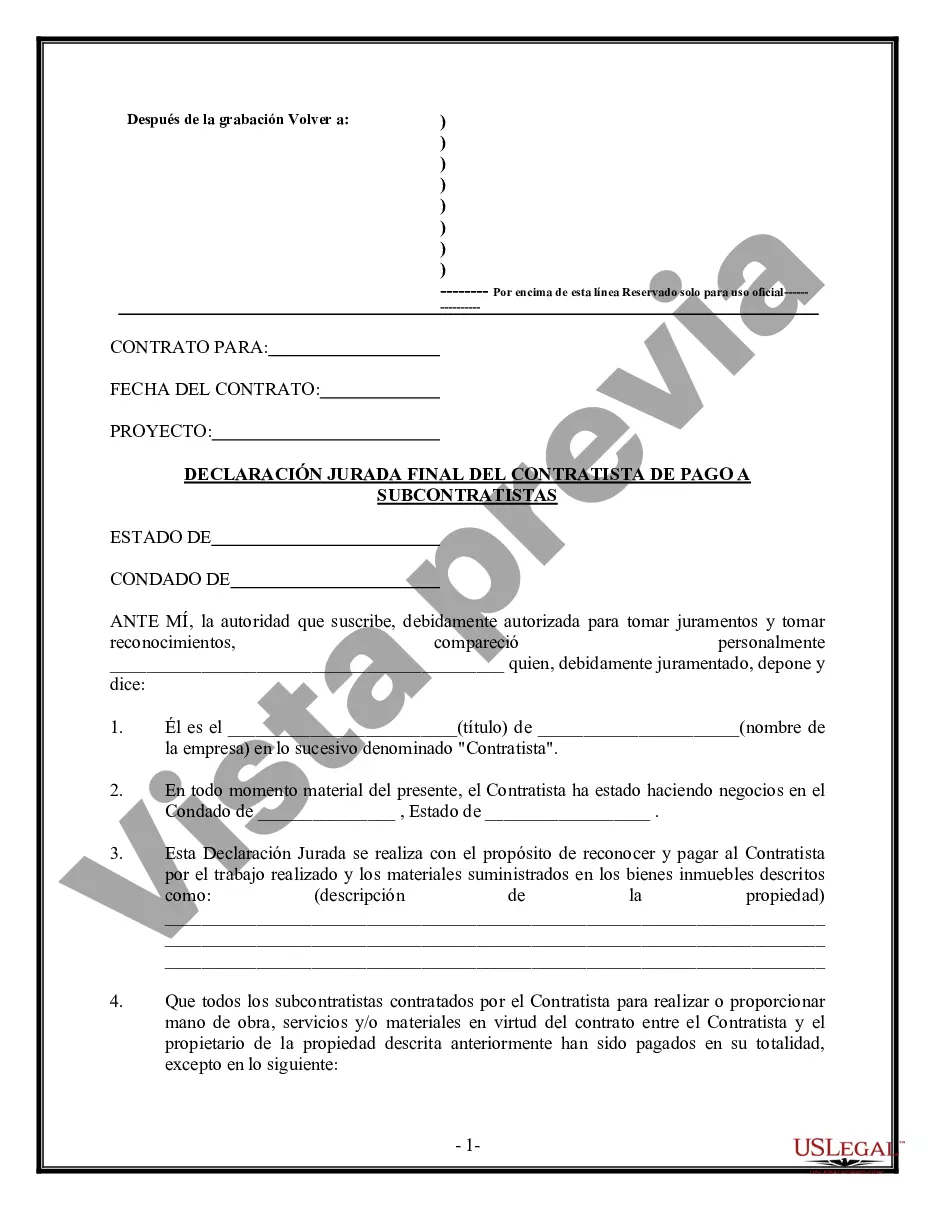

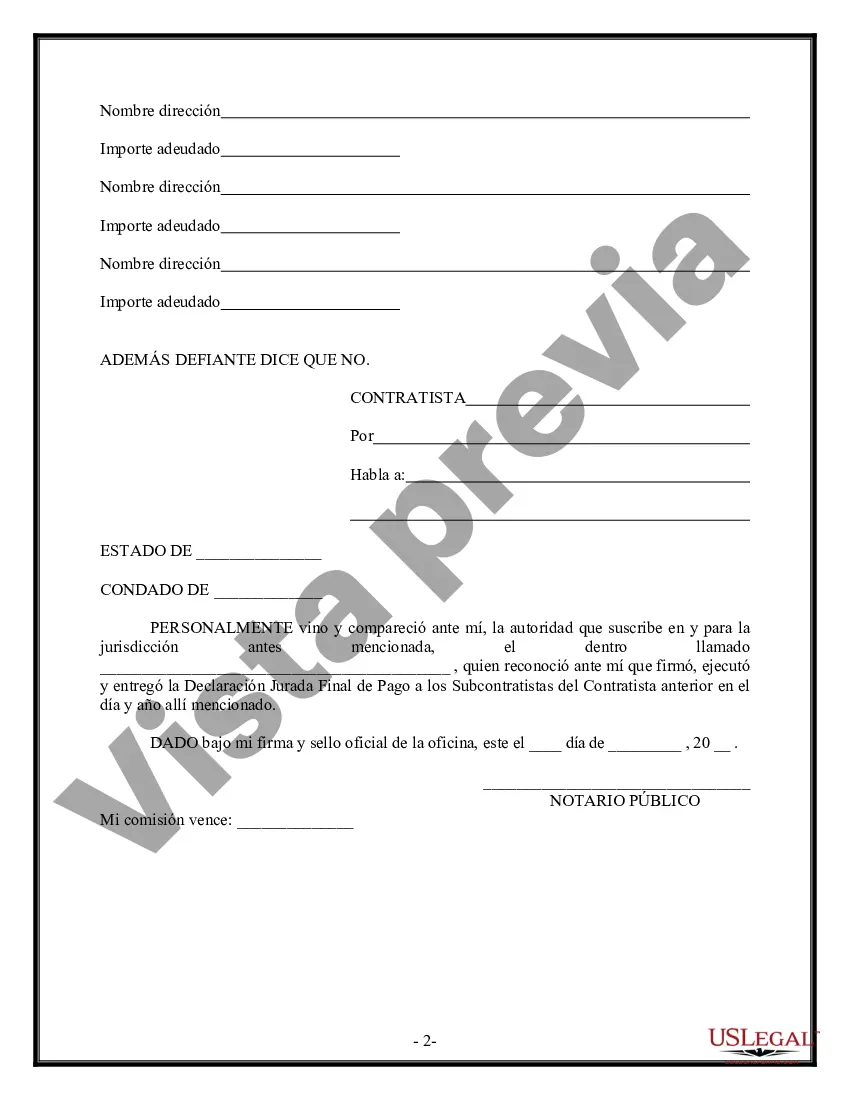

Fairfax, Virginia Contractor's Final Affidavit of Payment to Subcontractors serves as a legally binding document that verifies the completion of a construction project and outlines the payment status for subcontractors involved. This affidavit is typically used when a general contractor in Fairfax, Virginia, wants to confirm that all subcontractors connected with a specific project have been compensated properly. The purpose of the Fairfax Contractor's Final Affidavit of Payment to Subcontractors is to protect both the general contractor and the property owner from potential legal disputes or claims arising from non-payment issues. The document ensures transparency and accountability throughout the payment process, offering a detailed record of all subcontractors who have contributed to the project and their respective payments. Keywords: Fairfax, Virginia, contractor, final affidavit, payment, subcontractors, construction project, completion, legally binding, payment status, general contractor, compensation, property owner, legal disputes, claims, non-payment, transparency, accountability, record. Different types of Fairfax Virginia Contractor's Final Affidavit of Payment to Subcontractors: While the basic purpose and structure remain the same for different projects, the specific affidavit forms may vary slightly to suit the unique requirements of each construction endeavor. Some variations may include: 1. Residential Construction Affidavit: Designed for projects involving residential properties, this affidavit covers subcontractors working on homes, townhouses, duplexes, or other similar residential structures. 2. Commercial Construction Affidavit: This type of affidavit is tailored for commercial construction projects, including office spaces, retail stores, restaurants, hotels, or any other non-residential structures. 3. Government Construction Affidavit: When a construction project is financed or overseen by government entities in Fairfax, Virginia, this affidavit form ensures compliance with specific regulations and reporting requirements. 4. Renovation or Remodeling Affidavit: For projects involving renovation or remodeling of existing structures, this affidavit details subcontractor payments related to the restoration, expansion, or modification efforts. Please note that these variations are not exclusive and may overlap in certain cases, depending on the nature and scope of the project being undertaken in Fairfax, Virginia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Declaración jurada final de pago a subcontratistas del contratista - Contractor's Final Affidavit of Payment to Subcontractors

Description

