Consent to Release of Financial Information is a legally binding document that grants permission to disclose an individual's confidential financial information to designated parties. This consent is typically required when seeking financial services or applying for loans or credit in Orange, California. By providing this consent, individuals allow financial institutions or entities to access and review their financial records to evaluate creditworthiness, conduct audits, or comply with applicable laws and regulations. The Orange California Consent to Release of Financial Information encompasses various types, tailored to specific financial transactions or institutions. Some common types include: 1. Bank Consent to Release of Financial Information: Individuals authorize banks or other financial institutions to share their financial statements, account balances, transaction histories, and credit reports to assess creditworthiness or facilitate financial transactions. 2. Mortgage Consent to Release of Financial Information: This form allows mortgage lenders to gather financial information regarding an individual's income, assets, debts, and credit history, necessary for mortgage loan approval or refinancing. 3. Credit Card Consent to Release of Financial Information: When applying for a credit card, individuals consent to sharing their financial details, such as income, employment history, credit score, and current debts, with credit card issuers for assessment and approval. 4. Loan Consent to Release of Financial Information: Individuals seeking loans, such as personal, auto, or business loans, provide consent to financial institutions or lenders to access their financial information to evaluate loan eligibility and determine appropriate loan terms. 5. Collection Agency Consent to Release of Financial Information: If an individual owes a debt that has been transferred to a collection agency, this consent enables the agency to access relevant financial information to facilitate the collection process. 6. Business Consent to Release of Financial Information: In business transactions, this consent allows financial institutions, potential investors, or authorized parties to access a company's financial records, statements, tax returns, and other relevant financial information. 7. Legal Consent to Release of Financial Information: This type of consent empowers attorneys, courts, or other legal entities to access an individual's financial records for legal proceedings, such as divorce settlements, bankruptcy cases, or disputes involving financial matters. It's important to note that the specific content and required information within each type of Orange California Consent to Release of Financial Information may vary based on the institution, transaction type, and applicable laws. Individuals should carefully review and understand the terms of their consent before granting access to their financial information.

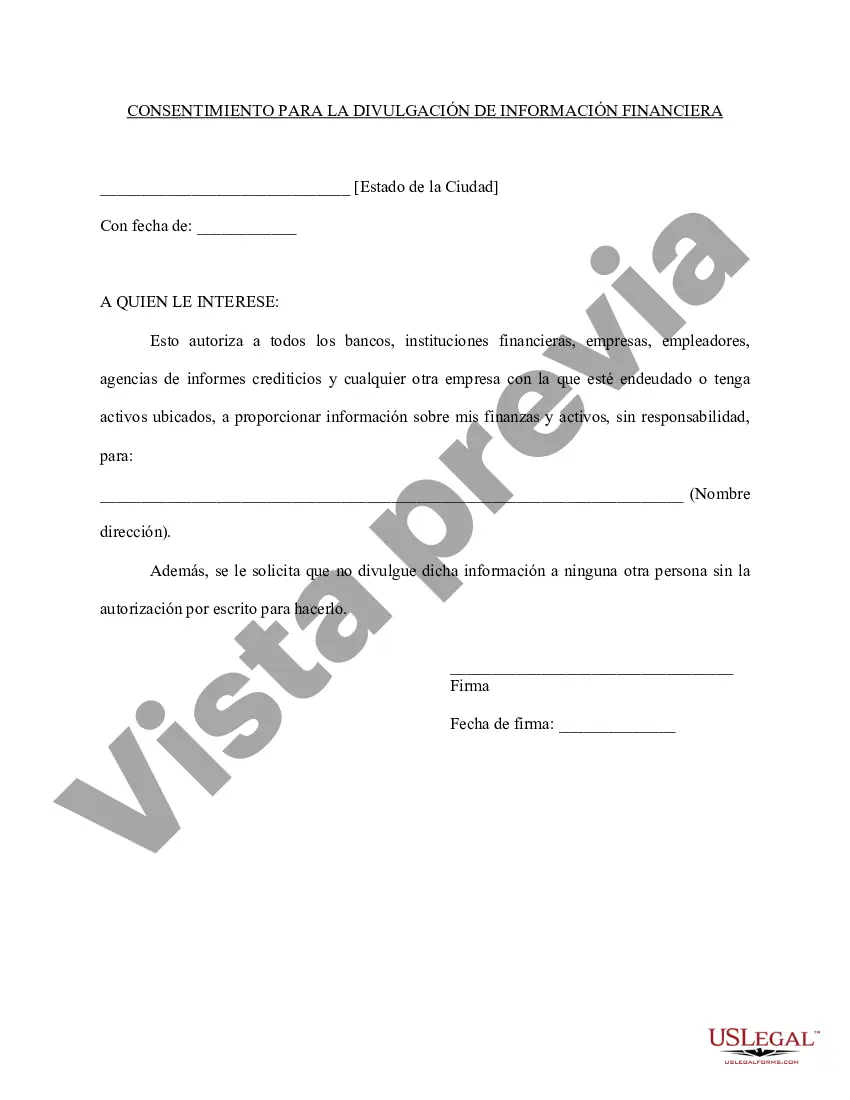

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Consentimiento para la divulgación de información financiera - Consent to Release of Financial Information

Description

How to fill out Orange California Consentimiento Para La Divulgación De Información Financiera?

If you need to find a trustworthy legal form provider to obtain the Orange Consent to Release of Financial Information, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support make it easy to locate and complete different documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Orange Consent to Release of Financial Information, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Orange Consent to Release of Financial Information template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more affordable. Set up your first company, arrange your advance care planning, create a real estate agreement, or execute the Orange Consent to Release of Financial Information - all from the convenience of your home.

Sign up for US Legal Forms now!