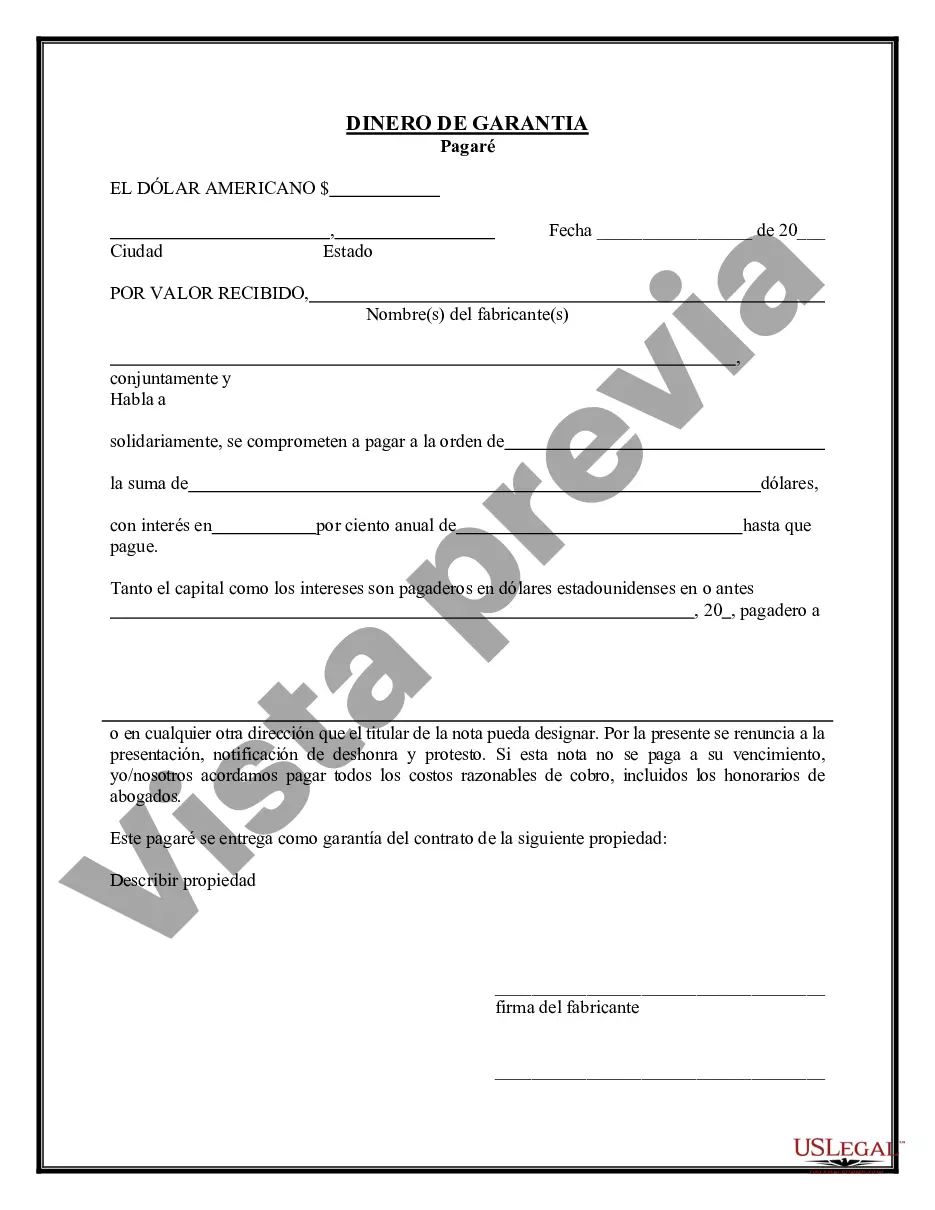

Travis Texas Earnest Money Promissory Note is a legally binding document that sets out the terms and conditions surrounding the earnest money deposit in a real estate transaction. It acts as a written agreement between the buyer and the seller, providing security to both parties involved. The earnest money deposit, often referred to as good faith money, is a sum of money that the buyer puts forward to demonstrate their seriousness and commitment to purchasing the property. The Travis Texas Earnest Money Promissory Note outlines the amount of earnest money to be deposited and the terms under which it will be held, distributed, or refunded. There are several types of Travis Texas Earnest Money Promissory Notes, including: 1. Escrow Deposit: This type of promissory note involves depositing the earnest money with a neutral third party, usually an escrow agent or an attorney. The escrow agent holds the funds until the closing of the transaction, ensuring that neither party can access the money without the other's consent. 2. Seller-Held Deposit: In this scenario, the seller holds the earnest money deposit instead of it being placed in escrow. This can provide convenience for both parties as the funds are readily available to the seller if the buyer defaults. However, it also entails a certain level of risk for the buyer, as the seller becomes the custodian of the funds. 3. Interest-Bearing Deposit: This type of promissory note allows the earnest money deposit to accrue interest over time. The agreed-upon interest rate is typically specified in the promissory note, ensuring that the buyer's money earns a return while waiting for the completion of the transaction. 4. Contingency Protection Deposit: This type of promissory note includes specific contingencies that protect the buyer's earnest money deposit. For example, if the buyer fails to secure financing or if the property inspection uncovers significant issues, the deposit may be refundable to the buyer. Regardless of the type, Travis Texas Earnest Money Promissory Notes contain important details such as the property address, purchase price, payment terms, deadline for deposit, and procedures in case of breach of contract. It is essential for both parties to read and understand the terms of the promissory note thoroughly before signing to ensure a smooth and legally sound real estate transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Pagaré de arras - Earnest Money Promissory Note

Description

How to fill out Travis Texas Pagaré De Arras?

Preparing documents for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Travis Earnest Money Promissory Note without professional help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Travis Earnest Money Promissory Note by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Travis Earnest Money Promissory Note:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!