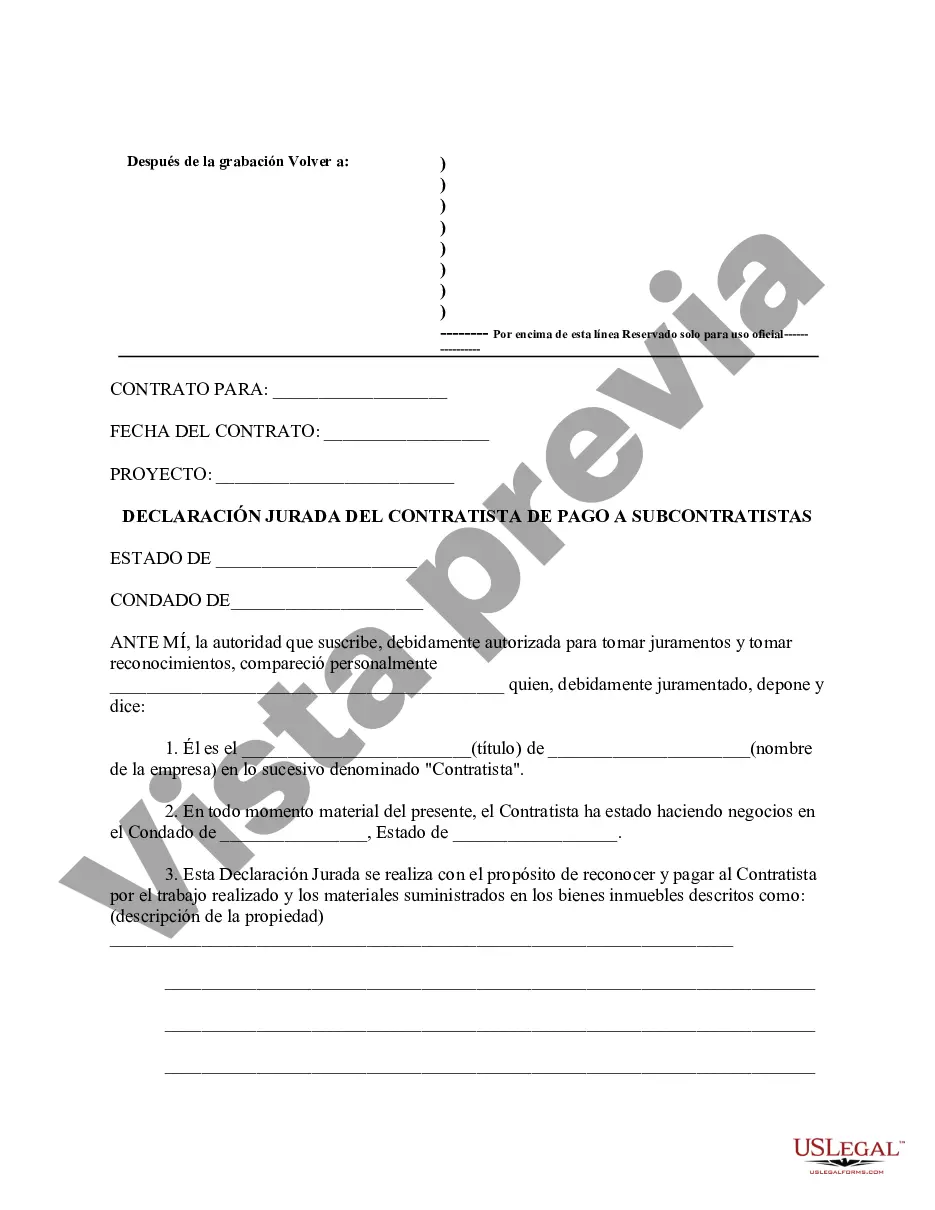

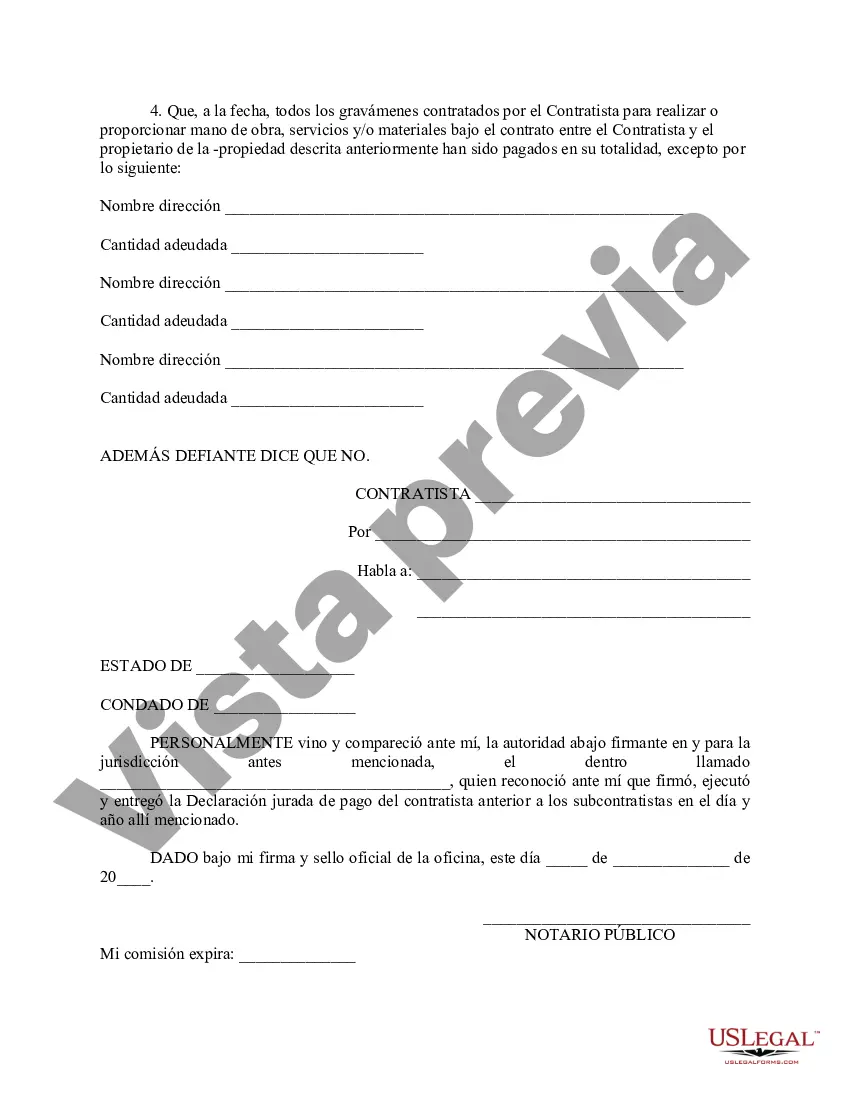

A Fairfax Virginia Contractor's Affidavit of Payment to Subs is an important legal document used in construction projects to ensure transparency and accountability in subcontractor payments. This affidavit serves as proof that a contractor has paid their subcontractors for the work they have completed on the project. The Contractor's Affidavit of Payment to Subs is necessary to avoid any legal disputes or claims of non-payment from subcontractors. It establishes a record of payment and protects both the contractor and the subcontractor by providing evidence of fulfilling financial obligations. Key components typically included in a Fairfax Virginia Contractor's Affidavit of Payment to Subs may include: 1. Contractor Information: This section requires the contractor to provide their full legal name, contact details, and business address. 2. Project Information: The affidavit should include information about the construction project, such as its name, location/address, and project identification number. 3. Subcontractor Details: The contractor must list the names, addresses, and contact information of all subcontractors who have worked on the project. Each subcontractor should have a separate entry. 4. Payment Breakdown: The affidavit should provide a detailed breakdown of the payments made to each subcontractor. It should include the payment dates, amounts, and the specific work or services for which the payment was made. 5. Attachments: The contractor may need to attach supporting documents, such as invoices, receipts, or proof of payment, to validate the accuracy of the payment information provided. It is important to note that different types of Fairfax Virginia Contractor's Affidavit of Payment to Subs may exist based on the specific requirements or preferences of the contracting party. For example, some affidavits may require additional information, such as the subcontractor's license number or insurance details for compliance purposes. In conclusion, a Fairfax Virginia Contractor's Affidavit of Payment to Subs is a crucial document for construction contractors in the area. It ensures transparency and accountability in subcontractor payments, minimizing the risk of payment disputes and legal issues.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Declaración jurada de pago del contratista a los subcontratistas - Contractor's Affidavit of Payment to Subs

