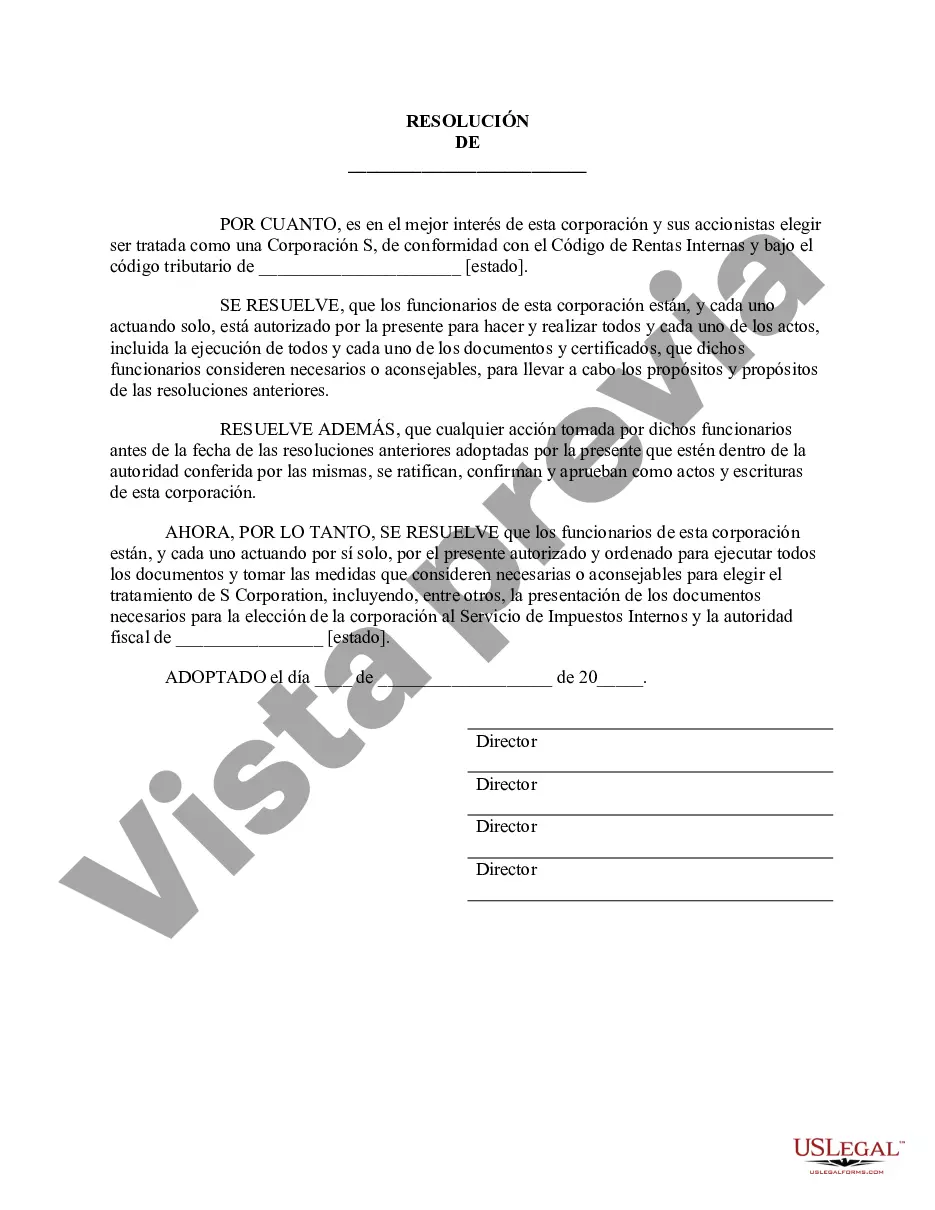

Cook Illinois, often referred to as Cook, is a prominent corporation that provides transportation services in the state of Illinois. It caters to both public and private sectors, offering a wide range of transportation solutions to meet the diverse needs of its clients. Cook Illinois has established itself as a trusted name in the industry, recognized for its exceptional service, reliability, and commitment to customer satisfaction. One significant step taken by Cook Illinois is obtaining S Corporation status. By transitioning from a regular corporation to an S Corporation, Cook Illinois can enjoy certain tax benefits and advantages. This enables the corporation to pass its income, deductions, and credits to its shareholders, avoiding double taxation. Moreover, S Corporations are subject to fewer corporate compliance requirements, making it an attractive option for many businesses. To obtain S Corporation status, Cook Illinois needs to complete specific legal procedures and file appropriate paperwork. Corporate resolutions forms play a pivotal role in this process, as they document the decisions and actions taken by the corporation's board of directors or shareholders. These resolutions help solidify the intent of Cook Illinois to obtain S Corporation status and ensure the compliance with legal requirements. The Cook Illinois Obtain S Corporation Status — Corporate Resolutions Forms consist of various types, each serving a particular purpose. These forms include: 1. S Corporation Election Resolution: This form outlines the decision of Cook Illinois to elect S Corporation status. It covers details such as the date of the election, approval by the board of directors or shareholders, and other necessary information required by the Internal Revenue Service (IRS). 2. Articles of Amendment: This form modifies the original articles of incorporation of Cook Illinois to reflect the change in its corporate status. It typically includes the amendment language, effective date, and signature of an authorized representative of the corporation. 3. Shareholder Consent Resolution: This resolution is signed by the shareholders of Cook Illinois to provide their consent and support for the conversion to S Corporation status. It affirms their understanding of the benefits and obligations associated with such a transition. 4. Board of Directors Meeting Minutes: This documentation records the proceedings of the board of directors' meeting where the decision to pursue S Corporation status was made. It includes details about the discussions held, the vote count, and any specific resolutions passed during the meeting. These are the primary types of Cook Illinois Obtain S Corporation Status — Corporate Resolutions Forms. However, it's important to note that the specific forms and requirements may vary depending on the jurisdiction and legal regulations applicable to Cook Illinois. Overall, Cook Illinois' decision to obtain S Corporation status through the completion of relevant corporate resolutions forms demonstrates its commitment to maximizing tax benefits and streamlining its operations. It exemplifies Cook Illinois' proactive approach to enhancing its business structure and ensuring long-term sustainability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Obtener el estado de S Corporation - Formularios de resoluciones corporativas - Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Cook Illinois Obtener El Estado De S Corporation - Formularios De Resoluciones Corporativas?

If you need to find a trustworthy legal form provider to get the Cook Obtain S Corporation Status - Corporate Resolutions Forms, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to get and complete different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Cook Obtain S Corporation Status - Corporate Resolutions Forms, either by a keyword or by the state/county the form is intended for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Cook Obtain S Corporation Status - Corporate Resolutions Forms template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less expensive and more reasonably priced. Create your first company, organize your advance care planning, create a real estate agreement, or complete the Cook Obtain S Corporation Status - Corporate Resolutions Forms - all from the comfort of your home.

Join US Legal Forms now!