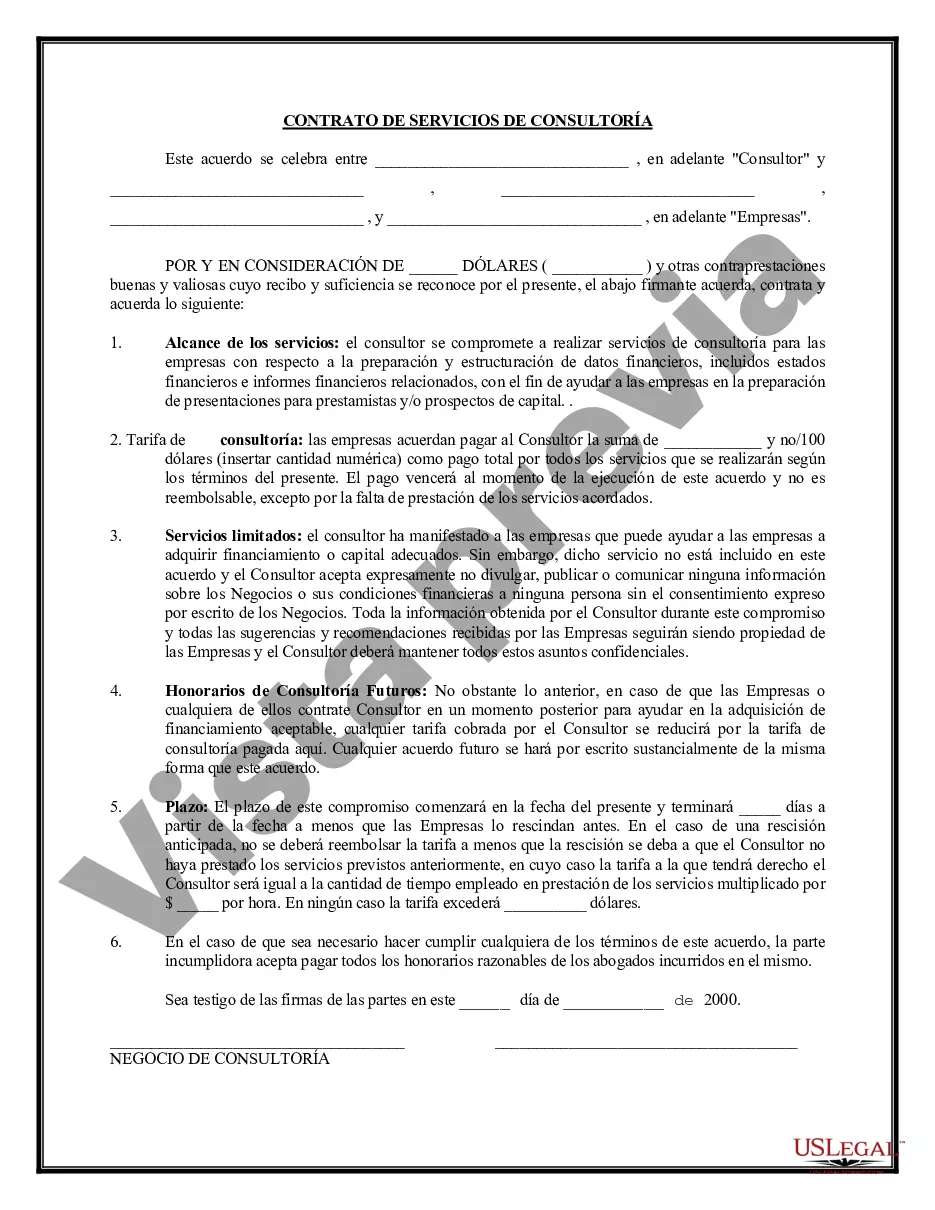

Oakland Michigan Consulting Agreement — Assist Company Obtain Loan is a comprehensive document that outlines the terms and conditions for a professional consulting service aimed at helping companies in the Oakland, Michigan area secure loans for their business needs. This agreement serves as a legally binding contract between the consulting firm and the company seeking financial assistance. The primary purpose of the Oakland Michigan Consulting Agreement is to provide expert guidance, advice, and support to businesses throughout the entire loan acquisition process. By leveraging their expertise in financial analysis, market research, and industry trends, the consulting firm assists companies in navigating the complex loan application procedures and increasing their chances of obtaining the necessary funding. Key components of the agreement may include: 1. Scope of Work: This section outlines the specific services the consulting firm will provide to the company. It may involve a thorough assessment of the company's financial health, identification of appropriate loan options, preparation of loan applications, drafting proposals, and providing ongoing support throughout the approval process. 2. Responsibilities: Both the consulting firm and the company will have defined responsibilities. The consulting firm will commit to ensuring accurate information, adhering to legal and ethical standards, and maintaining confidentiality. The company will be responsible for providing relevant financial documentation, cooperating in a timely manner, and following the consultant's recommendations. 3. Payment Terms: This section outlines the fee structure for the consulting services, which can be an hourly rate, a fixed fee, or a percentage of the loan amount obtained. It may also include provisions for reimbursing additional expenses incurred during the consulting process. 4. Term and Termination: The duration of the consulting agreement will be specified, along with conditions for termination by either party, such as breach of contract, unsatisfactory performance, or completion of the loan acquisition process. Additional types of Oakland Michigan Consulting Agreements — Assist Company Obtain Loan may be categorized based on factors like the type of loan sought, the size or nature of the company, or the specific industry. Some examples include: 1. Small Business Loan Consulting Agreement: Aimed at small businesses in Oakland, Michigan, this agreement provides specialized assistance for securing loans tailored to meet the specific needs and challenges faced by smaller enterprises. 2. Commercial Real Estate Loan Consulting Agreement: This type of agreement focuses on helping businesses in Oakland, Michigan, acquire loans specifically for commercial real estate purposes. It involves expert guidance on assessing property value, understanding market dynamics, and preparing loan applications for purchasing or developing commercial properties. 3. Startup Funding Consulting Agreement: Designed for startups in Oakland, Michigan, this agreement assists emerging businesses in obtaining venture capital or angel investments instead of traditional loans. The consulting firm provides strategic advice on creating compelling business plans, investor presentations, and financial forecasts to attract potential investors. By utilizing the services described in the Oakland Michigan Consulting Agreement — Assist Company Obtain Loan, businesses can increase their chances of securing financing, accelerate growth, mitigate risks, and position themselves for long-term success in the competitive market of Oakland, Michigan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Acuerdo de consultoría: ayudar a la empresa a obtener un préstamo - Consulting Agreement - Assist Company Obtain Loan

Description

How to fill out Oakland Michigan Acuerdo De Consultoría: Ayudar A La Empresa A Obtener Un Préstamo?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Oakland Consulting Agreement - Assist Company Obtain Loan is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Oakland Consulting Agreement - Assist Company Obtain Loan. Follow the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Oakland Consulting Agreement - Assist Company Obtain Loan in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!