Title: Understanding Suffolk New York Consent to Release of Financial Information Introduction: Suffolk County, located in New York, has specific regulations regarding the release of financial information. In certain circumstances, individuals or organizations may require access to an individual's financial records to make informed decisions or review their financial standing. To legally obtain this information, a Suffolk New York Consent to Release of Financial Information is usually required. This article aims to provide a detailed description of this document while highlighting its types, process, and importance. Types of Suffolk New York Consent to Release of Financial Information: 1. Personal Consent: This type of consent allows an individual to authorize the release of their personal financial information to a designated person, organization, or entity. 2. Commercial Consent: Businesses may require consent to release financial information to potential partners, investors, or financial institutions for essential purposes such as loan applications, audits, or due diligence processes. 3. Legal Consent: Suffolk New York Consent to Release of Financial Information can also refer to the authorization granted by an individual to their attorney or legal representative to access their financial records for legal purposes like divorce proceedings, estate planning, or insurance claims. Process of Obtaining Consent: To obtain Suffolk New York Consent to Release of Financial Information, several essential steps must be followed: 1. Identifying the purpose: The requesting party needs to clearly explain the purpose of accessing the financial information and specify the information required. 2. Written consent: The individual whose financial information is sought must provide written consent explicitly stating the permitted scope of access and the duration of authorization. 3. Confidentiality agreement: To protect the privacy of the individual, a confidentiality agreement may be necessary to ensure the requesting party handles the information responsibly. 4. Notarization: In some cases, notarization might be required to authenticate the consent document. Importance and Considerations: 1. Privacy protection: Suffolk New York Consent to Release of Financial Information helps ensure that an individual's financial records are securely shared only with authorized parties, minimizing the risk of misuse or unauthorized access. 2. Informed decision-making: With the consent granted, the requesting party can gain access to accurate financial data to inform their decision-making process, whether it's related to loans, investment opportunities, legal proceedings, or business partnerships. 3. Legally binding document: This consent acts as a legal agreement, setting clear terms and conditions for the release of financial information. It ensures compliance with state and federal laws regarding the privacy and protection of personal information. 4. Revocable Consent: Individuals maintain the right to revoke their consent, typically by providing written notice to the authorized parties. This allows them to control the duration and termination of access to their financial records. Conclusion: Suffolk New York Consent to Release of Financial Information is a crucial legal document that enables the authorized sharing of financial records for various specific purposes. Understanding the different types of consent, the process of obtaining it, and its significance helps protect privacy while facilitating informed decision-making in personal, commercial, and legal contexts.

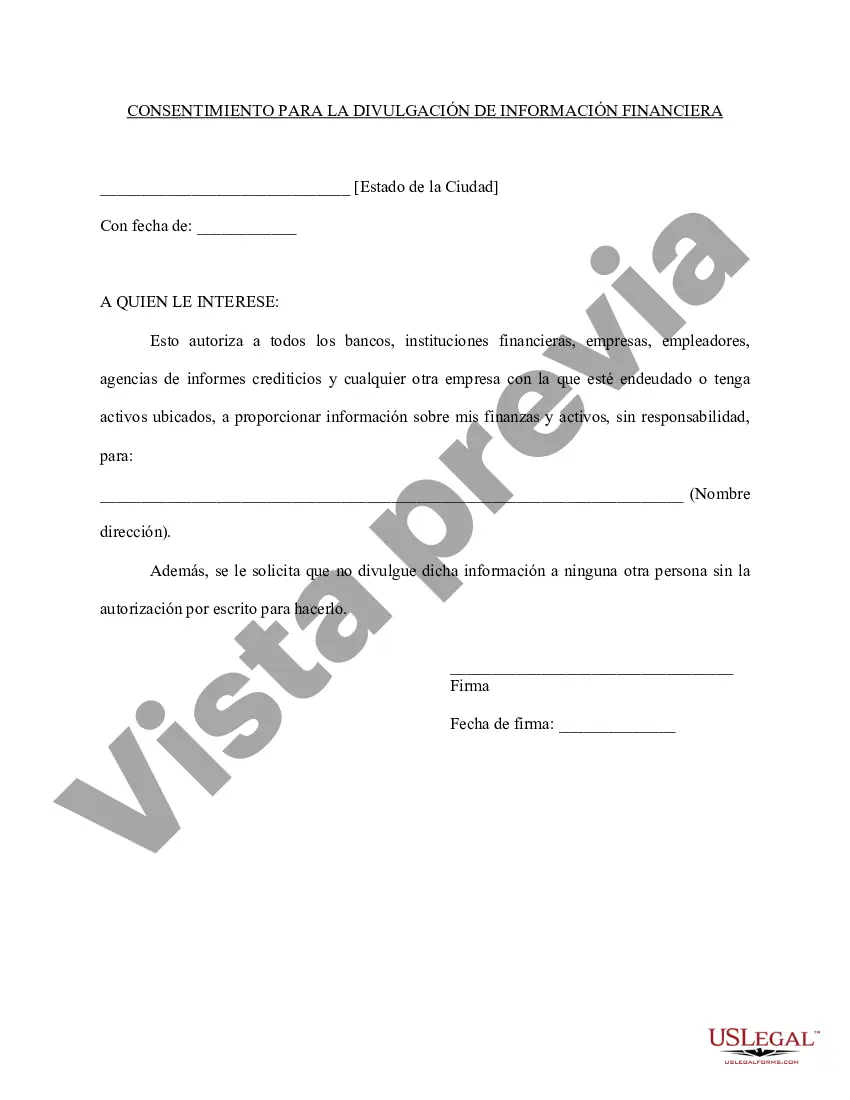

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Consentimiento para la divulgación de información financiera - Consent to Release of Financial Information

Description

How to fill out Suffolk New York Consentimiento Para La Divulgación De Información Financiera?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Suffolk Consent to Release of Financial Information, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any activities related to document completion straightforward.

Here's how to purchase and download Suffolk Consent to Release of Financial Information.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the legality of some documents.

- Check the related document templates or start the search over to find the right document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment method, and purchase Suffolk Consent to Release of Financial Information.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Suffolk Consent to Release of Financial Information, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you have to cope with an exceptionally difficult case, we advise getting a lawyer to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!