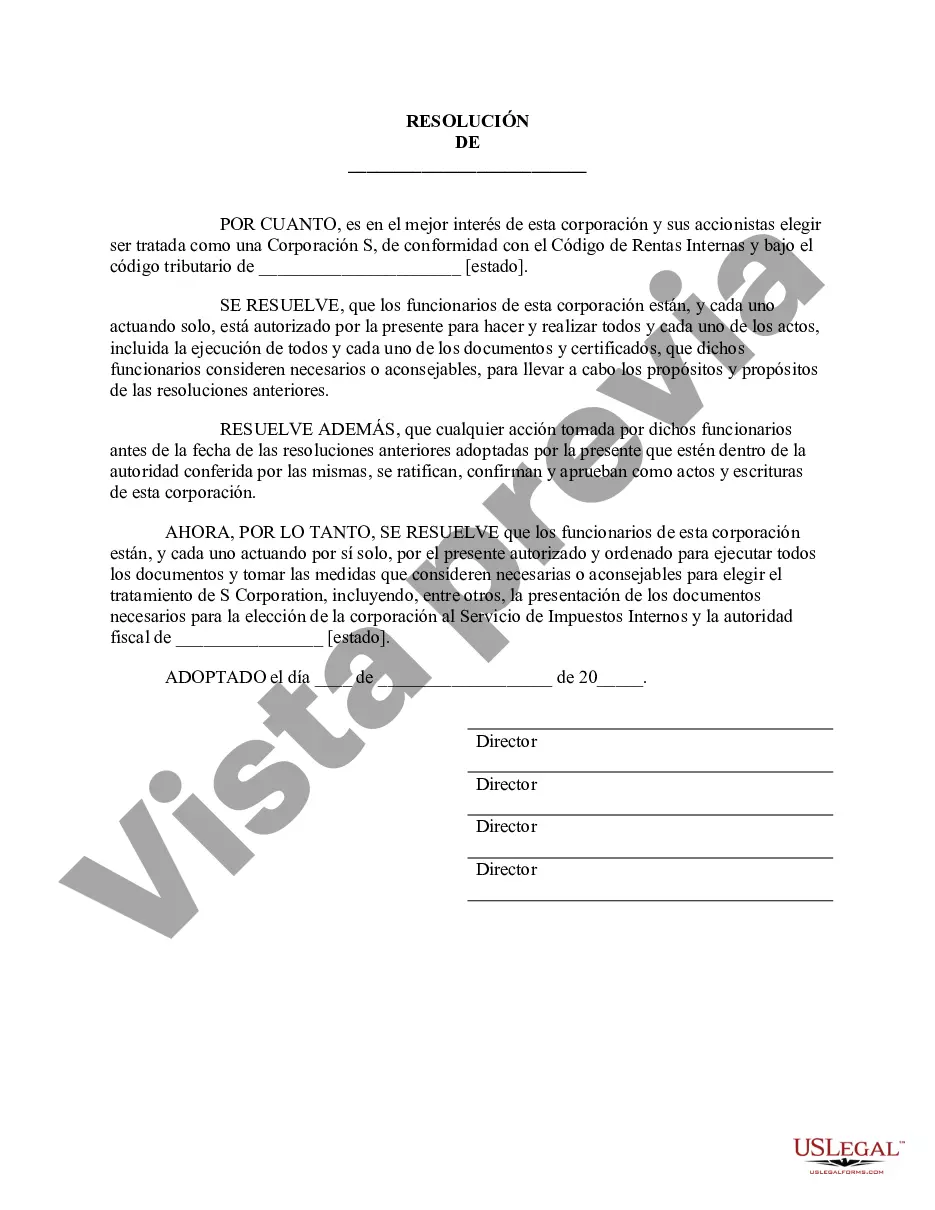

Bexar, Texas, is a bustling county located in the southern part of Texas, known for its vibrant culture, rich history, and thriving business sector. For entrepreneurs and small business owners in Bexar County who wish to obtain an S Corporation status, Corporate Resolutions Forms play a crucial role in the process. These forms are essential for documenting the decisions and actions taken by the Board of Directors and shareholders, ensuring compliance with legal requirements. There are several types of Corporate Resolutions Forms that businesses in Bexar County may need to consider while obtaining S Corporation status. Some commonly used forms include: 1. S Corporation Election Form: This form is filed with the Internal Revenue Service (IRS) to request S Corporation status. It outlines the company's eligibility criteria, such as having no more than 100 shareholders, being a domestic corporation, and having only allowable shareholders. 2. Board Resolution Forms: These forms document the resolutions and decisions made by the Board of Directors regarding the S Corporation status. They cover various aspects such as electing officers, adopting bylaws, approving financial statements, authorizing the filing of necessary documents, and more. 3. Shareholder Consent Forms: These forms are used to obtain the consent of the shareholders for electing S Corporation status. Shareholders must agree to the conversion from a regular corporation to an S Corporation and sign these forms. 4. Articles of Amendment: In some cases, companies may need to amend their articles of incorporation to reflect the change in status from a regular corporation to an S Corporation. The Articles of Amendment form is used to officially update the company's legal documentation. 5. IRS Form 2553: This is a crucial form required to be filed with the IRS within a specific timeframe to request S Corporation status. It includes details about the company, its shareholders, and its fiscal year. When obtaining S Corporation status in Bexar County, it is important to consult with legal or tax professionals to ensure compliance with all the necessary requirements and regulations. Properly completing and filing the relevant Corporate Resolutions Forms will help businesses benefit from reduced tax obligations, limited liability protection, and other advantages associated with S Corporation status.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Obtener el estado de S Corporation - Formularios de resoluciones corporativas - Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Bexar Texas Obtener El Estado De S Corporation - Formularios De Resoluciones Corporativas?

If you need to get a trustworthy legal form provider to find the Bexar Obtain S Corporation Status - Corporate Resolutions Forms, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to find and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to search or browse Bexar Obtain S Corporation Status - Corporate Resolutions Forms, either by a keyword or by the state/county the form is created for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Bexar Obtain S Corporation Status - Corporate Resolutions Forms template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less pricey and more affordable. Set up your first business, arrange your advance care planning, create a real estate contract, or complete the Bexar Obtain S Corporation Status - Corporate Resolutions Forms - all from the convenience of your home.

Join US Legal Forms now!