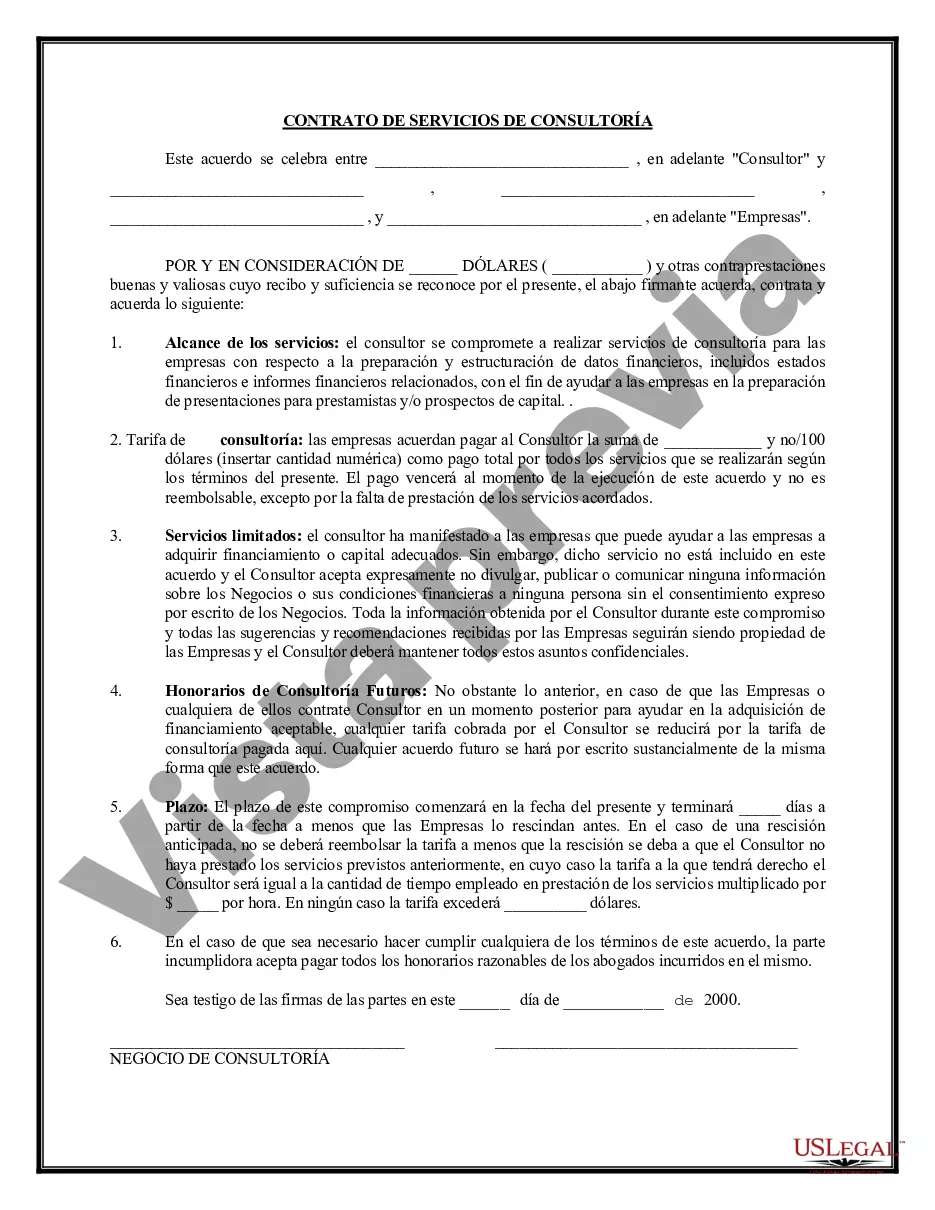

Travis Texas Consulting Agreement — Assist Company Obtain Loan serves as a formal agreement between a consulting firm and a company seeking financial assistance in securing a loan. This agreement outlines the terms, responsibilities, and contractual obligations of both parties involved in the loan acquisition process. Trusted and reliable consultants from Travis Texas provide expert guidance and assistance to empower businesses in successfully securing loans tailored to their specific needs. The primary objective of this consulting agreement is to support companies in navigating the complex loan application process, enabling them to access the necessary capital required for growth, expansion, or overcoming financial hurdles. Travis Texas consultants possess in-depth knowledge and expertise in various industries, financial institutions, and loan options, making them well-equipped to offer personalized and strategic solutions to clients. The Travis Texas Consulting Agreement offers various types of loan assistance services, each tailored to meet specific business requirements. Some of these specialized services include: 1. Startup loan consulting: This type of consulting agreement focuses on assisting new ventures in securing startup loans or capital to fund their initial operations, covering expenses such as equipment purchase, marketing, and personnel. 2. Expansion loan consulting: This agreement type is designed for established businesses looking to expand their operations, purchase additional assets, or enter new markets. Consultants aid in identifying suitable loan options and developing comprehensive strategies to gain approval for expansion loans. 3. Financial restructuring loan consulting: This consulting agreement type helps companies facing financial challenges, assisting them in obtaining restructuring loans to alleviate debt burdens, improve cash flow, and revitalize their business. 4. Acquisitions and mergers loan consulting: In situations where a company intends to acquire or merge with another business entity, consultants provide guidance on securing the necessary loans to align financial resources and facilitate a smooth transition. 5. Working capital loan consulting: Travis Texas consultants also specialize in assisting businesses in obtaining working capital loans to cover day-to-day operational expenses, manage inventory, meet payroll, or seize growth opportunities. Travis Texas Consulting Agreement — Assist Company Obtain Loan ensures that both the consulting firm and the client are aligned in their objectives and responsibilities throughout the loan acquisition process. The agreement typically covers areas such as confidentiality, termination clauses, scope of services, performance expectations, and fee structure. Engaging Travis Texas consultants under this agreement provides businesses with the crucial advantage of utilizing their expertise, industry connections, and comprehensive market insights. By leveraging their experience in loan procurement, Travis Texas consultants greatly enhance the chances of securing optimal financial resources and positioning companies for long-term success in today's competitive business landscape.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de consultoría: ayudar a la empresa a obtener un préstamo - Consulting Agreement - Assist Company Obtain Loan

Description

How to fill out Travis Texas Acuerdo De Consultoría: Ayudar A La Empresa A Obtener Un Préstamo?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Travis Consulting Agreement - Assist Company Obtain Loan without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Travis Consulting Agreement - Assist Company Obtain Loan by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Travis Consulting Agreement - Assist Company Obtain Loan:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that meets your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a few clicks!