Queens New York Consent to Release of Financial Information is a legal document that allows individuals or entities to authorize the release of their financial information to designated parties. This document pertains specifically to residents of Queens, New York, and is essential for various financial transactions and legal matters. The Queens New York Consent to Release of Financial Information is typically used when applying for loans, mortgages, or credit cards. It enables lenders, banks, or financial institutions to access and review the applicant's financial records, including income, assets, debts, and credit history. This information is crucial for determining one's financial eligibility and creditworthiness. Furthermore, this consent form may also be required when engaging in real estate transactions, such as renting or purchasing a property in Queens, New York. Landlords or property owners may request this consent to assess the applicant's financial stability and ability to pay rent or fulfill lease obligations. Some common types of Queens New York Consent to Release of Financial Information include: 1. Loan Application Consent: This form grants permission to lenders to review the applicant's financial information when applying for personal loans, business loans, or student loans. 2. Mortgage Application Consent: This type of consent authorizes mortgage lenders or brokers to access the applicant's financial records to determine their eligibility for a home loan or mortgage refinance. 3. Rental Application Consent: When renting a property in Queens, New York, landlords may require this consent to evaluate the financial capability and creditworthiness of potential tenants. 4. Credit Card Application Consent: Credit card companies often ask for consent to release financial information for credit card applications, ensuring the applicant's financial reliability for issuing credit. 5. Legal Proceedings Consent: In legal matters such as divorce, estate planning, or bankruptcy, consent to release financial information may be necessary to present evidence or reach fair judgments. Regardless of the specific type, a Queens New York Consent to Release of Financial Information ensures compliance with privacy laws while allowing relevant parties to access an individual's financial records for legitimate purposes. It is crucial to read and review the document carefully before signing to understand the terms and disclosures associated with the release of financial information. Keywords: Queens New York, consent to release, financial information, loans, mortgages, credit cards, real estate transactions, rental application, credit card application, legal proceedings.

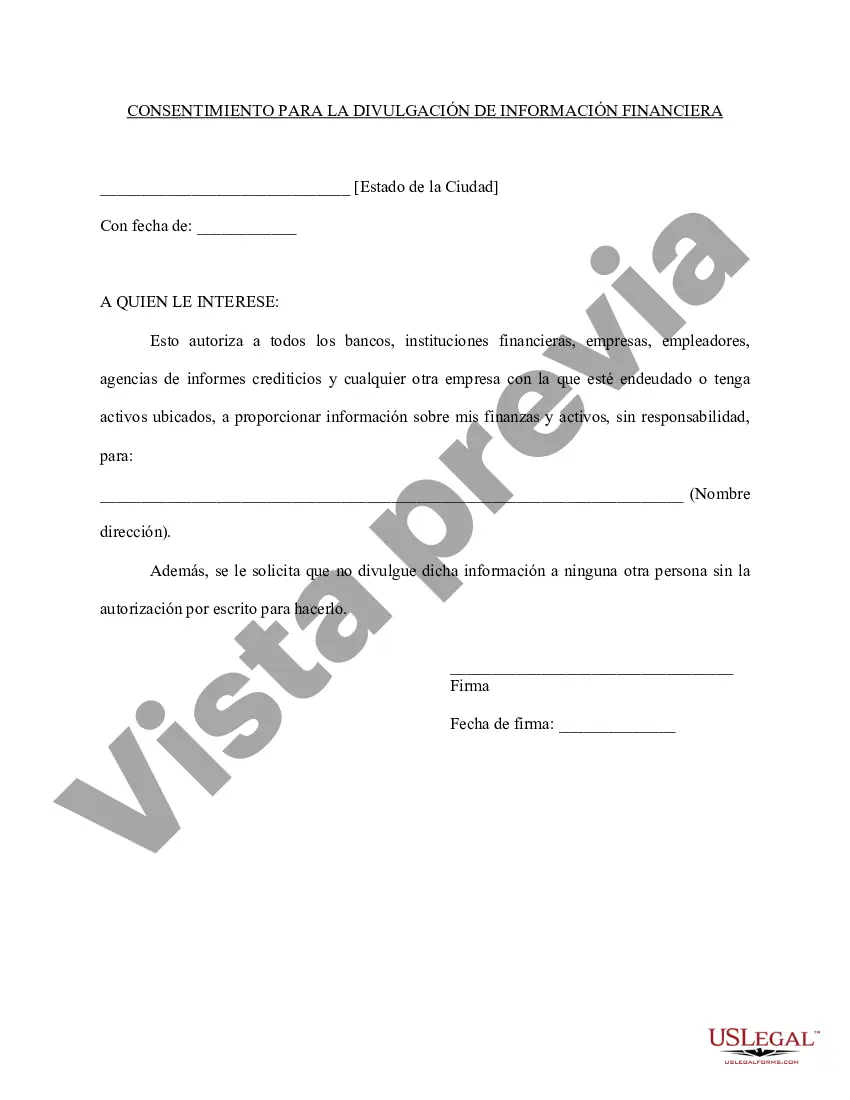

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Consentimiento para la divulgación de información financiera - Consent to Release of Financial Information

Description

How to fill out Queens New York Consentimiento Para La Divulgación De Información Financiera?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Queens Consent to Release of Financial Information, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information resources and tutorials on the website to make any activities related to paperwork completion straightforward.

Here's how to locate and download Queens Consent to Release of Financial Information.

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the validity of some records.

- Examine the similar forms or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and buy Queens Consent to Release of Financial Information.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Queens Consent to Release of Financial Information, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you need to deal with an exceptionally difficult case, we recommend using the services of a lawyer to review your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific paperwork with ease!