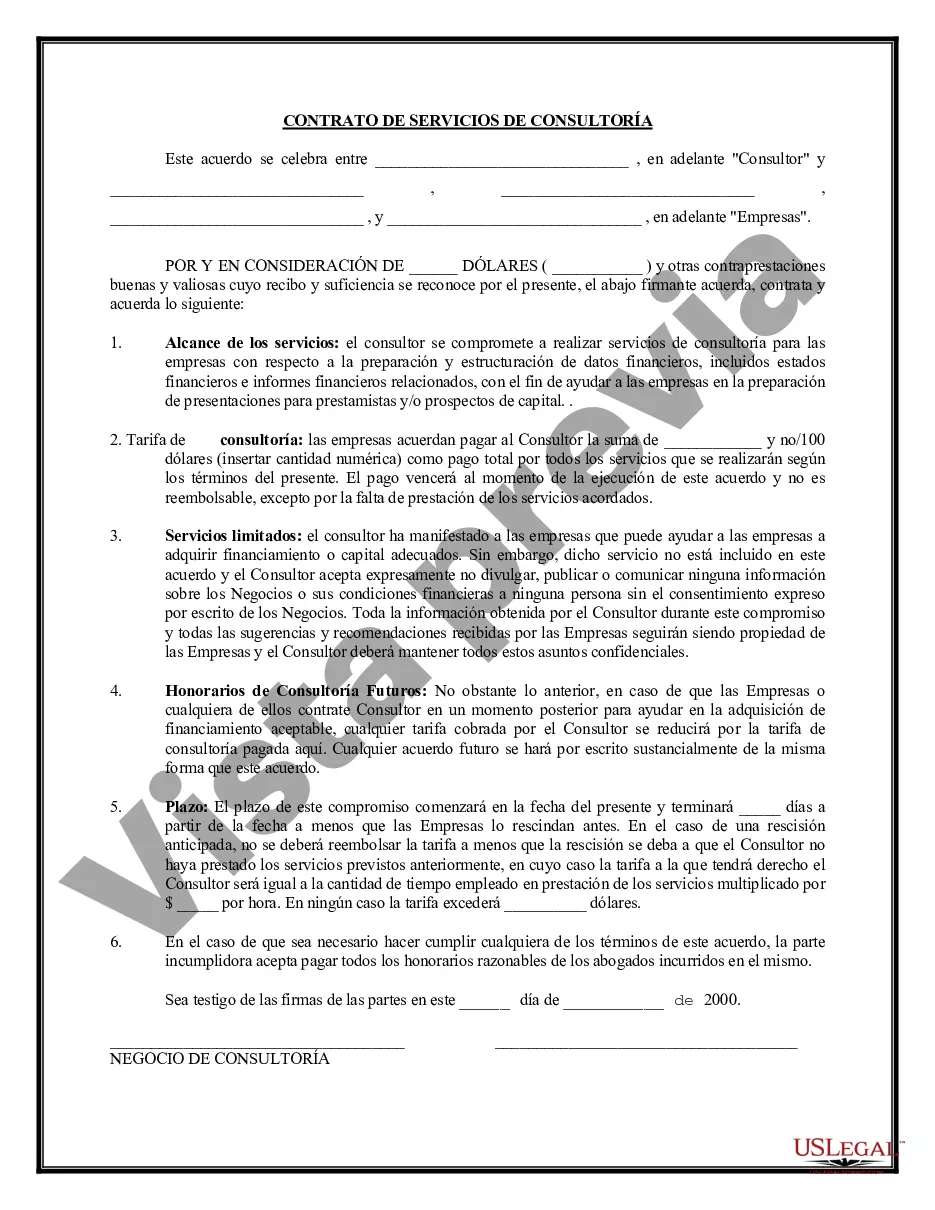

Alameda California Consulting Agreement — Assist Company Obtain Loan A consulting agreement, specifically tailored for companies in Alameda, California, seeking assistance in obtaining loans, is a legally binding document that outlines the terms and conditions between a business and a consultant. Such an agreement allows businesses to access expert advice and support from consultants who possess extensive knowledge of the loan application process and are well-versed in the local financial landscape. This consulting agreement provides a comprehensive framework under which the consultant (often a financial advisor or consultant specializing in loan acquisition) agrees to assist the company in navigating the complexities of obtaining loans tailored to their specific needs. The agreement outlines various key elements, including scope of services, fees, compensation, responsibilities, duration, and confidentiality. Keywords: Alameda California, consulting agreement, company, obtain loan, financial advisor, loan acquisition, expert advice, support, terms and conditions, local financial landscape, loan application process, tailored needs, scope of services, fees, compensation, responsibilities, duration, confidentiality. Types of Alameda California Consulting Agreements — Assist Company Obtain Loan: 1. Financial Consulting Agreement: This type of consulting agreement focuses on providing financial advice and guidance to companies in Alameda, California, to enhance their loan application process. Financial consultants help companies assess their financial health, prepare necessary documents, complete loan applications, and advise on strategies to increase the likelihood of loan approval. 2. Credit Consulting Agreement: Companies often require assistance in improving their creditworthiness to secure favorable loan terms. Credit consultants work closely with businesses in Alameda, California, to analyze credit reports, identify areas for improvement, implement strategies, and negotiate with lenders to achieve the best possible loan terms. 3. Collateral Consulting Agreement: Some companies may struggle to meet collateral requirements set by lenders during the loan application process. Collateral consultants help businesses identify suitable collateral options, assess collateral value, and advise on maximizing collateral assets to meet lender requirements. 4. Loan Packaging Consulting Agreement: This type of consulting agreement focuses on ensuring that all necessary documents and information required for loan applications are properly organized and presented. Loan packaging consultants assist companies in Alameda, California, in preparing comprehensive loan packages that effectively showcase the company's strengths, financial stability, and potential for loan repayment. 5. Small Business Administration (SBA) Consulting Agreement: For businesses seeking loans guaranteed by the Small Business Administration, SBA consultants provide specialized advice and guidance. These consultants assist in navigating the SBA loan application process, ensuring compliance with SBA regulations, and maximizing the chances of loan approval. Keywords: Alameda California, consulting agreements, financial consulting, credit consulting, collateral consulting, loan packaging consulting, small business administration consulting, loan application, loan approval, creditworthiness, collateral requirements, collateral options, loan packages, small business administration, SBA loan application process, SBA regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Acuerdo de consultoría: ayudar a la empresa a obtener un préstamo - Consulting Agreement - Assist Company Obtain Loan

Description

How to fill out Alameda California Acuerdo De Consultoría: Ayudar A La Empresa A Obtener Un Préstamo?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the Alameda Consulting Agreement - Assist Company Obtain Loan.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Alameda Consulting Agreement - Assist Company Obtain Loan will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Alameda Consulting Agreement - Assist Company Obtain Loan:

- Make sure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Alameda Consulting Agreement - Assist Company Obtain Loan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!