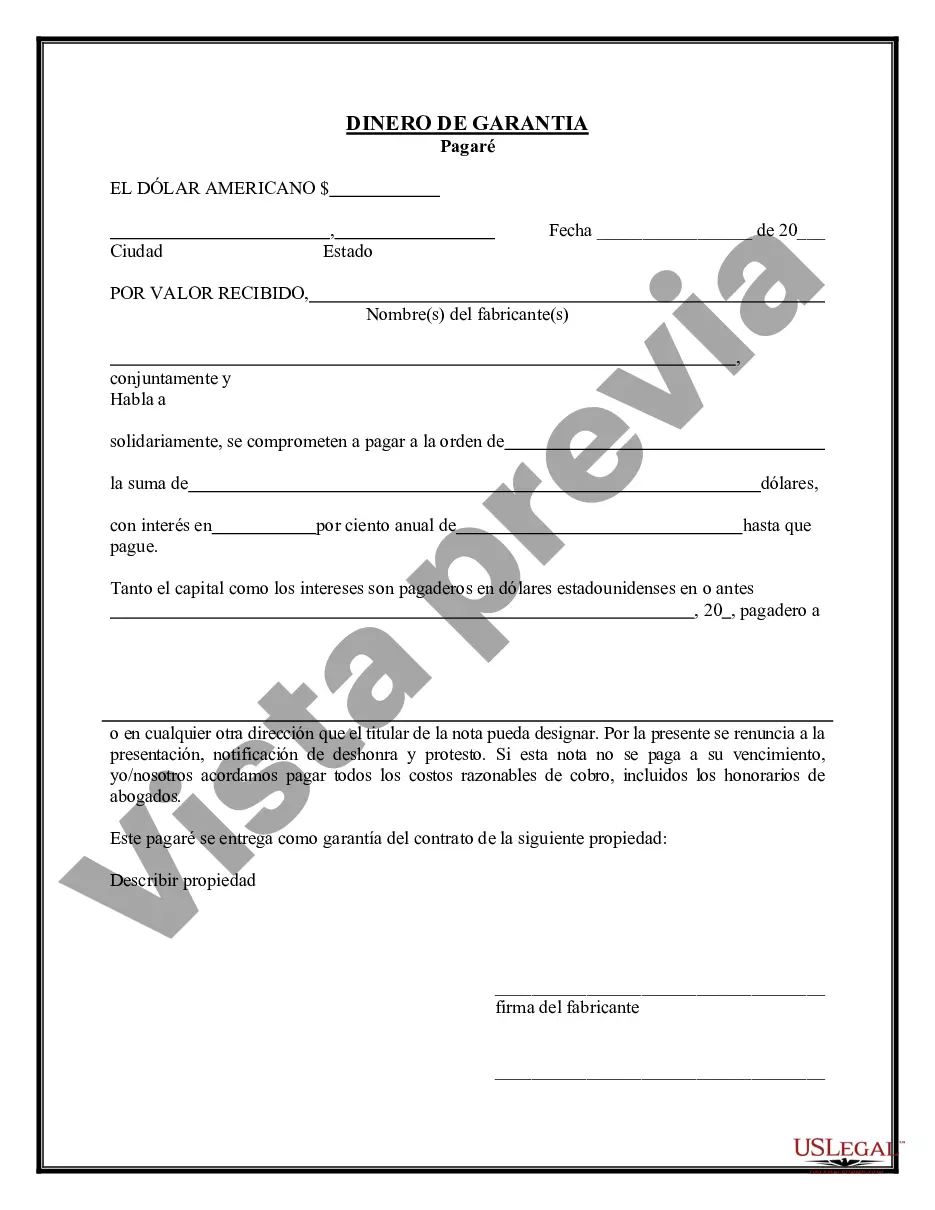

Salt Lake Utah Earnest Money Promissory Note is a legally binding contract that outlines the terms and conditions between a buyer and seller during a real estate transaction in Salt Lake City, Utah. This document serves as evidence of the buyer's good faith and commitment to purchase the property. Keywords: Salt Lake Utah, Earnest Money Promissory Note, real estate transaction, buyer, seller, good faith, commitment, property. Types of Salt Lake Utah Earnest Money Promissory Notes include: 1. Traditional Promissory Note: This is the most common type of Earnest Money Promissory Note used in Salt Lake City. It stipulates the amount of earnest money the buyer agrees to deposit and the timeline for payment. It also outlines the conditions under which the earnest money can be refunded or forfeited. 2. Contingency Promissory Note: This type of Promissory Note includes specific contingencies that must be met for the earnest money to be retained or refunded. Contingencies might include appraisal values, financing approvals, or inspection results. If these conditions are not met within the specified timeline, the buyer may be entitled to a refund of the earnest money. 3. Non-Refundable Promissory Note: In some cases, the buyer may agree to make the earnest money non-refundable. This means that if the transaction falls through due to the buyer's default, the seller will keep the earnest money as compensation for their time and effort. 4. Escrow Promissory Note: An Escrow Promissory Note is used when the earnest money is held by a neutral third party, typically an escrow agent. The note specifies the conditions under which the earnest money will be released to the seller or refunded to the buyer. 5. Post-Closing Promissory Note: This type of Promissory Note is used when the earnest money is retained by the seller after the closing of the real estate transaction. The earnest money serves as a down payment towards the purchase price of the property. Salt Lake Utah Earnest Money Promissory Notes protect both buyers and sellers by providing a clear understanding of the financial commitment involved in a real estate transaction. It is essential for all parties involved in a real estate transaction to carefully review and understand the terms and conditions outlined in the Promissory Note before entering into an agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Pagaré de arras - Earnest Money Promissory Note

Description

How to fill out Salt Lake Utah Pagaré De Arras?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Salt Lake Earnest Money Promissory Note, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any tasks associated with document completion simple.

Here's how you can locate and download Salt Lake Earnest Money Promissory Note.

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the validity of some documents.

- Check the similar document templates or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Salt Lake Earnest Money Promissory Note.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Salt Lake Earnest Money Promissory Note, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you have to cope with an exceptionally challenging situation, we recommend using the services of an attorney to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-specific paperwork with ease!