Description

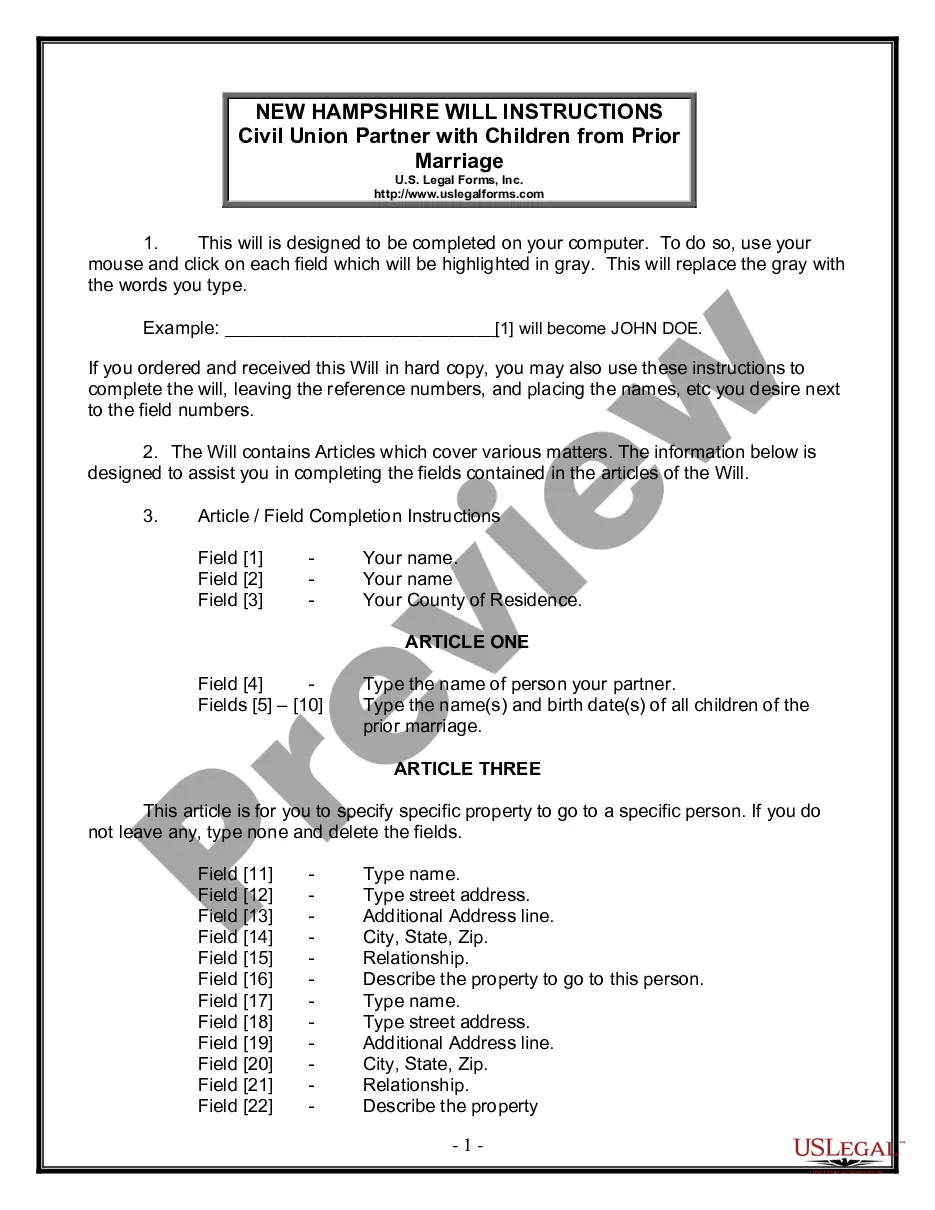

How to fill out Declaración Jurada De Pago Del Contratista A Los Subcontratistas?

Legislation and guidelines in every sector vary from one state to another.

If you're not a lawyer, it's straightforward to become disoriented among numerous standards when it comes to creating legal documents.

To prevent costly legal aid when composing the Fairfax Contractor's Affidavit of Payment to Subs, you require a verified template suitable for your county.

That's the easiest and most cost-effective method to obtain current templates for any legal situations. Find them all with a few clicks and keep your documents organized with the US Legal Forms!

