Travis Texas Consent to Release of Financial Information is a legal document that allows an individual or organization to obtain and use another party's financial information for specific purposes. This consent is typically required when there is a need to access sensitive financial data, such as during loan applications, mortgage processes, or credit evaluations. The document ensures that the authorized party can request, review, and gather relevant financial information about the subject individual or entity. The Travis Texas Consent to Release of Financial Information is an essential tool to facilitate the exchange of financial data while maintaining security and privacy. It is crucial to have this consent in place to protect both parties involved in the information-sharing process. Without explicit consent, it would be unlawful to access someone's financial records and could potentially lead to legal consequences. Different types of Travis Texas Consent to Release of Financial Information may exist depending on the specific requirements and purposes. Some common variations include: 1. Loan Consent to Release of Financial Information: This type of consent is typically used during loan applications, where the lender requires access to the borrower's financial records to assess creditworthiness and determine the risk associated with lending money. 2. Mortgage Consent to Release of Financial Information: When applying for a mortgage, lenders often request consent to access the borrower's financial information to evaluate their ability to repay the loan and assess the property's value. 3. Credit Evaluation Consent to Release of Financial Information: Creditors, such as credit card companies or financial institutions, may require consent to release financial information to evaluate a customer's creditworthiness before granting credit or approving loans. 4. Background Check Consent to Release of Financial Information: Employers or background screening companies may request this consent to access an individual's financial records as part of a background check, especially for positions involving financial responsibility or security clearances. 5. Partnership or Business Consent to Release of Financial Information: When entering into a partnership or business venture, parties may require consent to access each other's financial information to ensure transparency and evaluate financial feasibility. In summary, the Travis Texas Consent to Release of Financial Information is a vital legal document that enables authorized individuals or entities to obtain and use someone's financial information for specific purposes. Its types may vary depending on the context, such as loans, mortgages, credit evaluations, background checks, or business partnerships.

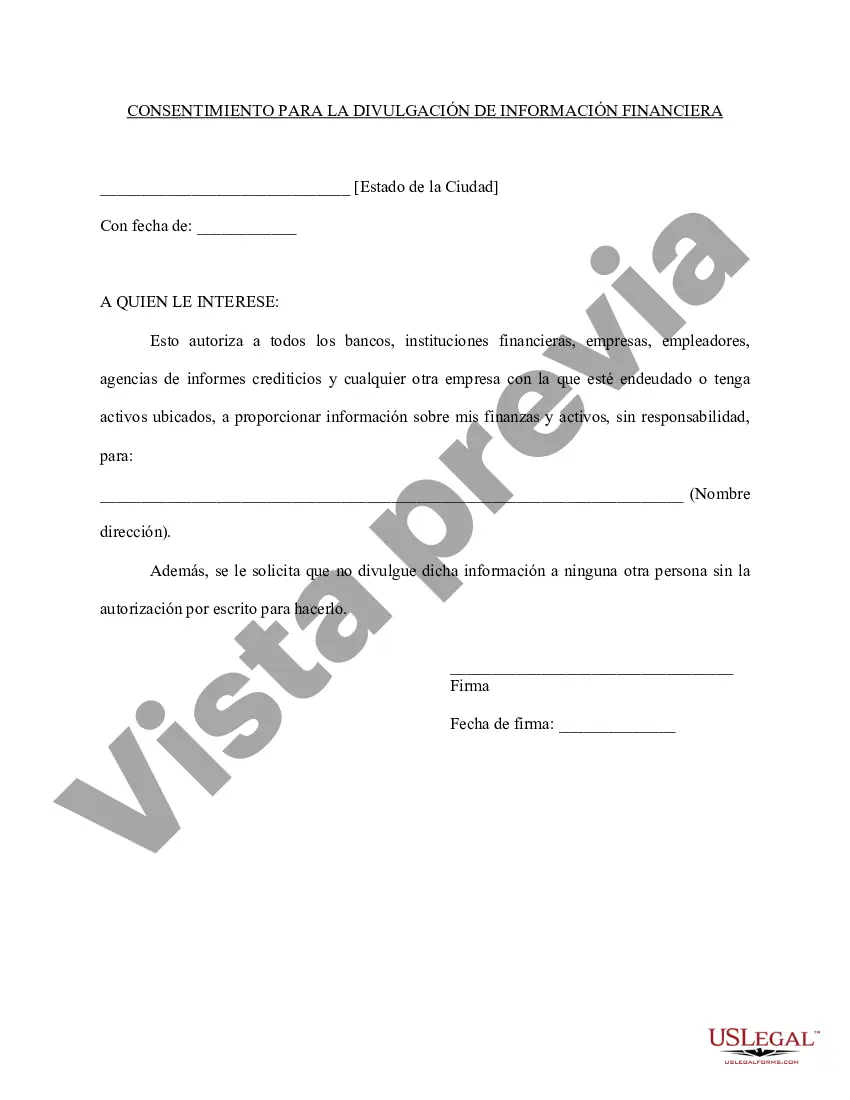

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Consentimiento para la divulgación de información financiera - Consent to Release of Financial Information

Description

How to fill out Travis Texas Consentimiento Para La Divulgación De Información Financiera?

Preparing paperwork for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Travis Consent to Release of Financial Information without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Travis Consent to Release of Financial Information by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Travis Consent to Release of Financial Information:

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!