How to fill out Fairfax Virginia Declaración Jurada Final De Pago A Subcontratistas Del Contratista?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life sphere, finding a Fairfax Contractor's Final Affidavit of Payment to Subcontractors meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Fairfax Contractor's Final Affidavit of Payment to Subcontractors, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Fairfax Contractor's Final Affidavit of Payment to Subcontractors:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fairfax Contractor's Final Affidavit of Payment to Subcontractors.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

En el caso de una persona menor de 65 anos y los ingresos son menores a $12,550 al ano, podrias no tener que presentar una declaracion de impuestos. Si tienes mas de 65 anos y los ingresos no sobrepasan los $14,250 por ano, no tienes que declarar taxes.

En general, los contribuyentes deben pagar al menos el 90 por ciento (sin embargo, vea el Alivio de Multas de 2018, a continuacion) de sus impuestos durante todo el ano mediante retenciones, pagos de impuestos estimados o adicionales, o una combinacion de ambos.

Usted debe pagar el impuesto sobre el trabajo por cuenta propia y presentar el Anexo SE (Formulario 1040 o 1040-SR) si se da alguno de estos casos. Sus ganancias netas del trabajo por cuenta propia (sin incluir el ingreso como empleado de una iglesia) fueron de $400 o mas.

A diferencia de los contratistas primarios, los subcontratistas no trabajan directamente con el gobierno, sino que trabajan para otros contratistas. Algunos contratos gubernamentales grandes requieren que las companias grandes subcontraten a pequenas empresas.

¿Como llenar formulario 1099-MISC en Mac? Descarga el formulario 1099-MISC del IRS de aqui. Instala PDF Expert en tu Mac y abre el formulario descargado. Introduce tus propios detalles en la informacion del Pagador y la informacion del Destinatario de tu formulario W-9 en el lado izquierdo del formulario.

Empresa contratista y sus trabajadores: Que es aquella que ejecuta las labores externalizadas por la empresa principal. Empresa subcontratista y sus trabajadores: Que es aquella que participa si la empresa contratista a su vez subcontrata la obra o servicio encomendado por la empresa principal.

La subcontratacion es aquel trabajo llevado a cabo para un empleador llamado contratista o subcontratista, que ejecuta obras o servicios por cuenta y riesgo propio para una empresa principal, duena de la obra o faena.

Actualmente, los impuestos sobre los ingresos de los contratistas independientes son los mismos que los de cualquier otro impuesto sobre los ingresos, con tasas que van del 10% al 37%.

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.