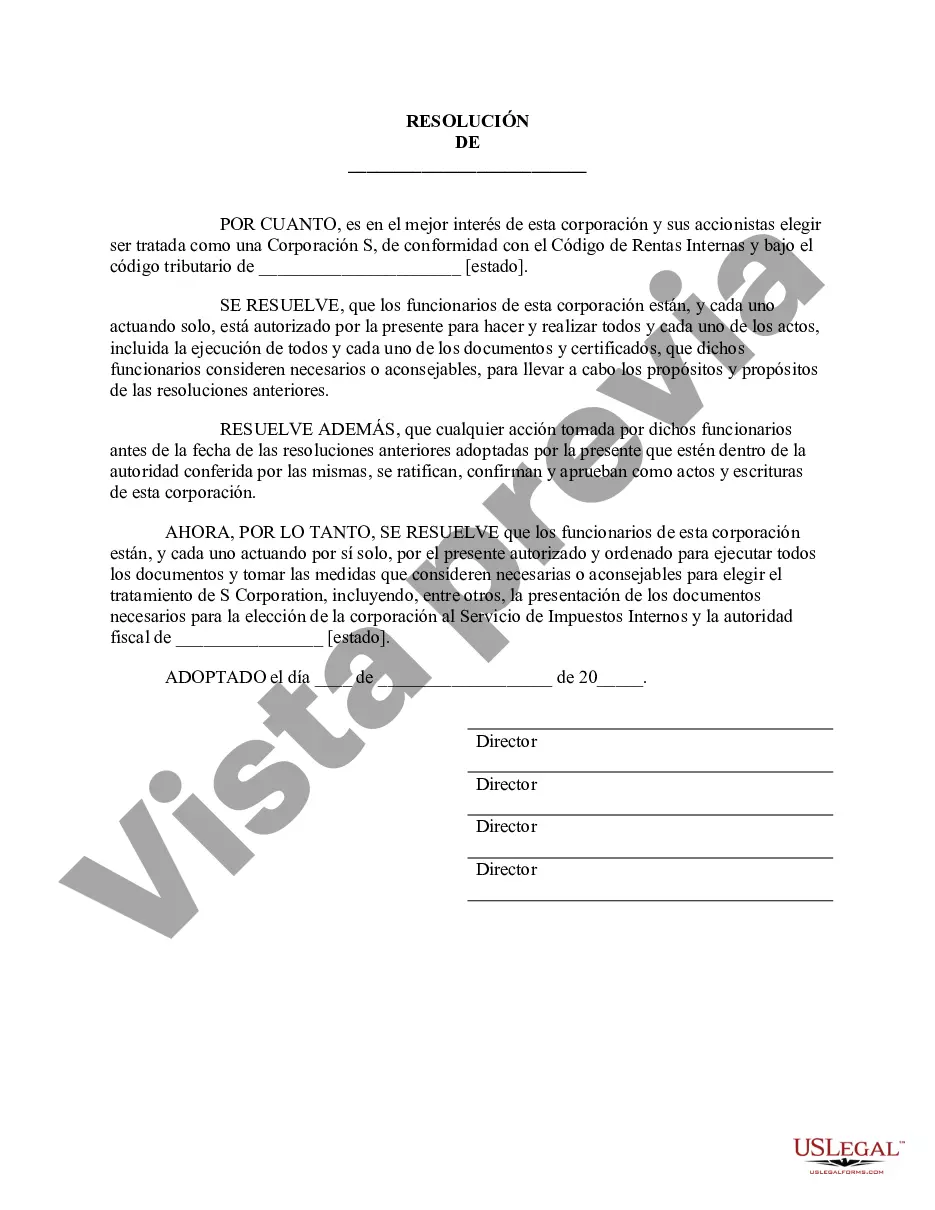

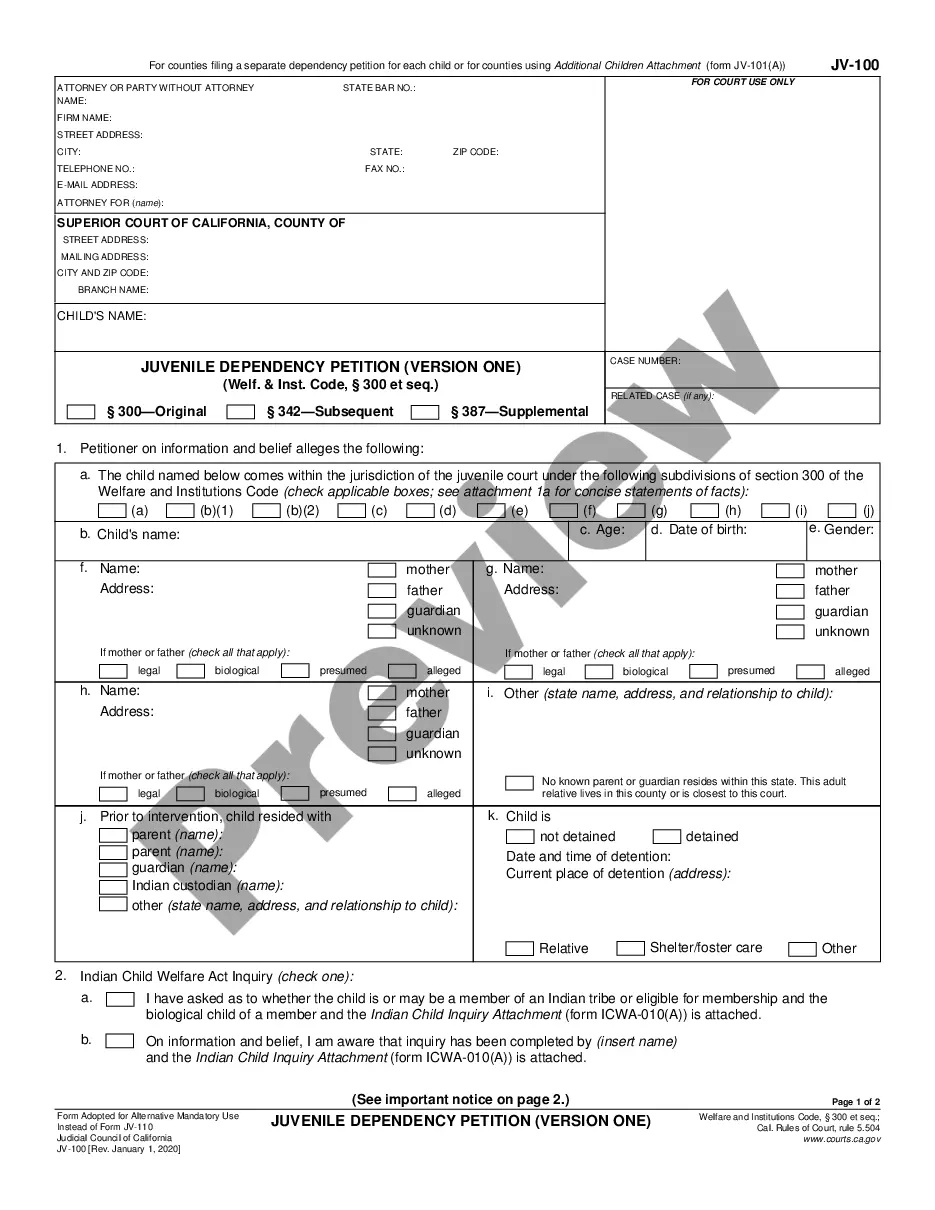

Cuyahoga Ohio Obtain S Corporation Status — Corporate Resolutions Forms: Cuyahoga County, located in Ohio, offers businesses the opportunity to obtain S Corporation status through corporate resolutions forms. An S Corporation is a type of business structure that allows for certain tax benefits and limited liability for shareholders. To achieve S Corporation status in Cuyahoga Ohio, businesses must file specific forms and follow the necessary resolutions outlined by the county. Here are the different types of Cuyahoga Ohio Obtain S Corporation Status — Corporate Resolutions Forms: 1. Articles of Incorporation: This form allows businesses to officially establish themselves as a corporation with the state of Ohio. It outlines the company's name, purpose, registered agent details, and other necessary information. 2. Resolution to Elect S Corporation Status: This resolution form is essential for businesses seeking S Corporation designation. It states the intent of the corporation to be treated as an S Corporation for tax purposes and must be adopted by the shareholders. 3. Shareholder Consent Agreement: This form serves as written consent from each shareholder, indicating their agreement to elect S Corporation status. It typically includes their names, share amounts, and signatures. 4. Resolution to Adopt Bylaws: Bylaws are the internal rules and regulations that govern a corporation's operations. This resolution form is used to officially adopt these bylaws, addressing important aspects such as shareholder rights, director roles, and meeting procedures. 5. Resolution to Appoint Officers and Directors: This resolution form designates the individuals who will hold key positions within the corporation, such as president, secretary, treasurer, and directors. It typically includes their names, titles, and respective responsibilities. 6. Resolution to Ratify Previous Actions: This form is used to ratify any prior acts or decisions made by the corporation that may be necessary for obtaining S Corporation status. It ensures that all past actions align with the requirements and guidelines set forth by Cuyahoga Ohio. By completing these Cuyahoga Ohio Obtain S Corporation Status — Corporate Resolutions Forms, businesses can achieve S Corporation status and enjoy the benefits it offers in terms of taxation and liability protection. It is essential to consult with legal and tax professionals to ensure compliance with state and federal laws and to tailor the resolutions to the specific needs of the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Obtener el estado de S Corporation - Formularios de resoluciones corporativas - Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Cuyahoga Ohio Obtener El Estado De S Corporation - Formularios De Resoluciones Corporativas?

Drafting papers for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Cuyahoga Obtain S Corporation Status - Corporate Resolutions Forms without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Cuyahoga Obtain S Corporation Status - Corporate Resolutions Forms by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Cuyahoga Obtain S Corporation Status - Corporate Resolutions Forms:

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!