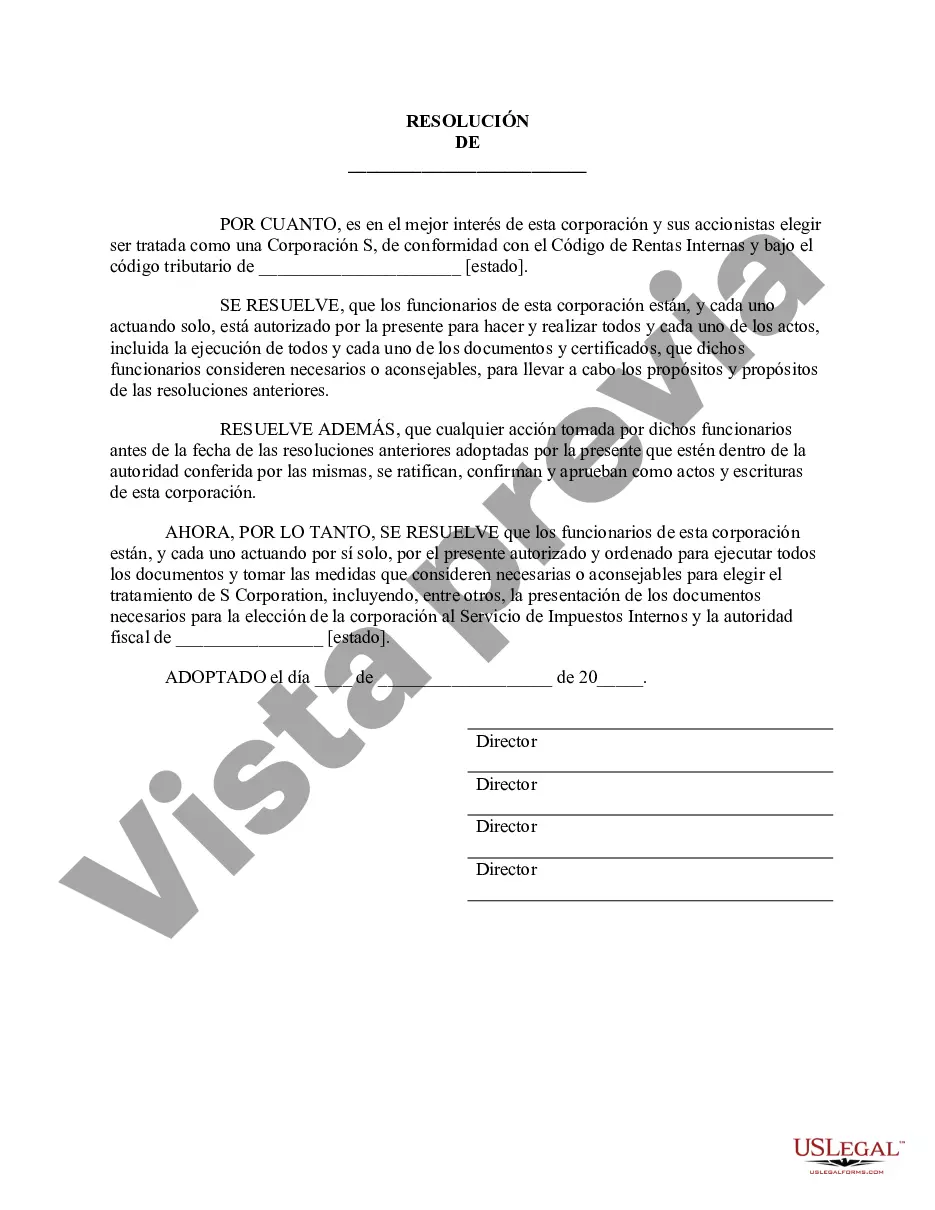

Travis Texas Obtain S Corporation Status — Corporate Resolutions Forms: Everything You Need to Know If you are planning to start a business in Travis County, Texas, and wish to establish an S Corporation, you will need to follow several steps and complete specific forms to obtain S Corporation status. This detailed guide will provide you with the necessary information on Travis Texas Obtain S Corporation Status — Corporate Resolutions Forms, ensuring a smoother process for your business setup. Before diving into the forms, let's quickly discuss what an S Corporation is and why it may be beneficial for your business. An S Corporation is a type of business entity that combines the benefits of limited liability protection with a pass-through taxation structure. It allows shareholders to report business profits and losses on their personal tax returns, avoiding double taxation. Now, let's delve into the different types of Travis Texas Obtain S Corporation Status — Corporate Resolutions Forms you may encounter: 1. S Corporation Election Form: This is the primary form you will need to file with the Internal Revenue Service (IRS) to obtain S Corporation status. Commonly known as Form 2553, it must be completed within the specified time frame after your initial corporation formation. This form allows you to elect S Corporation tax treatment. 2. Articles of Incorporation: These are foundational documents that establish your business as a legal entity within Travis County. While not specific to S Corporations, they are a crucial step in the process and should be filed with the Secretary of State's office. Ensure that you adhere to all the state's requirements regarding corporate names, registered agents, and other relevant information. 3. Bylaws: Drafting and adopting corporate bylaws is an essential step for any corporation, including S Corporations. Bylaws outline how your business will be governed, including rules for shareholder meetings, director roles, and voting procedures. While not strictly a form, bylaws are an important component of the process. 4. Corporate Resolutions Forms: Within the context of obtaining S Corporation status, corporate resolution forms may be required to document specific decisions made by the corporation's directors or shareholders. These resolutions can cover various matters, such as electing officers, adopting a fiscal year, approving the S Corporation election, and more. 5. Shareholder Agreements: Although not a specific form related to obtaining S Corporation status, shareholders may choose to create a shareholder agreement to outline their rights, obligations, and ownership percentages. These agreements can protect shareholder interests and provide clarity on how the business should be operated. When completing Travis Texas Obtain S Corporation Status — Corporate Resolutions Forms, ensure accuracy, as mistakes or missing information can lead to delays or complications in the process. Consulting with legal professionals or business advisors experienced in S Corporations can provide valuable assistance throughout the filing and resolution process. Remember, the specific requirements and forms may vary in different jurisdictions. It is crucial to research and understand the relevant regulations and guidelines specific to Travis County, Texas, to ensure compliance with all legal obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Obtener el estado de S Corporation - Formularios de resoluciones corporativas - Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Travis Texas Obtener El Estado De S Corporation - Formularios De Resoluciones Corporativas?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Travis Obtain S Corporation Status - Corporate Resolutions Forms suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Aside from the Travis Obtain S Corporation Status - Corporate Resolutions Forms, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Travis Obtain S Corporation Status - Corporate Resolutions Forms:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Travis Obtain S Corporation Status - Corporate Resolutions Forms.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!