San Antonio, Texas is a vibrant city located in the southern part of the state. It is the second most populous city in Texas and has a rich history, diverse culture, and a strong business environment. The city is known for its famous attractions like the Alamo, River Walk, and the San Antonio Missions National Historical Park. When it comes to starting a business in San Antonio, one option available to entrepreneurs is to obtain S Corporation status. An S Corporation is a type of business structure that offers certain tax benefits and limited liability for its owners. To achieve S Corporation status in San Antonio, there are certain steps and corporate resolutions forms that need to be followed. The process of obtaining S Corporation status in San Antonio typically begins with the formation of a corporation. This involves filing the necessary paperwork, such as the Certificate of Formation or Articles of Incorporation, with the Texas Secretary of State. Once the corporation is formed, it can then elect to be treated as an S Corporation by filing Form 2553 with the Internal Revenue Service (IRS). Corporate resolutions forms play a crucial role in the process of obtaining S Corporation status in San Antonio. These forms are legal documents that record important decisions made by a corporation's board of directors or shareholders. They provide written evidence of the corporation's intent to operate as an S Corporation and outline the specific resolutions adopted to achieve this status. There are various types of corporate resolutions forms that may be required during the process of obtaining S Corporation status in San Antonio. Some common forms include: 1. Resolution to Elect S Corporation Status: This form is used to formally declare the corporation's intention to operate as an S Corporation. It typically includes details such as the corporation's name, the date of the resolution, and the names and titles of the individuals adopting the resolution. 2. Shareholder Consent to Elect S Corporation Status: This form is signed by the corporation's shareholders, indicating their consent to elect S Corporation status for the company. It includes information such as the names of the shareholders, the number of shares held, and their respective signatures. 3. Board of Directors' Resolution to Elect S Corporation Status: This form records the decision made by the corporation's board of directors to pursue S Corporation status. It typically includes details such as the date of the resolution, the names of the directors, and their signatures. 4. IRS Form 2553: While not a corporate resolution form per se, IRS Form 2553 is a crucial document required to elect S Corporation status with the IRS. It must be completed accurately and submitted within the specified timeframe. These forms and resolutions are important in the process of obtaining S Corporation status in San Antonio. Seeking professional advice from a qualified attorney or accountant is recommended to ensure compliance with all legal requirements and to maximize the benefits of operating as an S Corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Obtener el estado de S Corporation - Formularios de resoluciones corporativas - Obtain S Corporation Status - Corporate Resolutions Forms

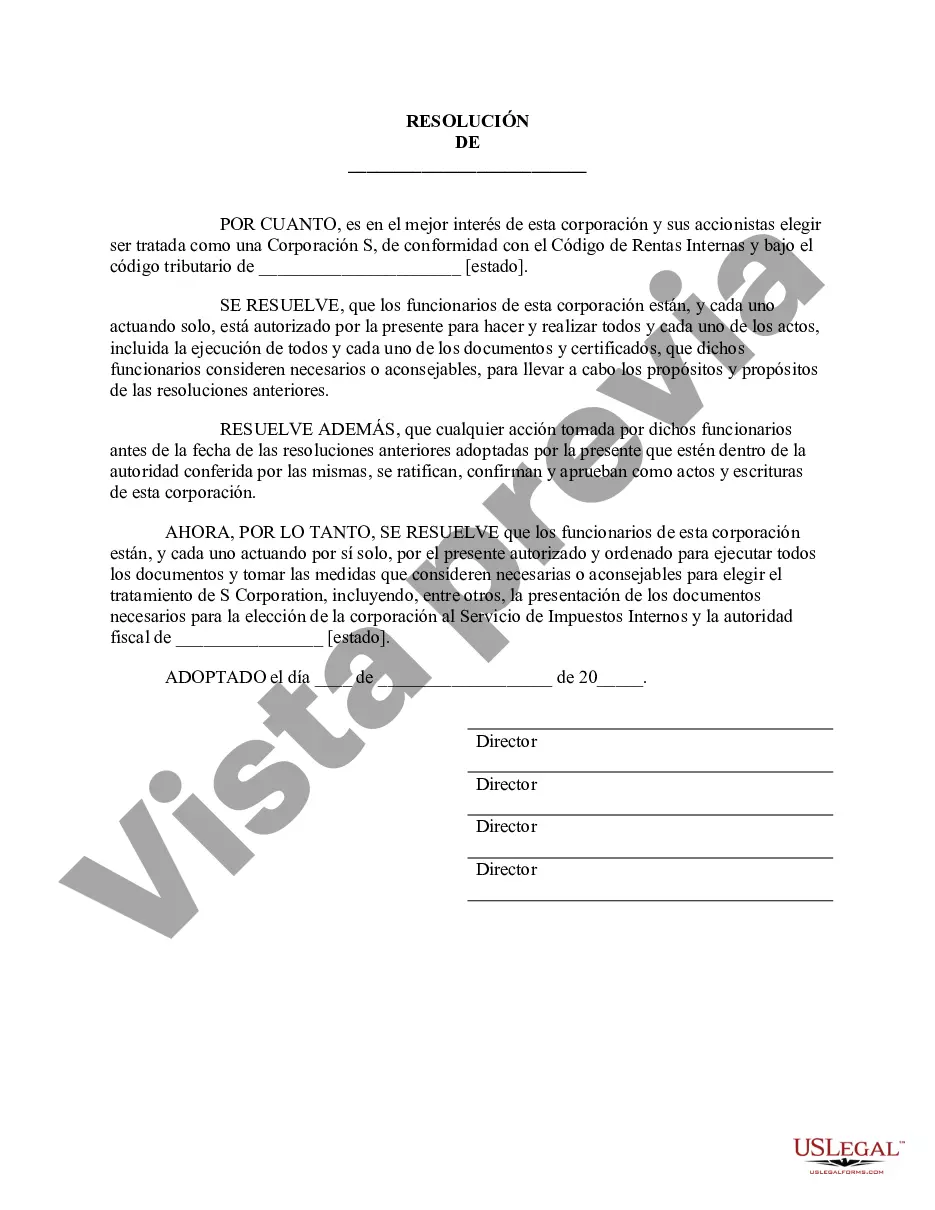

Description

How to fill out San Antonio Texas Obtener El Estado De S Corporation - Formularios De Resoluciones Corporativas?

Preparing papers for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate San Antonio Obtain S Corporation Status - Corporate Resolutions Forms without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid San Antonio Obtain S Corporation Status - Corporate Resolutions Forms by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Antonio Obtain S Corporation Status - Corporate Resolutions Forms:

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a few clicks!