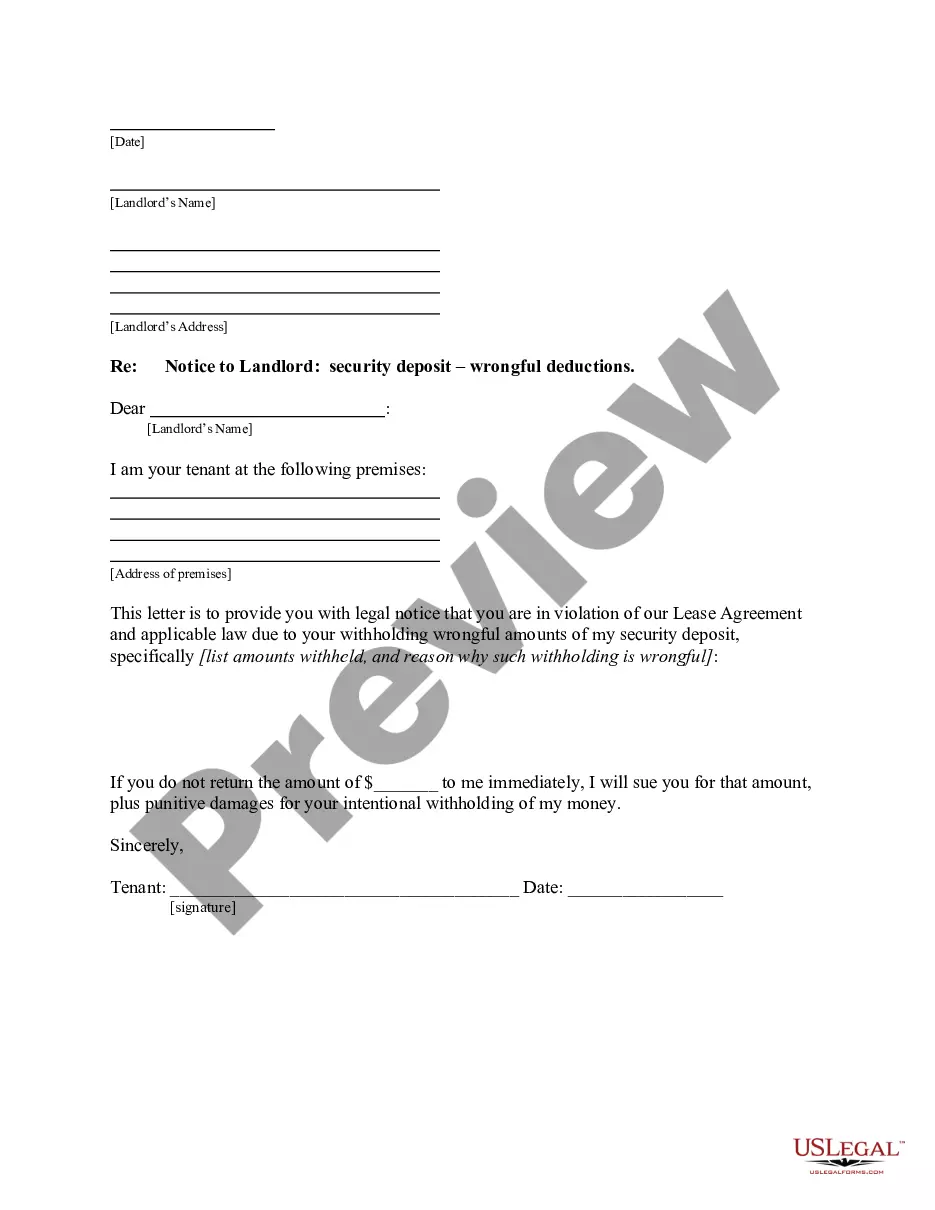

- Examine the page content to ensure you've discovered the correct sample.

- Utilize the Preview feature or review the form description if it's provided.

- Look for another document if there are discrepancies with any of your requirements.

- Use the Buy Now button to acquire the document once you identify the right one.

- Select one of the subscription options and Log In or create an account.

- Decide how you wish to pay for your subscription (via credit card or PayPal).

- Choose the format you wish to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

Form popularity

FAQ

Los contratistas 1099 obtienen un formulario 1099 y los empleados W-2 un formulario W-2. Los utilizan para informar sus salarios, propinas e ingresos personales. 1099 contratistas pagan sus propios impuestos. Esto no sucede con los empleados W-2 ya que sus empleadores tienen que retener sus impuestos sobre la renta.

El formulario 1099-MISC es aquel que reciben las personas que trabajaron como subcontratistas o trabajadores independientes. Estas personas no estan en una nomina de empleados, sino que son contratados independientemente para proyectos especificos.

Tipos comunes del formulario 1099 1099-MISC (en ingles) para trabajos como contratista o trabajador por cuenta propia (freelance), ganancias relacionadas con premios y apuestas, y otros. 1099-INT (en ingles) para intereses de cuentas bancarias. 1099-DIV (en ingles) para distribuciones de inversion y dividendos.

