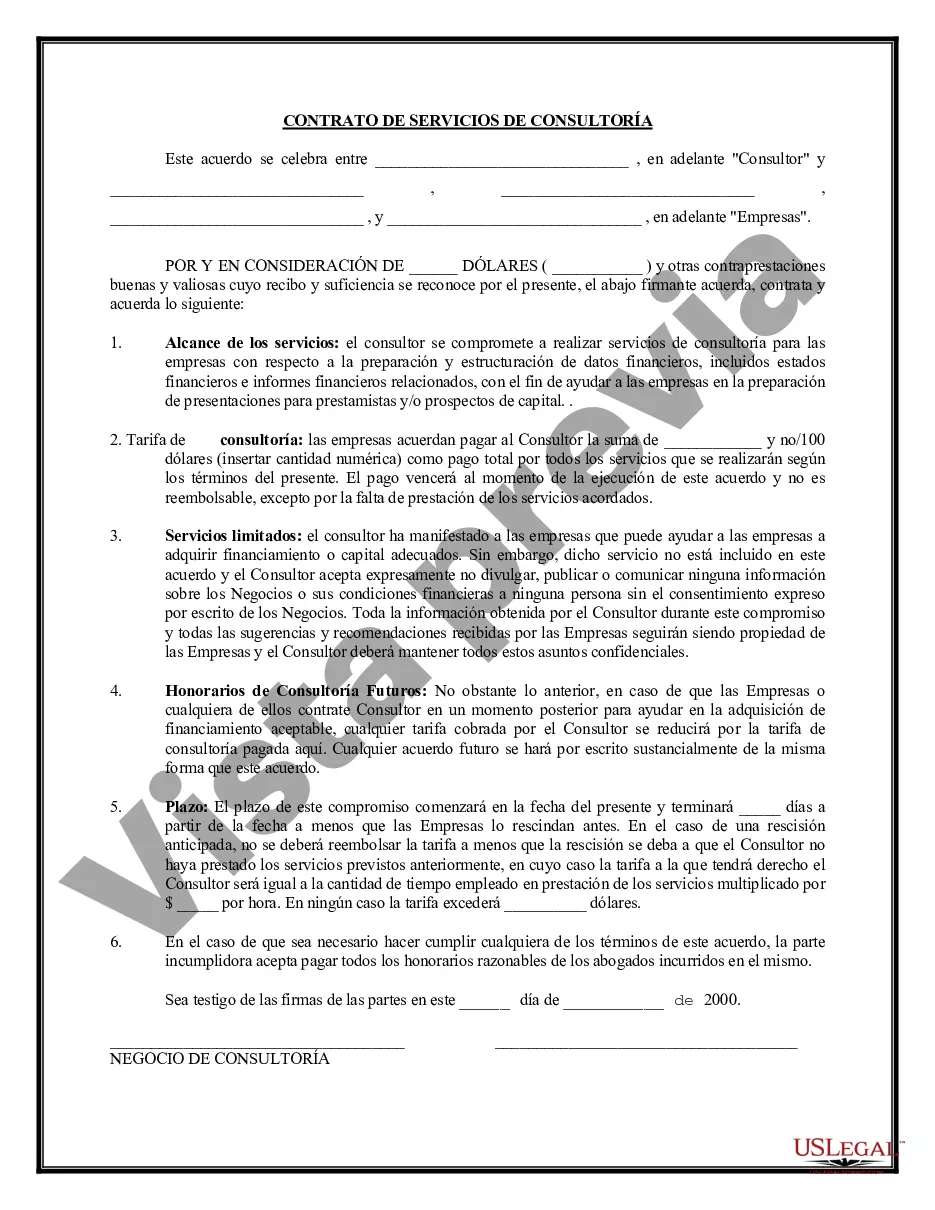

A Cuyahoga Ohio Consulting Agreement — Assist Company Obtain Loan is a legal contract between a consulting firm and a business seeking financial assistance in Cuyahoga County, Ohio. This agreement outlines the terms and conditions under which the consulting firm will provide its services to help the company secure a loan from financial institutions or lenders. The primary goal of this agreement is to assist the company in accessing the necessary funds to meet its financial needs, whether it's for business expansion, working capital, or any other purpose. The consulting firm will utilize its expertise in finance, accounting, and business strategy to guide and support the company throughout the loan acquisition process. Key areas covered in a Cuyahoga Ohio Consulting Agreement — Assist Company Obtain Loan may include: 1. Objectives: The agreement will clearly define the specific loan objectives, such as loan amount, purpose, and desired terms, that the consulting firm will help the company achieve. 2. Scope of Work: It will outline the consulting services to be provided, which may consist of financial analysis, loan application and documentation assistance, preparation of business plans or financial projections, credit score improvement advice, negotiations with lenders, and overall guidance to increase the company's chances of obtaining a loan. 3. Responsibilities: Both parties' responsibilities will be detailed, including the company's obligation to provide accurate financial information and the consulting firm's commitment to perform its services diligently and professionally. 4. Fees and Payment: The agreement will specify the compensation structure, whether it's a fixed fee, a percentage of the loan amount obtained, or an hourly rate. It will also outline the payment terms, such as upfront fees, installment payments, or contingency-based fees tied to loan success. 5. Confidentiality: This clause will establish the confidentiality obligations of the consulting firm regarding the company's sensitive financial information and any non-public loan-related discussions. 6. Duration and Termination: The agreement will state the duration of the consulting engagement and the circumstances under which either party can terminate the agreement, including notice periods and any associated penalties. Different types or variations of a Cuyahoga Ohio Consulting Agreement — Assist Company Obtain Loan may include: 1. Short-term Loan Consulting Agreement: Specifically tailored to businesses seeking short-term loans for immediate working capital requirements. 2. Long-term Loan Consulting Agreement: Designed for companies pursuing long-term financing, such as expansion projects, equipment purchases, or real estate acquisitions. 3. Small Business Loan Consulting Agreement: Focused on assisting small businesses or startups in obtaining loans from regional or local financial institutions. 4. Debt Restructuring Consulting Agreement: Geared towards businesses that need help restructuring their existing loans or negotiating better terms to alleviate financial stress. In conclusion, a Cuyahoga Ohio Consulting Agreement — Assist Company Obtain Loan serves as a crucial document that enables businesses in Cuyahoga County to collaborate with consulting firms to navigate the loan acquisition process effectively. With the assistance and expertise of a consulting firm, companies can maximize their chances of securing the financial resources they need to achieve their goals and sustain their operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo de consultoría: ayudar a la empresa a obtener un préstamo - Consulting Agreement - Assist Company Obtain Loan

Description

How to fill out Cuyahoga Ohio Acuerdo De Consultoría: Ayudar A La Empresa A Obtener Un Préstamo?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cuyahoga Consulting Agreement - Assist Company Obtain Loan, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Cuyahoga Consulting Agreement - Assist Company Obtain Loan, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Consulting Agreement - Assist Company Obtain Loan:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Cuyahoga Consulting Agreement - Assist Company Obtain Loan and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!