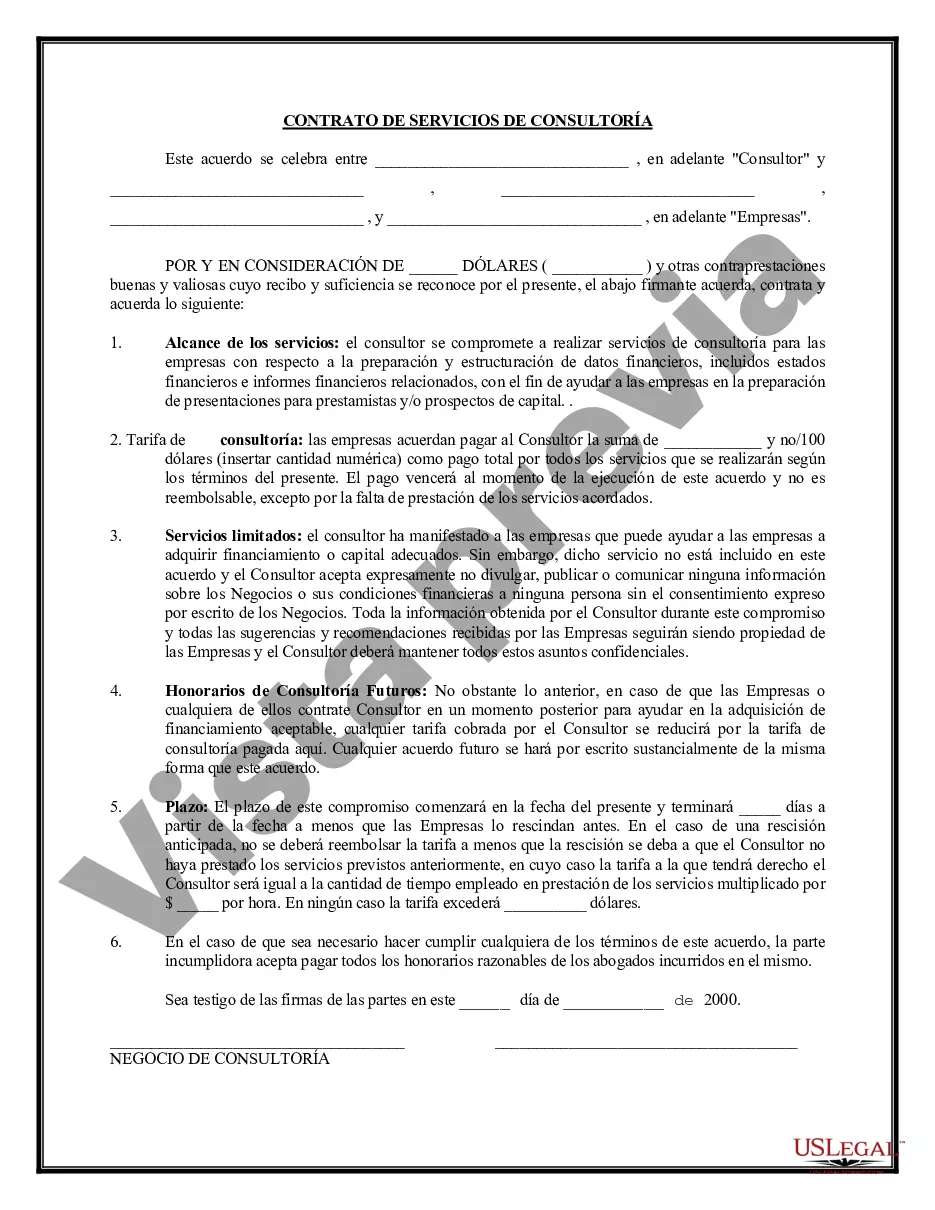

A Chicago Illinois consulting agreement to assist a company in obtaining a loan is a comprehensive legal document that outlines the terms and conditions between a consultant and a company seeking financial assistance. This agreement is specifically tailored to cater to businesses located in Chicago, Illinois, and ensures the smooth facilitation of loan acquisition while adhering to the local laws and regulations. The purpose of this consulting agreement is to establish a professional relationship between the consultant and the company, where the consultant utilizes their expertise and knowledge to guide and support the company throughout the loan acquisition process. By entering into this agreement, both parties agree to work together in a mutually beneficial manner to achieve successful loan procurement. Key areas covered in a Chicago Illinois consulting agreement to assist a company to obtain a loan may include: 1. Scope of Services: This section defines the specific services the consultant will provide to the company. It outlines the tasks and responsibilities involved in assisting the company with loan acquisition, such as conducting a financial analysis, preparing loan applications, identifying potential lenders, and negotiating loan terms. 2. Compensation: The compensation structure for the consulting services is detailed in this section. It may include hourly rates, fixed fees, or a percentage of the loan amount obtained. Both parties agree on the payment terms, including when and how the consultant will be compensated. 3. Term and Termination: This clause specifies the duration of the consulting agreement. It also outlines the circumstances under which either party can terminate the agreement, along with any notice period required. 4. Confidentiality: To maintain the privacy and protection of sensitive information, this section ensures that both the consultant and the company commit to keeping all confidential information strictly confidential. It may include provisions regarding the use, disclosure, and return of confidential materials. 5. Indemnification: This clause establishes the responsibilities and liabilities of each party. It outlines the extent to which the consultant will be held liable in case of any financial losses incurred during the loan acquisition process. 6. Governing Law and Jurisdiction: As this agreement is specific to Chicago, Illinois, it will state that the laws of the state govern the interpretation and enforcement of the agreement. It may also specify the jurisdiction or court where any disputes will be resolved. Types of Chicago Illinois consulting agreements to assist a company to obtain a loan may include: 1. General Loan Consulting Agreement: This agreement covers standard loan acquisition services provided by a consultant working with a wide range of businesses seeking loans in Chicago, Illinois. 2. Small Business Loan Consulting Agreement: This type of agreement caters specifically to small businesses in Chicago, Illinois, looking for assistance in securing loans tailored to their unique needs and challenges. 3. Real Estate Loan Consulting Agreement: This agreement focuses on companies involved in real estate ventures in Chicago, Illinois, and provides specialized consulting services for acquiring real estate financing. 4. SBA Loan Consulting Agreement: SBA (Small Business Administration) loans are a common funding option for small businesses. This agreement specifically addresses the intricacies of obtaining SBA loans in Chicago, Illinois. In summary, a Chicago Illinois consulting agreement to assist a company in obtaining a loan is a legally binding document that outlines the terms, conditions, and responsibilities of both the consultant and the company. By entering into this agreement, the company can benefit from the consultant's expertise and guidance throughout the loan acquisition process, ensuring the best possible outcome for their financial needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de consultoría: ayudar a la empresa a obtener un préstamo - Consulting Agreement - Assist Company Obtain Loan

Description

How to fill out Chicago Illinois Acuerdo De Consultoría: Ayudar A La Empresa A Obtener Un Préstamo?

If you need to get a trustworthy legal form provider to obtain the Chicago Consulting Agreement - Assist Company Obtain Loan, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to find and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to search or browse Chicago Consulting Agreement - Assist Company Obtain Loan, either by a keyword or by the state/county the form is intended for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Chicago Consulting Agreement - Assist Company Obtain Loan template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less expensive and more affordable. Set up your first business, arrange your advance care planning, create a real estate agreement, or complete the Chicago Consulting Agreement - Assist Company Obtain Loan - all from the convenience of your home.

Sign up for US Legal Forms now!