¿Como llenar formulario 1099-MISC en Mac? Descarga el formulario 1099-MISC del IRS de aqui. Instala PDF Expert en tu Mac y abre el formulario descargado. Introduce tus propios detalles en la informacion del Pagador y la informacion del Destinatario de tu formulario W-9 en el lado izquierdo del formulario.

¿Como llenar formulario 1099-MISC en Mac? Descarga el formulario 1099-MISC del IRS de aqui. Instala PDF Expert en tu Mac y abre el formulario descargado. Introduce tus propios detalles en la informacion del Pagador y la informacion del Destinatario de tu formulario W-9 en el lado izquierdo del formulario.

A diferencia de los contratistas primarios, los subcontratistas no trabajan directamente con el gobierno, sino que trabajan para otros contratistas. Algunos contratos gubernamentales grandes requieren que las companias grandes subcontraten a pequenas empresas.

Actualmente, los impuestos sobre los ingresos de los contratistas independientes son los mismos que los de cualquier otro impuesto sobre los ingresos, con tasas que van del 10% al 37%.

Empresa contratista y sus trabajadores: Que es aquella que ejecuta las labores externalizadas por la empresa principal. Empresa subcontratista y sus trabajadores: Que es aquella que participa si la empresa contratista a su vez subcontrata la obra o servicio encomendado por la empresa principal.

La subcontratacion es aquel trabajo llevado a cabo para un empleador llamado contratista o subcontratista, que ejecuta obras o servicios por cuenta y riesgo propio para una empresa principal, duena de la obra o faena.